Good morning, Chief...

The following is important information related to the development of the business universe that needs attention today based on the curation of the SUAR Team.

Manufacturing Outlook 2026: Still Growing but Overshadowed by Global Uncertainty and Wage Issues

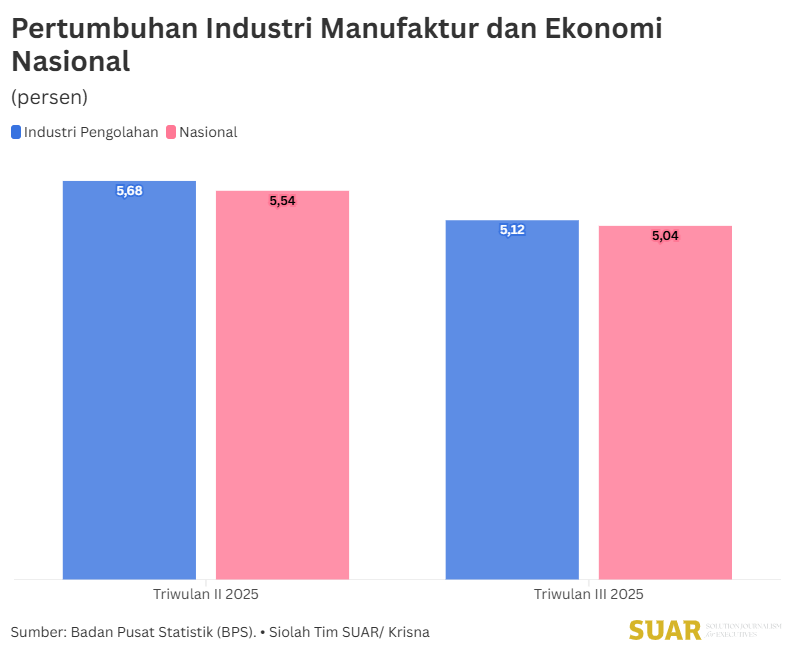

- Growth in the manufacturing sector in 2026 is projected to remain stable despite the shadow of the global economic slowdown and wage issues. The business world continues to expand due to rising domestic demand, and straightforward policies are needed to attract investment into Indonesia. According to data from the Central Statistics Agency (BPS), in the third quarter of 2025, the manufacturing industry grew by 5.54%year on year (YoY). This figure is lower than the growth of the manufacturing industry in the second quarter of 2025, which was 5.68%. In the second quarter of 2025 and the third quarter of 2025, industrial growth was higher than national economic growth.

- The manufacturing industry will remain the largest contributor to Indonesia's Gross Domestic Product (GDP) in 2026. With its significant contribution to GDP, the manufacturing sector is expected to provide extensive employment opportunities for the community. This is so that people will no longer be unemployed, will have livelihoods, which in turn can boost economic growth. BPS data from August 2025 states that the manufacturing industry sector absorbs 13.86% of Indonesia's total working population. This makes it the third largest contributor to employment, behind agriculture in first place and trade in second place. However, according to BPS data, the manufacturing industry was the business sector with the largest contribution to GDP in the third quarter of 2025, accounting for 19.51% of total GDP.

Read the full story here.

Notes on Manufacturing Sector Performance Throughout 2025

- The performance of the manufacturing sector throughout 2025 showed a positive trend with expansive growth driven by domestic demand and investment, while government policies also boosted the performance of the manufacturing industry. Looking back at the events of the past year, SUAR has recorded several significant events that have been the highlights of the manufacturing sector this year.

Read the full story here.

