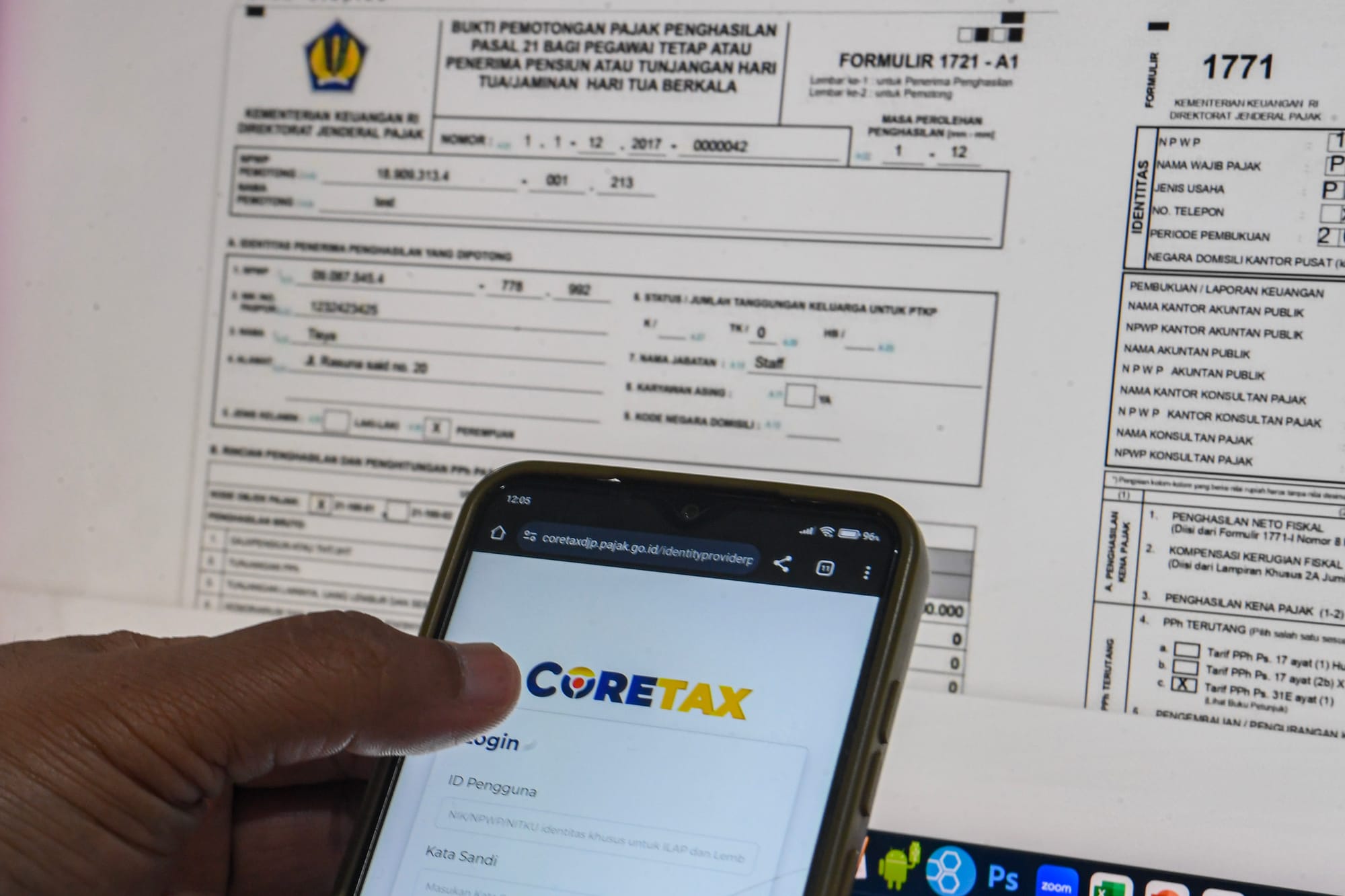

Ahead of the annual tax return reporting period, which is due on March 31, 2026, entrepreneurs are pushing for the Coretax implementation procedure to be simplified to avoid the obstacles that companies have experienced in using the web-based system.

This is in response to the Ministry of Finance's accelerated activation of Coretax, which targets all registered taxpayers.

Data from the Directorate General of Taxes (DJP) of the Ministry of Finance shows that as of Monday (05/01/2026), 11,397,471 taxpayers have successfully logged in and activated their Coretax accounts. This number is dominated by 10,489,395 million individual taxpayer accounts, 819,407 corporate taxpayer accounts, 88,448 government agency taxpayer accounts, and 221 electronic trading system (PMSE) accounts.

