In the midst of efforts to increase thetax ratio, the government will not only focus on tax collection. In 2026, the government will further optimize tax incentives to support public consumption and micro, small, and medium enterpriseUMKM) activities.

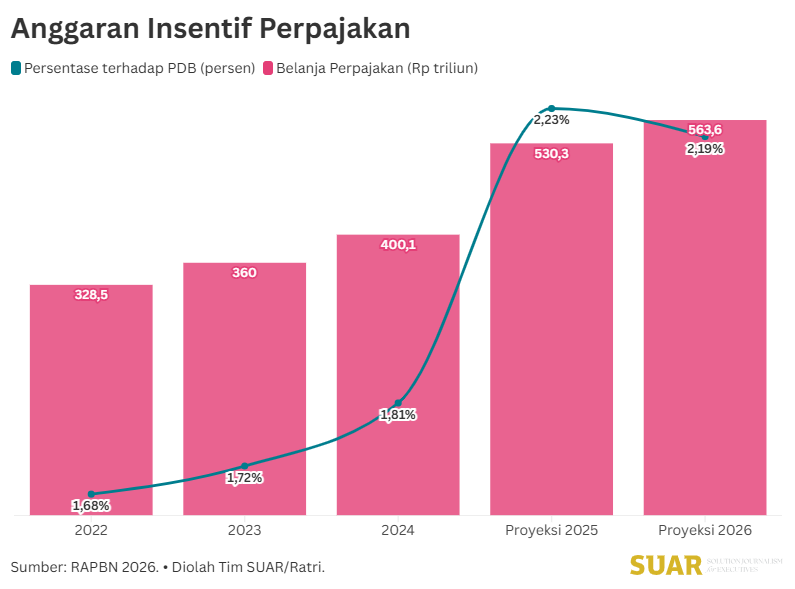

Data on tax incentives is projected to continue to increase, reaching IDR 563.6 trillion in the 2026 RAPBN, an increase from this year's allocation, which is targeted at IDR 530.3 trillion. This increase shows how tax incentives are an important instrument in supporting economic growth and public welfare.

These incentives, which are tax expenditures, are specifically allocated to key sectors that have a broad impact on the economy and daily life. One of the main focuses is the VAT exemption for basic goods, education services, and public transportation, which is allocated up to IDR 82.1 trillion.

This policy directly eases the burden on people's expenditure, especially low-income groups, and ensures access to basic needs remains affordable. With increased purchasing power, domestic consumption will be boosted, which in turn will turn the wheels of the economy from the bottom and create a domino effect to various sectors.

In addition to public consumption, the largest portion of tax incentives is directed to support the UMKM sector. The amount reached IDR 104.7 trillion (18.6%). With final income tax and VAT facilities that are not collected for small entrepreneurs, the government provides space for UMKM players to develop without being burdened by complex administration and tax costs. The significant allocation of incentives for UMKM shows the government's understanding that the sustainability of this sector is key to economic stability. This move is expected to encourage innovation and job creation, and strengthen the foundation of the economy from the smallest scale.

Furthermore, the government also uses tax incentives to attract investment for the long-term economy. Through the tax holiday and tax allowance policies, the government creates a more attractive investment climate and encourages foreign capital inflows and domestic business expansion. This mechanism has been tested during the period 2020-May 2025, which succeeded in attracting investment realization of up to IDR 441 trillion and tax allowance of up to IDR 34 trillion.

With the increase in tax incentives, the government realizes that boosting tax revenue cannot be done without taking into account the real conditions of the community and the business world. The provision of incentives also serves as a safety net that ensures that fiscal policy does not burden the economy.

These incentives also act as a stimulus that pumps liquidity into the market, encourages economic activity, and will ultimately result in a broader and healthier tax base in the future. This balance is key to creating inclusive and sustainable economic growth.

The challenges of increasing the tax ratio and allocating tax incentives are not contradictory, but complementary. Through this policy, it is expected that incentives are given selectively to the most strategic sectors, while tax enforcement is carried out fairly and effectively. Thus, the government can achieve state revenue targets without neglecting the micro and basic economic thrust on society.