The upstream textile industry welcomed the government's move to impose Safeguard Measures Import Duty (BMTP) on imports of cotton yarn products amid a wave of dumping and illegal imports that have caused many factories to close.

Starting on October 30, 2025, this three-year policy covers 27 types of products with eight-digit Harmonized System (HS) numbers according to the Indonesian Customs Tariff Book (BTKI) of 2022.

Andrew Purnama, Chairman of the Central Regulatory Committee of the Indonesian Textile Association (API), believes that the BMTP policy can protect the spinning industry, which has been sluggish in recent years.

"The policy is important to arrest the rate of decline in performance in the upstream textile sector," he told SUAR in Jakarta, Monday (27/10/2025).

Based on the investigation results of the Indonesian Trade Safeguard Committee (KPPI), domestic industries producing cotton yarn suffered serious losses.

The findings show a decline in production volume, domestic sales, productivity levels, labor force, and capacity utilization. This condition is the basis for KPPI to recommend the application of trade protection measures.

USDA Foreign Agricultural Service (FAS) Jakarta data sourced from the Trade Data Monitor (TDM) shows a surge in Indonesia's cotton yarn imports in the last two years. In 2024, total imports reached around 24 thousand tons, up from 17 thousand tons in 2023 or grew around 41% on an annual basis. During January to October 2024, the import volume increased by 33% compared to the same period the previous year, with Vietnam being the largest supplier accounting for 36.9% of total imports, followed by China 26.5% and India 19.8%.

The products included in the imposition of BMTP include various types of cotton yarn with HS codes from 5204.11.10 to 5206.45.00. All types are the main raw materials used by the spinning and weaving industry in the textile sector.

Based on API data, the surge in imports has a direct impact on the financial and operational performance of association member companies. Recommendations are then submitted by KPPI to the government after going through the process of evaluating and verifying industry data.

This regulation will later be regulated in Minister of Finance Regulation (PMK) Number 67 of 2025. The amount of import duty is set in stages, namely IDR 7,500 per kilogram in the first year, IDR 7,388 per kilogram in the second year, and IDR 7,277 per kilogram in the third year.

Through this mechanism, the government seeks to provide space for affected industries to make structural adjustments.

Continues to Decline

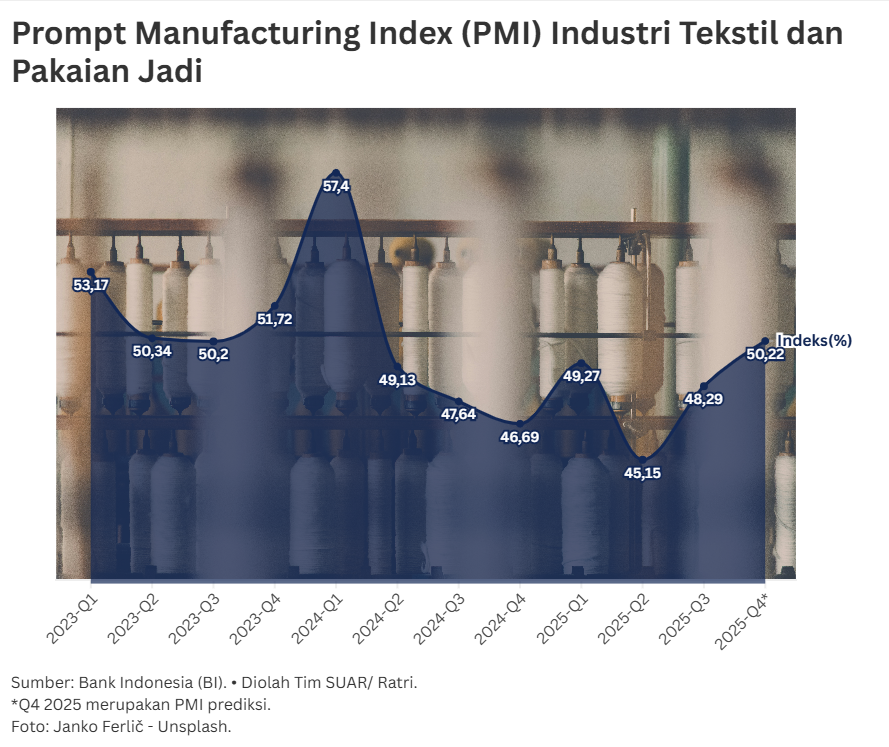

Andrew explained that based on API monitoring, the performance of the cotton yarn industry declined from 2020 to 2024 in almost all key indicators, with a downward trend of around 30 to 40% compared to pre-pandemic conditions.

He said a number of large factories such as Sritex Group have stopped operating, while some other API members are only operating with a utilization rate of 17 to 19%.

