The main purpose of redenomination is to simplify the nominal rupiah which is considered too large, making it difficult to record accounting, administration, and digital transactions. With fewer digits, the rupiah is expected to improve its image and credibility in international eyes, as well as save cash management costs in the long run.

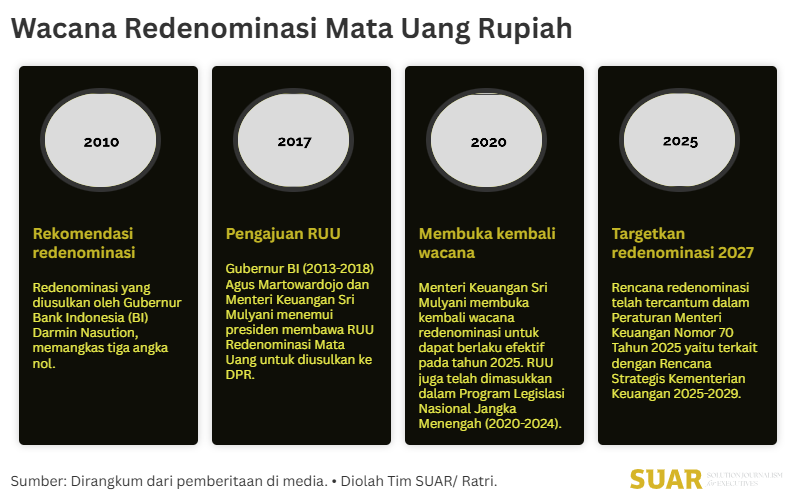

The emergence of the current redenomination discourse is a continuation of the discourse that took place in 2010 and 2017. At that time, the currency redenomination bill was blocked in the House of Representatives due to political factors and public concerns.

Today, the discourse is based on Indonesia's much stronger macroeconomic stability. With inflation under control, the current condition is considered an ideal time for non-emergency monetary policy. In addition, the readiness of digital infrastructure is now much more mature (with massive QRIS and mobile banking) which facilitates the adaptation of banking information technology systems and reduces dependence on cash transactions.

Throughout history, Indonesia has never recorded a currency redenomination. However, Indonesia did carry out sanering strategies in 1962 and 1965. Unlike redenomination, sanering at that time was done as a strategy to control soaring inflation so that cutting the nominal value of the currency had an impact on the value of the currency and helped suppress public consumption.

Other than Indonesia, a number of other countries have redenominated and proved successful because they were supported by strong stabilization programs. In Romania (2005), for example, the program was considered successful due to strict supervision from the European Union so that impacts such as inflation and public confidence in the financial system were maintained. Romania's redenomination also facilitated the process of converting the Romanian currency to the Euro because the financial system was more efficient.

The main expectation of the current rupiah redenomination plan is one of achieving total efficiency in the national financial and accounting system as well as increasing the credibility of the rupiah currency globally. This efficiency will be felt by the corporate and government sectors in financial reporting. Psychologically, a simpler currency is expected to provide a stronger perception of value, supporting the nation's economic competitiveness.

Despite the positives, this move is not without its negatives. The most important thing to watch out for is the emergence of psychological inflation. This occurs when traders or businesses take the opportunity during the transition period to round up prices, for example, from Rp 1,900 to Rp 2, which should be Rp 1.9.

This mass rounding risks triggering a spike in the prices of goods and services, which in turn will affect the purchasing power of the people, especially the middle to lower class. Therefore, the success of Indonesia's redenomination is highly dependent on the government's commitment in maintaining price discipline and conducting transparent and convincing socialization during the transition period.

Apart from technical issues, this policy is highly dependent on parliamentary discussion and communication to the public. In the process, the discussion and implementation of this policy must be done with caution.