Indonesia's manufacturing performance at the end of the year is still in an expansionary position. This is reflected in the position of the Indonesian Manufacturing Purchasing Managers' Index (PMI) in December 2025, which stood at 51.2, down from 53.3 in November 2025. Despite the decline, Indonesia's PMI remains above the 50 level, which means it is still in an expansionary position.

This achievement shows that Indonesia's manufacturing sector will continue to grow at the end of 2025, despite a slowdown in its expansion rate. S&P Global assesses that the monthly decline in the PMI reflects a slowdown in production growth amid relatively solid demand conditions.

In its report, quoted on Sunday (January 4, 2026), S&P Global noted that new demand was once again the main driver of expansion, with total new orders increasing for the fifth consecutive month.

However, the growth rate of orders slowed compared to November. A number of companies reported that new product launches and an increase in the number of customers contributed to the increase in sales, especially from the domestic market.

In terms of employment, manufacturing companies continued to hire new employees throughout December. Although the pace of job creation was moderate and slower than in November, the increase was in line with the average for 2025. S&P Global also noted an increase in backlogs for two consecutive months, indicating capacity pressures as a result of new order growth.

At the same time, purchasing and inventory activities also increased. Manufacturers increased their stocks of raw materials and finished goods in anticipation of current and future order requirements. In fact, post-production inventories rose to their highest combined level in six years.

S&P Global Market Intelligence economist Usamah Bhatti said Indonesia's manufacturing sector will continue to close 2025 with a sustainable growth trend.

"The Indonesian manufacturing sector closed 2025 with continued improvement in operating conditions, extending the current growth period to five consecutive months," Bhatti said in an official statement.

He added that although production only increased marginally due to supply constraints, companies still recorded expansion in new orders, employment, and purchasing activity. Business optimism also strengthened to its highest level in the last three months, in line with expectations of increased production in the next 12 months.

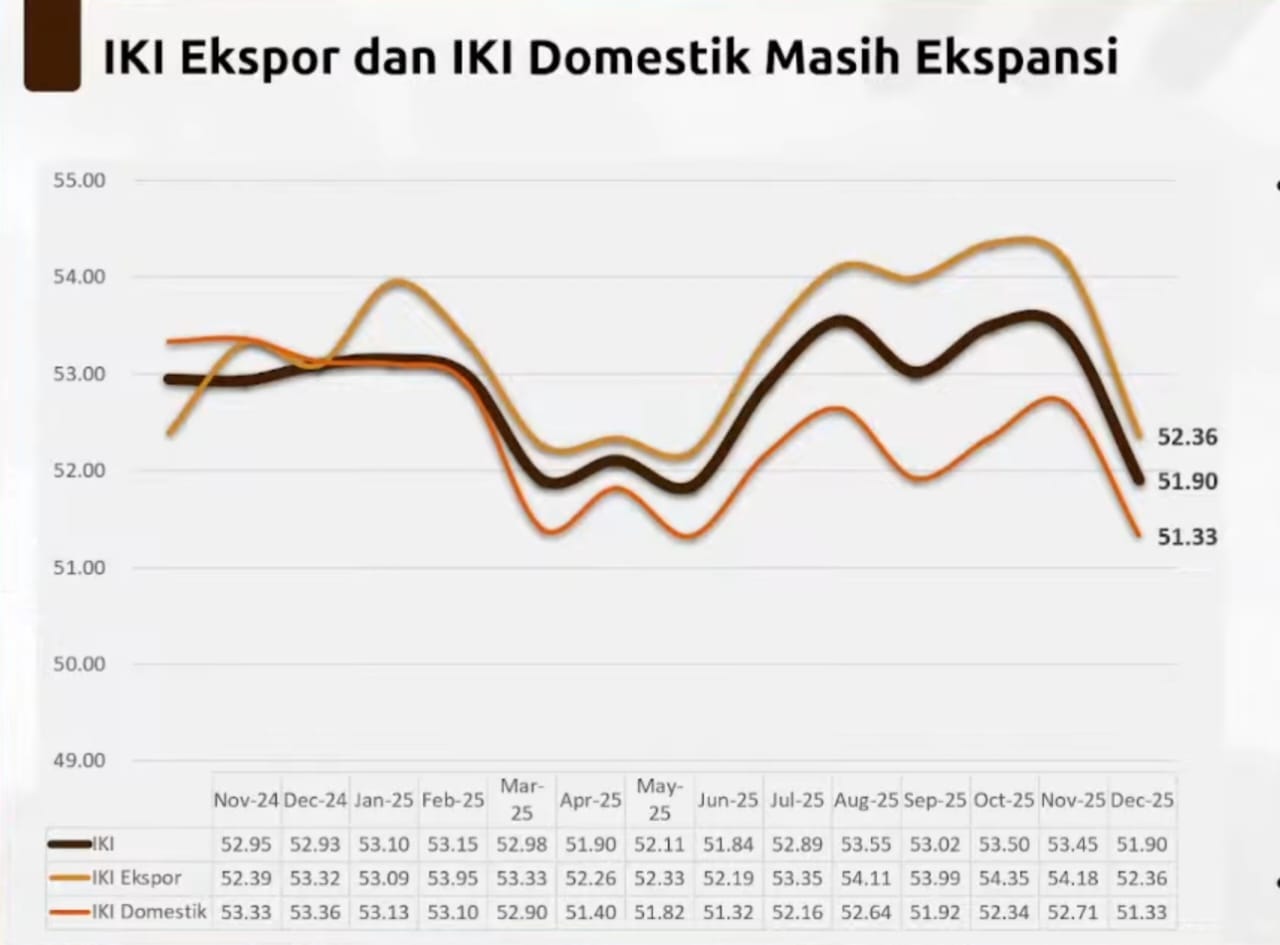

In line with PMI dynamics, the performance of the national manufacturing industry is also reflected in the Industrial Confidence Index (IKI). In December 2025, the IKI was recorded at 51.90, down 1.55 points compared to November 2025, which reached 53.45, and 1.03 points lower than the same period in the previous year of 52.93.

