Micro, small and medium entrepreneurs are enjoying incentives for loan interest relief from the Labor Intensive Industrial Credit (KIPK) program. Through this program, the government subsidizes interest deductions of up to 5%. The lower interest rate has stimulated the labor-intensive industrial sector to increase its capacity.

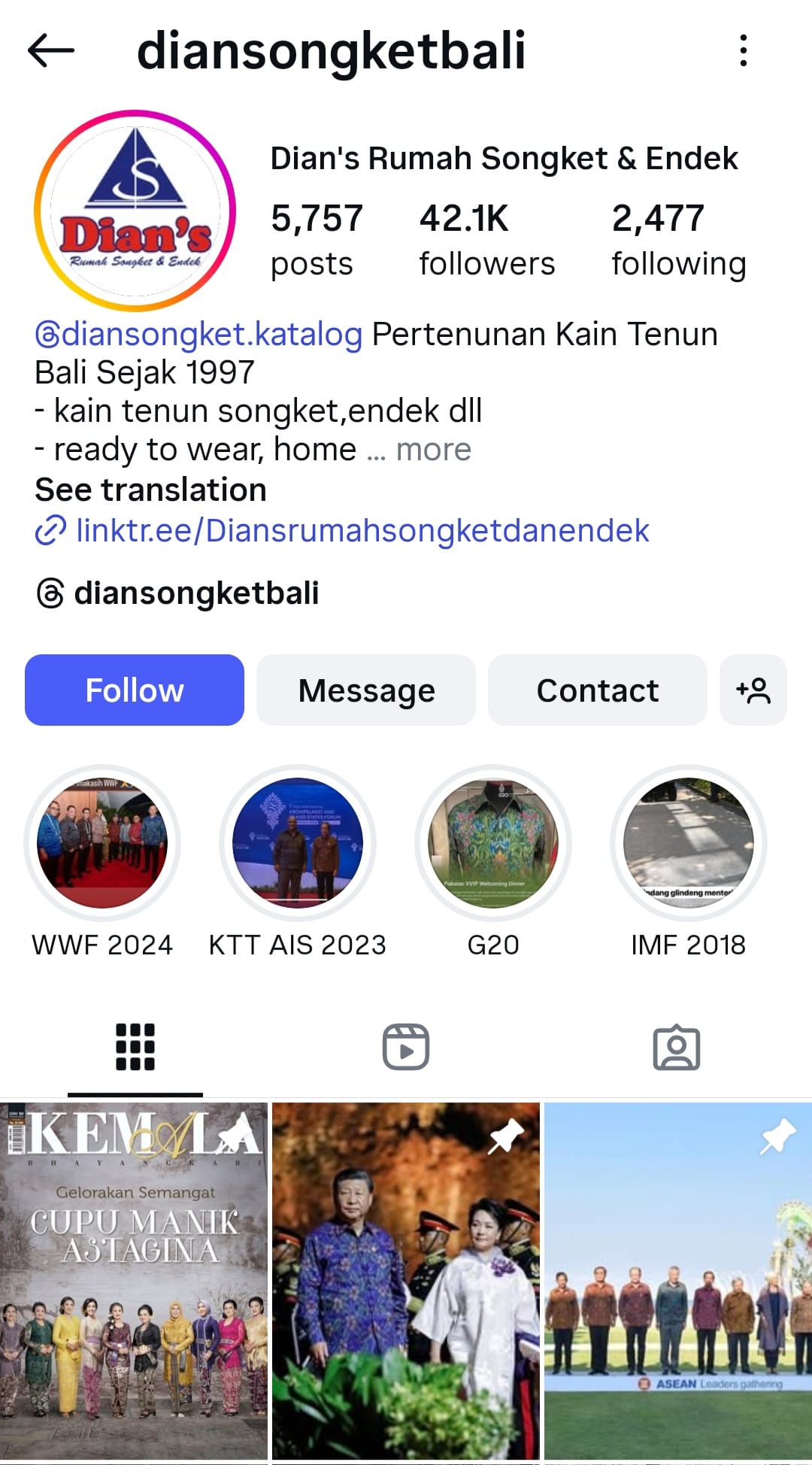

Putu Agus Aksara Diantika, owner of Dian's Rumah Songket and Endek, is one of BPD Bali's debtors in the KIPK program. Putu Agus considers low interest to be the main attraction of KIPK compared to commercial loans. If the interest rate usually reaches 12%-13%, KIPK only charges around 6% per year.

He said the 5% subsidy from the government made the interest burden feel much lighter. "We can turn around capital more freely because interest costs are smaller," said the 32-year-old man, contacted on Sunday (7/9/2025).

In addition to the interest rate, a tenor of up to eight years is also considered suitable for investment in production equipment. Putu said credit can not only be used to purchase machinery, but also as working capital for crafters. With this flexibility, he plans to expand production capacity while updating equipment.

He also feels the support from this program in the form of promotion and additional training. He assesses that BPD Bali not only distributes credit, but also provides non-financial assistance so that its fostered partners can develop. According to him, this support makes business actors more confident in expanding the market while improving product quality.