Money Supply Higher Thanks to 7.9% Credit Growth

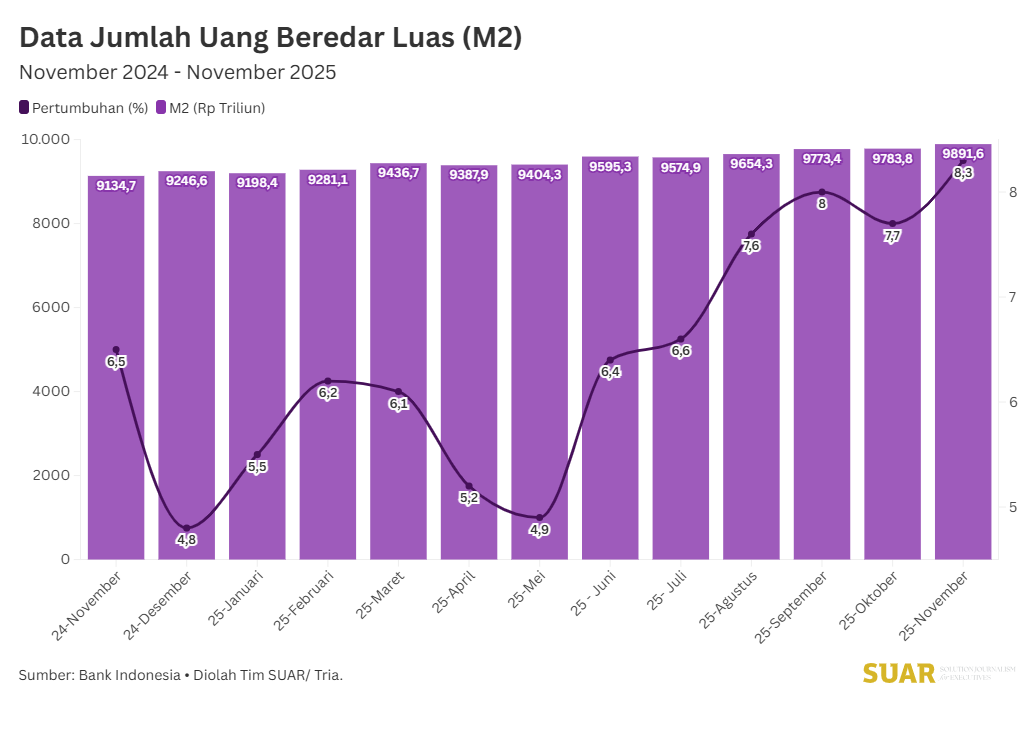

- Bank Indonesia (BI) announced that economic liquidity or broad money supply (M2) grew 8.3% year-on-year ( YoY) in November 2025. In addition to an increase in net bills to the central government, bank lending growth of 7.9% in November 2025 also contributed to this growth. This signal is expected to trigger real consumption in the fourth quarter of 2025, which will determine the annual economic growth rate. The recorded M2 growth of IDR 9,891.6 trillion was driven by the growth of narrow money supply (M1) by 11.4% YoY, amounting to IDR 5,748 trillion, driven by the development of rupiah savings that can be withdrawn at any time, as well as currency outside commercial banks and rural banks.

Read the full story here.

