Good morning, Chief...

The following is important information related to the development of the business universe that needs attention today based on the curation of the SUAR Team.

Banking Outlook 2026: Credit Expected to Increase, Supported by Declining Interest Rates

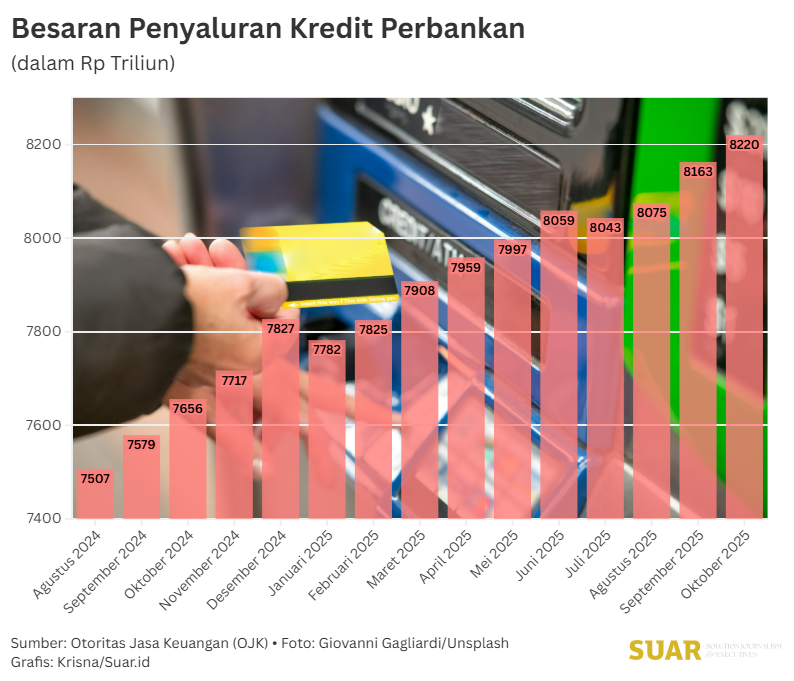

- The resilience of the banking sector in performing its intermediary function and navigating business amid economic uncertainty and global fluctuations throughout 2025 will serve as capital in preparing for 2026. Therefore, even though the banking sector has identified future challenges, players remain optimistic while increasing their vigilance in facing various possibilities that have not yet been anticipated.

- Based on the Bank Business Plan (RBB) report submitted at the end of November 2025, banking growth next year will remain positive, partly because credit growth is projected to increase slightly compared to 2025. There is still room for global and domestic interest rates to decline next year, which is expected to have a positive impact on deposit growth, liquidity availability, and assist banks in lending. Private banks and state-owned banks are also preparing themselves. A number of state-owned banks are holding extraordinary general meetings of shareholders at the end of this year to optimize their business strategies in 2026.

Read the full story here.

Notes from the Indonesian Banking World Throughout 2025

- The robust banking sector, which performed brilliantly throughout 2025, became one of the foundations of the financial sector's health in Indonesia, especially amid global uncertainty. Looking back at the events of the past year, SUAR notes 16 significant events that have shaped the banking sector this year, while also serving as a starting point for navigating the banking business going forward.

Read the full story here.

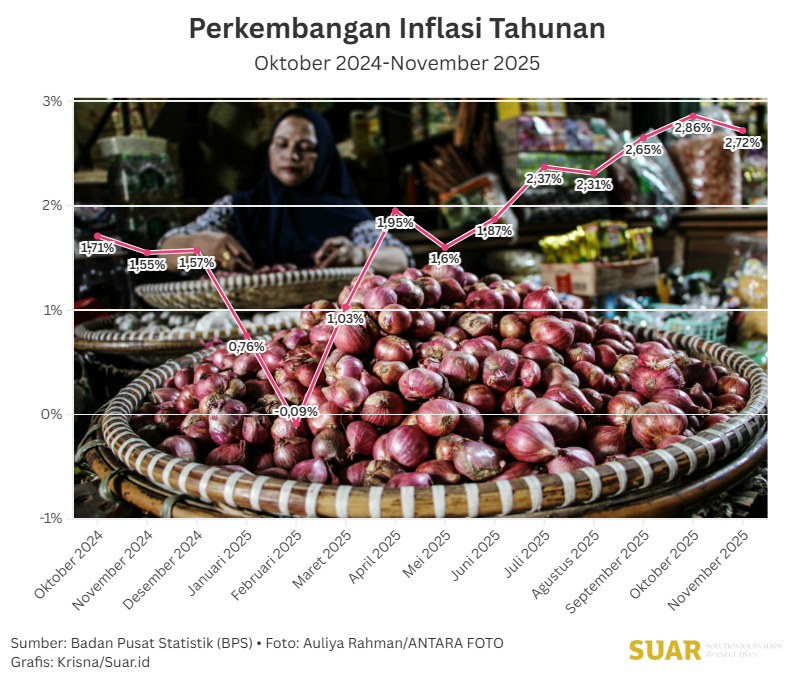

Starting January 2026, Minyakita Price to be in Line with Maximum Retail Price of IDR 15,700 per Liter

- The price of Minyakita cooking oil will follow the Maximum Retail Price (HET) of Rp 15,700 per liter starting in January 2026. This policy is stipulated in the Minister of Trade Regulation (Permendag) Number 43 of 2025 concerning Packaged Palm Cooking Oil and the Management of Cooking Oil for the People. The provision of Minyakita prices in accordance with the MRP provides benefits, especially for the lower-middle class.