About KIPK

Recently, the government launched the KIPK program with a loan ceiling of between IDR 500 million and IDR 10 billion, an interest subsidy of 5%, and a tenor of up to eight years. This scheme is intended to help industry players increase productivity, expand employment, while strengthening national economic resilience.

Industry Minister Agus Gumiwang Kartasasmita called this program an important milestone for industrial competitiveness. "With KIPK, industry players can expand and modernize production more lightly," he said in an official release, Thursday (4/9/2025).

The first socialization of the program took place in Bali, an area considered to have strong industrial dynamics from textiles, food, furniture, to crafts. On that occasion, a financing cooperation agreement was signed with BPD DIY, complementing the six channeling banks that had joined earlier.

The first distribution was symbolically carried out by BPD Bali to three local industry players in the food, textile and furniture sectors. The presence of this program is also considered by Bali Governor Wayan Koster to be in line with the concept of sustainable development in the region.

The KIPK program was designed as a follow-up to President Prabowo's directive to make labor-intensive industries more competitive. Data from the National Industrial Information System shows that there are 3,739 industry players who could potentially benefit from this program.

The Ministry of Industry (Kemenperin) is targeting to expand access so that more small and medium industries (IKM) can be involved. The hope is that this program will not only help working capital but also create thousands of new jobs in various regions.

Welcome from industry players

The Indonesian Furniture and Handicraft Industry Association (HIMKI) welcomes the presence of the KIPK program because it is considered relevant to the needs of the furniture and craft subsectors. HIMKI Chairman Abdul Sobur assessed that this scheme is able to accelerate the revitalization of production machinery, increase efficiency, and expand employment opportunities.

According to him, this financing support is an important step to strengthen competitiveness amid global competition. "This is the government's proactive response to support the transformation of labor-intensive industries," Abdul said.

Even so, HIMKI highlighted the realization of the program which was considered still far from the target. Until now, the distribution of KIPK has only reached around Rp 744 billion with 347 prospective recipients from 12 channeling banks. This figure is considered still very small compared to the ceiling set by the government of Rp 20 trillion. HIMKI emphasizes the need to improve the scheme to be more inclusive, especially for SMEs with smaller business scales.

Until now, the distribution of KIPK has only reached around Rp 744 billion with 347 prospective recipients from 12 channeling banks. This figure is considered still very small compared to the ceiling set by the government of IDR 20 trillion.

HIMKI also emphasized the importance of special allocations for the furniture and handicraft subsectors, which are proven to absorb a lot of labor and are locally based. The support is believed to have a domino effect on the regional economy, from direct labor to the raw material supply chain. In addition, this subsector has strong export potential, so it can increase its contribution to national foreign exchange.

Abdul said HIMKI is ready to play an active role as a communication bridge between the government, banks and businesses. HIMKI is committed to helping its members fulfill administrative requirements that often become obstacles. Through training and mentoring, they hope that access to KIPK will become more widely available. The effort also includes bringing together SMEs directly with channeling banks so that the distribution process runs quickly and is right on target.

Notes and challenges

Centre for Strategic and International Studies (CSIS) Economic Department Researcher Deni Friawan appreciates the government's intention to launch KIPK, but the design of this program still has fundamental weaknesses. According to him, administrative requirements and a minimum limit on the number of workers make it difficult for many small industry players to access the facility.

"Most of our labor-intensive actors are still small-scale, rarely able to meet the requirement of 50 workers," he said.

"Most of our labor-intensive actors are still small-scale, rarely able to meet the requirement of 50 workers," said Deni Friawan.

He emphasized that although interest is subsidized by the government, the risk of bad credit is still fully borne by the channeling bank. This condition is different from the People's Business Credit (KUR) scheme, which has a special guarantee.

As a result, banks tend to be more cautious in channeling financing, resulting in slow credit realization. This situation is exacerbated by the large number of informal businesses that do not have complete legality.

In addition, there are concerns that this program is not right on target. "There is potential for large businesses to access this program because it is easier to meet the requirements," said Deni.

This could reduce the effectiveness of the program in creating new jobs. He emphasized the need for strict supervision so that KIPK really reaches the target groups that need it most.

No less important, Deni highlighted the aspect of socialization and assistance to prospective KIPK recipients. According to him, many SMEs are not familiar with the details of the KIPK program, let alone understand the administrative requirements which are quite complicated. "The intention is good. But without assistance and a deep understanding of the conditions of business actors, this program is difficult to answer the real challenges in the field," said Deni.

Putu Agus also believes that this program can still be improved. He hopes that the government will add a grace period of six months after credit disbursement so that SMEs have room to rotate capital first before starting to pay installments. "That way, this program will be more friendly to SMEs," he said.

Deni emphasized that the obstacle to labor-intensive industries is not only the cost of credit, but also weak demand and purchasing power. According to him, cheap credit does not automatically encourage investment if the market is unable to absorb the product. Therefore, he believes that the program needs to be supported by more comprehensive policies, including cross-ministerial coordination and steps to restore purchasing power.