This was exacerbated by weak global demand and rising energy and logistics costs, while in the domestic market dumping practices and illegal imports depressed prices.

"The implementation of BMTP is a corrective step to restore market balance. This policy must be carried out in a measured manner so as not to cause distortion in a relatively stable subsector," he said.

Although this policy only covers cotton yarn products, Andrew thinks it will still have an impact on supply chain stabilization because it gives room for production recovery and employment. He assessed that the effectiveness of the policy is determined by field supervision and consistency of implementation.

Furthermore, Andrew stated that BMTP is temporary so industry players must utilize it for structural adjustments. Andrew encourages efficiency improvements, capacity building, and strengthening competitiveness so that the industry can become competitive again after the protection period ends.

"The sustainability of the textile industry can only be maintained if protection policies are followed by internal reform measures and enforcement of rules against unfair trade practices," he said.

The same thing was conveyed by the Chairman of the Indonesian Fiber and Filament Yarn Producers Association (APSyFI), Redma Gita Wirawasta, who assessed that this policy provided space for the spinning industry to recover performance after prolonged import pressure.

"This will help the spinning industry to survive," said Redma.

Redma explained that cotton yarn has a portion of about 30% of the total fiber consumption of the spinning industry, or about 300 thousand tons from the total need of 900 thousand tons per year.

According to Redma, although this policy does not directly impact the synthetic fiber industry, the sustainability of the spinning sector remains important as it will affect the demand for products produced by APSyFI members.

Redma considers the main problem of the national textile industry is not merely low competitiveness, but unfair trade practices due to dumped goods and illegal imports. He emphasized rule enforcement as the key to creating fair competition in the domestic market.

"APSyFI's position has always been clear, we support every policy that creates fairness competition throughout the industry chain," he said.

Need for fair competition

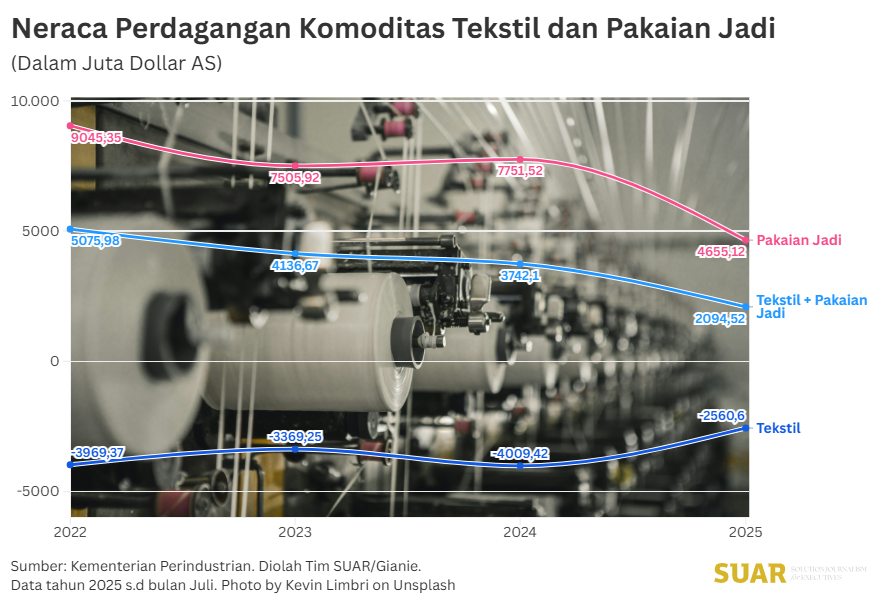

Mohammad Faisal, Executive Director of the Center of Reform on Economics (CORE) Indonesia, believes that the main problem pressing on the cotton yarn industry today comes from competition in the domestic market with imported products.

The most pressure comes from Chinese goods that are sold far below the price of domestic production, which weakens demand in the intermediate and upstream chains.

Faisal explained that the price difference between imported and local products is very striking. In his notes on several categories of goods, the price of products from China is only about 40 to 60% of the price sold by domestic producers.

"It will be very difficult for the national industry to compete with such a wide price gap ," he said.

This price pressure, according to Faisal, contributed to a decline in production and a wave of labor reductions in domestic market-oriented sectors.

In addition to the price issue, Faisal assessed that the rise of illegal imports exacerbates market imbalances because goods without official levies enter through large ports and unofficial channels.

So, according to him, the success of security policies such as BMTP is highly dependent on effective supervision of the flow of goods in the field.

Faisal also highlighted the need for cross-policy synchronization so that industrial protection does not run separately from other government programs. Many incentives for labor-intensive sectors have not been utilized due to inadequate procedures and information.

"If you want to seriously improve the textile industry, the policies must be synchronized from upstream to downstream," he said.