Deputy Chairman of the Indonesian Employers Association (Apindo) Sanny Iskandar appreciated the Minister of Finance's commitment to continue making improvements in order to increase the number of Coretax account activations. According to DGT data, corporate taxpayer activations continued to increase, from 801,000 on December 29, 2025, to 819,000 as of January 5, 2026.

"This means that there has been progress, albeit gradual. To that end, Apindo is pushing for procedures to be made simpler, more user-friendly, and the system more stable. These improvements also need to be accompanied by more intensive and technical outreach, so that the implementation of Coretax truly supports a healthy and sustainable business climate," concluded Sanny.

He emphasized that, in principle, the business community supports the government's efforts to improve taxation services through Coretax as part of the modernization of the taxation system.

"However, throughout 2025, we noted that there were still obstacles faced by the business world, ranging from relatively complicated procedures to technical system issues. This is important to note because Coretax is closely related to corporate income tax, which has a direct impact on cash flow and business certainty," Sanny told SUARon Wednesday (07/01/2026).

However, in addition to intensifying registration outreach, strengthening system reliability and software reliability will also determine the speed of Coretax activation.

Director of Outreach, Services, and Public Relations at the Ministry of Finance's Directorate General of Taxes (DGT) Rosmauli stated that the activation and use of Coretax accounts showed a positive trend. Between January 1 and 5, 2026, the DGT had already received 20,289 reports for the 2025 Annual Income Tax Return.

"The annual tax returns we have received consist of 14,926 tax returns from individual employees, 3,959 tax returns from individual non-employees, 1,397 tax returns from entities in rupiah, and 7 tax returns from entities in dollars," he said when contacted SUAR on Monday (5/1).

Adding to Rosmauli's explanation, Director General of Taxes Bimo Wijayanto stated that the Ministry of Finance has so far conducted twostress tests on the Coretax system. The first was in November, accessed simultaneously by 25,000 DGT employees, and the second was on December 10, 2025, accessed simultaneously by 50,000 Ministry of Finance employees. Both tests showed significant improvements in response speed and data input.

"Hopefully, by March 31, 2026, the submission of 14.9 million taxpayers can run smoothly, just like the 2024 reporting. For corporate tax returns, we have set the reporting deadline to April 30, 2026, so that corporate taxpayers can have an extension," said Bimo at the APBN KiTA Press Conference in Jakarta on Thursday (12/18/2025).

Continued

Apindo Economic Policy Analyst Ajib Hamdani emphasized that more than 80% of national tax revenue comes from business activities (agencies and corporations), so optimal collaboration between relevant parties is needed so that the business sector can become a more sustainable source of state revenue.

"Open and transparent communication will foster mutual trust among the parties involved. A collaborative, persuasive, wise, and fair approach will further encourage voluntary compliance by entrepreneurs to pay taxes," said Ajib.

In gaining public trust, strengthening the Coretax system and software reliability is not only related to the successful collection of taxes by the state, but also to building habits.

Head of Tax Research at the Center for Indonesia Taxation Analysis ( CITA) Fajry Akbar believes that when it comes to tax administration, people tend to do it close to the deadline, including filing their annual tax returns.

"Usually, they only file their tax returns when the deadline is approaching. I think that's what's happening now with the activation of Coretax. It's not the system that's causing the delay, but the behavior of people who are accustomed to filing too close to the deadline," said Fajry when contacted on Tuesday (06/01/2026).

Therefore, Fajry believes that even though registration and activation have been promoted to the fullest extent possible, Coretax activation will only be successful if people's behavior or habits can be encouraged to change.

The goal is not merely compliance, but also to prevent overloading or excessive traffic as new taxpayers rush to activate their accounts close to the tax return filing deadline, given that starting in 2026, without activating Coretax, people will not be able to file their tax returns.

"The problem is, when the public activates and reports their tax returns simultaneously, will the Coretax serverbe strong enough? This is the question. The DGT may be able to do this simultaneously for tens of thousands of Ministry employees, but remember that there are still 3.9 million taxpayers who are not yet registered," added Fajry.

Sharing Fajry's view, Lady Karlinah, a member of the Taxation Committee of the Indonesian Institute of Certified Public Accountants (IAPI), believes that the change from the DJP Online system to Coretax starting in 2025 is like "moving house" for all taxpayers, accompanied by stronger door locks, different room layouts, and features that must be understood.

"The differences between the DJP Online and Coretax systems make account activation the main bridge for taxpayers to understand the 'change of house keys' that occurs in the system. Due to stronger standards and a more developed system, activation requires a more complex process than the system previously developed by the DJP," said Karlinah in a virtual IAPI talk on Monday (05/01/2026).