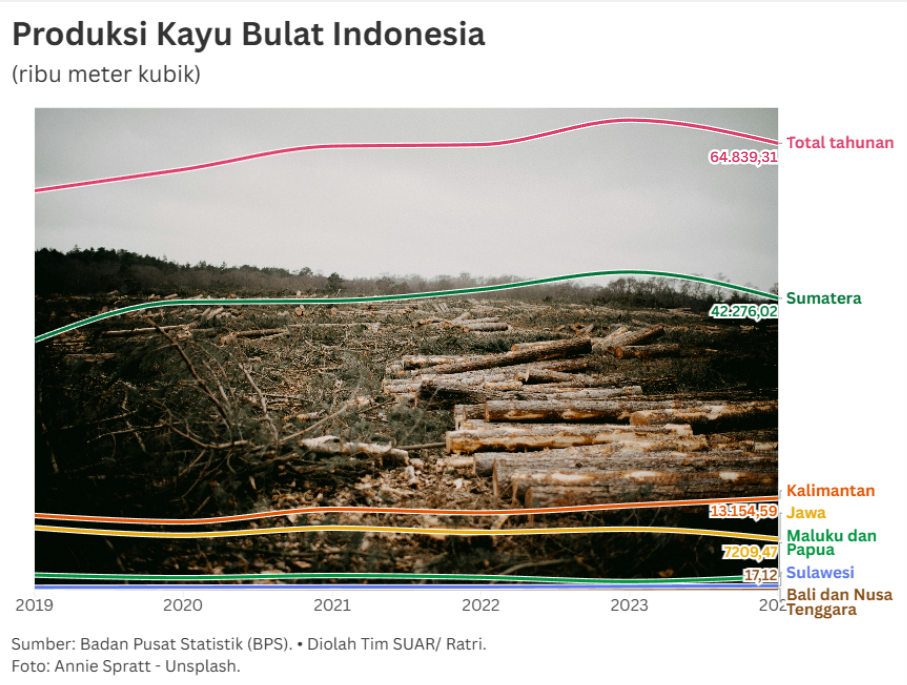

The forestry industry, particularly timber and its processed products, is one of the mainstays of the Indonesian economy. Data from the Central Statistics Agency (BPS) on roundwood production from 2019 to 2024 shows an upward trend in production volume.

National timber production grew significantly, starting from 57.930 million cubic meters in 2019 and peaking at 68.215 million cubic meters in 2023. In 2024, production declined slightly to 64.839 million cubic meters.

The increase in production reflects high domestic and global demand for processed wood products, such as plywood, furniture, and pulp & paper. This is the result of efforts by the government and the private sector to maintain the supply of raw materials through sustainable forest management and industrial forest plantation (HTI) licensing.

Geographically, roundwood production in Indonesia is dominated by two main regions, namely Sumatra and Kalimantan. The contribution from these two regions has consistently been the mainstay of national production.

Sumatra is the largest producer of roundwood, with volume peaking at 46.096 million cubic meters in 2023, despite a decline in 2024.

Meanwhile, Kalimantan shows a steady upward trend, with a volume of 13.154 million cubic meters in 2024. Other regions such as Java show relatively stable volumes (around 7-8 thousand cubic meters). Production in Sulawesi, Maluku, and Papua has increased significantly. Production in Sulawesi, for example, grew rapidly from 182,060 cubic meters (2019) to 411,070 cubic meters (2024), indicating the potential for developing the forest products industry in eastern Indonesia.

The dynamics of roundwood production are closely related to the performance of Indonesia's processed wood product exports in the global market. Data from the Directorate General of Sustainable Forest Management of the Ministry of Forestry shows that after peak export volume reached 23,114,354.87 cubic meters in 2021, export volume tended to decline in subsequent years. By 2025 (January-November period), it reached 17,207,669.95 cubic meters.

Despite the decline in volume, the value of exports remained relatively stable, even reaching a peak of US$14,205.45 million in 2022. This indicates a shift in the industry's focus tohigh-value added products or an increase in global commodity prices, which allowed the value of foreign exchange to be maintained despite the decline in shipment volume.

The decline in export volume amid high domestic roundwood production is estimated to be due to increased wood consumption in the domestic market, mainly driven by the massive construction and infrastructure development sectors. In addition, fluctuations in the value and volume of exports, particularly the sharp decline in export volume from 2022 to 2023, indicate the industry's sensitivity to global economic conditions.

On the other hand, sustainability is a central issue that cannot be separated from the Indonesian timber industry, especially amid global pressure related to environmental damage and climate change. High production figures must be balanced with strict sustainable forest management practices. The biggest challenge is ensuring that increased production does not sacrifice the ecological function of natural forests, which can lead to damage and disasters.

The decline in national production in 2024 and fluctuations in export volumes could be a starting point for reviewing the cut-and-plant policy and improving law enforcement against illegal logging. The implementation of a credible and transparent Timber Legality Verification System (SVLK) is key to meeting international market demands and combating deforestation.

Only by integrating sustainability principles that encompass ecological, social, and economic aspects can Indonesia's timber industry achieve long-term competitiveness while preserving the nation's biodiversity heritage.