Read the full story here.

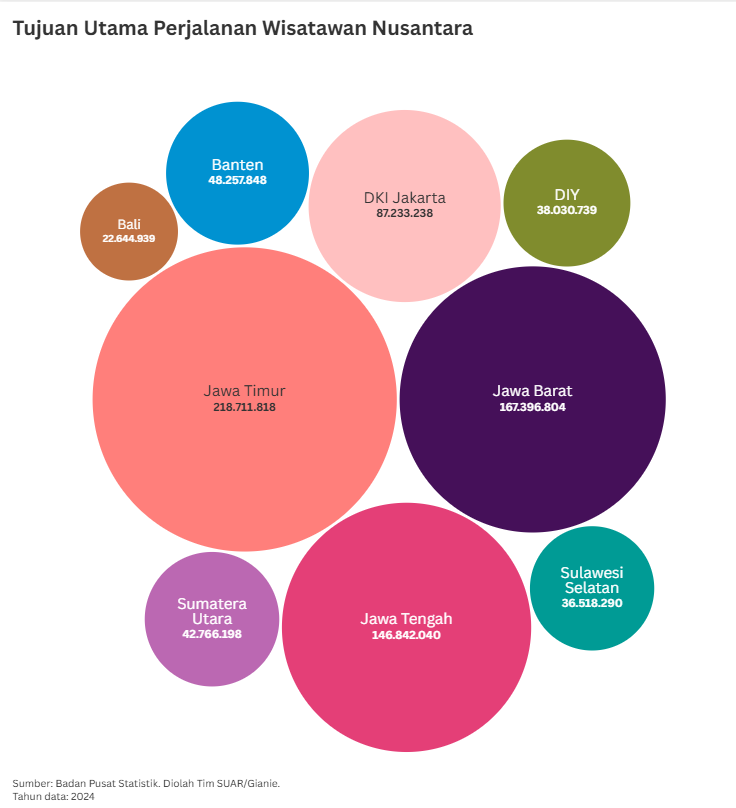

One Billion Domestic Tourist Trips by the End of the Year

- The government is relying on consumption and community movement ahead of the turn of the year to boost economic growth in the last quarter of 2025. The number of people traveling for domestic tourism purposes (domestic tourists) by the end of this year will again exceed 1 billion. The number of domestic tourists reached its lowest point during the Covid-19 pandemic in 2020. Restrictions on mobility to curb the spread of the coronavirus caused the number of domestic tourists to drop by 27% to around 525 million trips.

- However, the number of domestic tourists has slowly increased since 2021, with an average growth of 18%. Domestic tourist traffic is usually high during public holidays, school holidays, and year-end holidays. The highest growth in domestic tourists occurred in 2024, which was up 22% compared to the previous year. In April 2024, the number of domestic tourists reached its highest level since the pandemic until 2024, reaching 104.5 million trips. This was triggered by the movement of people celebrating Eid al-Fitr by carrying out the tradition of mudik (homecoming). This number cannot be matched by the number of domestic tourists during the June-July school holidays, which is still below 90 million trips per month.

Read the full story here.

The Central Statistics Agency (BPS) is scheduled to release the 2024 Financial Statistics of State-Owned Enterprises and Regional-Owned Enterprises on Monday, December 22, 2025. This statistical document is an annual document that presents the profile and financial health indicators of state-owned companies at the national and regional levels. The report covers several important variables such as asset value, liabilities, equity, and net profit of companies. The data presented is the financial report for the 2024 period. This report is intended for the purposes of transparency and evaluation of the performance and economic contribution of SOEs and ROEs to the national economy. The statistical publication can be accessed in full through the official BPS website.

Bank Indonesia (BI) is scheduled to release its November 2025 Money Supply Development report on Monday, December 22, 2025. The report is a macroeconomic indicator that captures the liquidity conditions of the national economy through money supply data. This publication is important to anticipate and observe as it provides an overview of the dynamics of bank lending, net bills to the Central Government, and net foreign assets, which determine money growth in the community. Complete data related to the release of this monthly report can be accessed directly through the official website of Bank Indonesia.

"Failure is simply the opportunity to begin again more intelligently." (Henry Ford - Ford Motor Company)

Have a good day, Chief.

Team SUAR