Calculating the Alpha Number that Can Improve Worker Welfare

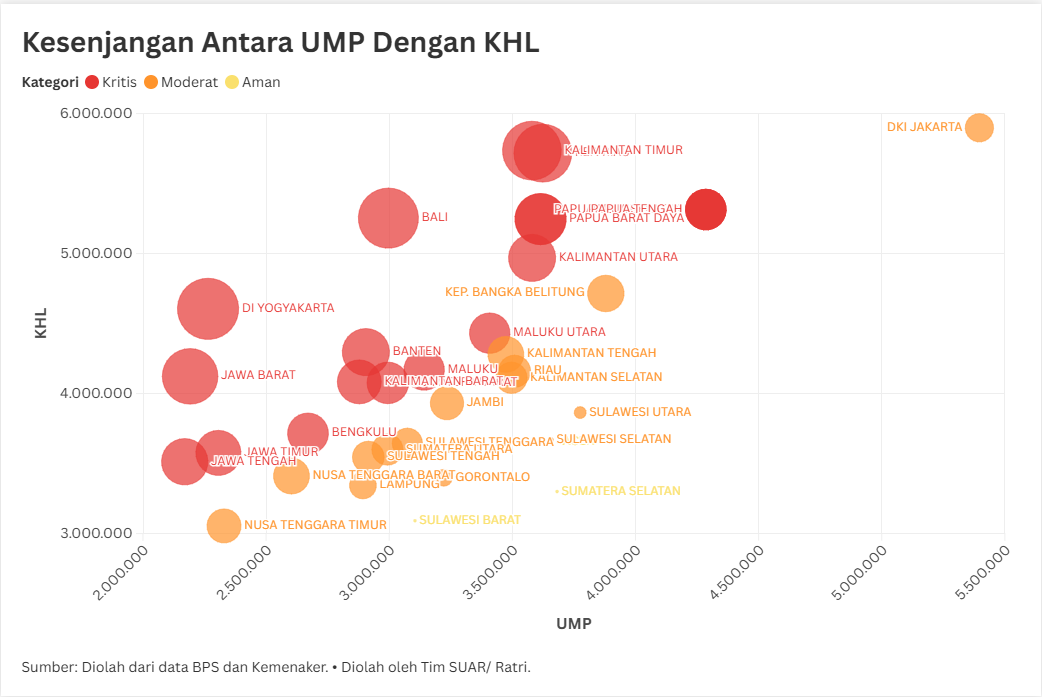

- Every year, the calculation of the Provincial Minimum Wage (UMP) sparks debate and leads to dissatisfaction among both workers/laborers and employers. The discussion always revolves around the gap between the UMP and the reality of the Decent Living Needs (KHL) in various regions. SUAR Team's analysis SUAR the nominal gap between the 2025 UMP and the 2026 KHL shows a picture of unequal welfare among workers/laborers in Indonesia.

- Based on the three categories established (Safe-Moderate-Critical), only three provinces fall into the Safe category with a positive gap, meaning that the UMP is higher than the KHL. The Moderate or Middle category is a negative gap with the KHL being higher than the UMP by between Rp 1 and Rp 1 million, occurring in 39.5% or around 15 provinces in Indonesia. As for the Critical category, which is experienced by more than half of the provinces in Indonesia (52%), there is a negative gap with a higher disparity, namely KHL is higher (above Rp 1 million) than UMP. A total of 20 provinces are in a deep deficit, with D.I. Yogyakarta (minus IDR 2.34 million), Bali (minus IDR 2.26 million), East Kalimantan (minus IDR 2.16 million), and Riau Islands (minus IDR 2.09 million) at the top as the regions with the highest negative gap .

Read the full story here.

The Indonesian government officially began enforcing an export duty policy for gold products on Tuesday, December 23, 2025. The policy, outlined in Minister of Finance Regulation (PMK) No. 80 of 2025, sets a progressive tariff of between 7.5% and 15%, depending on the type of gold product and the global reference price. For example, if the reference price is in the range of US$2,800 to below US$3,200 per troy ounce, the tariff imposed is 7.5%–12.5%, and will increase to 10%–15% if the reference price reaches US$3,200 or more. This strategic move was taken to support the domestic mineral downstreaming program, ensure domestic supply, and target additional state revenue estimated at Rp3 trillion (around US$180 million) in the coming year.

Gadjah Mada University, through its Center for Transportation and Logistics Studies (Pustral), is hosting a webinar titled Building Resilient Food and Energy Logistics in Sumatra: Crisis Analysis, Policy, and Future Strategies. The webinar will be held on Tuesday, December 23, 2025, from 8:30 a.m. to 11:30 a.m. Western Indonesian Time via the Zoom platform. The event, supported by the Indonesian Ministry of Food Security and Pertamina Patra Niaga, will feature experts such as Dr. Nani Hendiarti, Hari Purnomo, and Prof. Kuncoro Harto Widodo to discuss strategic solutions to ensure that the supply chain in the Sumatra region remains adaptive amid crisis situations. Further information regarding the webinar can be accessed directly through Pustral UGM.

Many people equate rigidity with discipline. I prefer flexibility. (Reed Hastings, Netflix)

Have a good day, Chief.

Team SUAR