Although weakening, the level is still above the 50 threshold, which indicates a phase of expansion.

Spokesperson for the Ministry of Industry, Febri Hendri Antoni Arif, said that the weakening of the IKI in December was a pattern that commonly occurred at the end of each year.

"Despite experiencing a monthly decline, the December 2025 IKI remains in the expansion zone. This shows that the foundations of the national manufacturing industry remain quite strong amid global and domestic dynamics," said Ministry of Industry spokesperson Febri Hendri Antoni Arif in the December 2025 IKI release in Jakarta on Tuesday (12/30/2025).

Historically, the IKI in December tends to be lower than in November. In December 2023, the IKI was recorded at 51.32, down 1.11 points, while in December 2024 it stood at 52.93, down 0.02 points. This decline is in line with the reduction in effective working days due to the Christmas and year-end holidays, which have an impact on the adjustment of the production schedule of the non-oil and gas processing industry.

"The Ministry of Industry remains committed to maintaining the sustainability of manufacturing industry expansion by strengthening the domestic market, increasing the use of domestic products, protecting the industry from unfair trade practices, and ensuring the availability of competitive energy and raw materials," Febri emphasized.

Manufacturing notes

Chairperson of the Indonesian Employers Association (APINDO) Shinta Kamdani said that throughout 2025, the manufacturing industry will face considerable pressure, especially in the first half of the year.

The Manufacturing PMI was recorded to be in the contraction zone for four consecutive months from April to July, even reaching its lowest level in nearly four years. This condition reflects a weakening in production and demand, both from the domestic market and exports.

However, entering the second half of 2025, conditions began to show improvement. The Manufacturing PMI returned to the expansion zone from August to November, reaching around 53.3 in November 2025, the highest since February. Data from the Central Statistics Agency (BPS) also recorded that the processing industry grew by 5.54% (yoy) in the third quarter of 2025, while non-oil and gas manufacturing grew by 5.58%, higher than the national economic growth of 5.04%.

"So we are entering 2026 from a position that is not yet ideal, but there are signs of improvement," said Shinta when contacted on Sunday (4/1/2026).

Read also:

According to Shinta, the manufacturing outlook for 2026 will be largely determined by two main factors. First, the continued effects of government policies throughout 2025, ranging from stimulus packages and import deregulation to licensing reforms through PP 28/2025 and the P2SP Task Force.

If implemented consistently, Shinta explained, the policy has the potential to reduce the industry's cost structure and provide room for manufacturing expansion. Second, external dynamics and potential policy shocks, such as reciprocal tariffs in the United States, the implementation of IEU-CEPA, EUDR and CBAM in Europe, and the direction of the Fed's policy.

"The key lies in how quickly the government and the business world can turn the momentum of recovery in 2025 into deeper reindustrialization, not just a short-term rebound," he said.

Shinta also highlighted the structural challenges faced by the manufacturing sector. In 2024, non-oil and gas manufacturing recorded a contraction of around minus 0.86 percentage points. In the last decade, nine of the 15 manufacturing sub-sectors experienced a decline in their contribution to GDP, which she referred to as a symptom of premature deindustrialization.

Domestically, the business world still faces high economic costs. Logistics costs reach around 14.29% of GDP, industrial electricity tariffs are around 32% more expensive than in Vietnam, and loan interest rates are in the range of 8–14%, far above neighboring countries, which are at the level of 4–6%. The complexity of regulations at the regional level is also considered to limit the scope for industrial expansion.

Looking ahead, Shinta said that achieving the 2026 manufacturing targets would require a coordinated and consistent policy approach, including reducing logistics, energy, and financing costs, strengthening trade instruments, and accelerating deregulation of licensing so that manufacturing expansion could be more sustainable.

Expansive but fragile

Director of Big Data Development and Economist at the Institute for Development of Economics and Finance (INDEF) Eko Listiyanto assessed that the decline in the Manufacturing PMI and Industrial Confidence Index (IKI) in December 2025, despite still being in the expansion zone, reflects the structural pressures that continue to loom over the national manufacturing sector.

"If I interpret this slowdown signal, it actually reflects structural pressure in the manufacturing sector. Although there is expansion, the figures are below November's or show a moderation in expansion," Eko told Suar.id on Sunday (4/1/2025).

According to Eko, this situation is unusual considering that December is generally a month of increased industrial activity. However, in December 2025, the increase in demand is not expected to be particularly strong. This is due to the fact that people's purchasing power has not yet fully recovered and that not all consumption is derived from manufactured products.

"Although consumers usually increase demand in December, if we look at it, it's not that strong. This is very likely related to the fact that people's purchasing power has not yet recovered," he said.

In addition, increased consumption at the end of the year was also driven more by the service sector, such as transportation and tourism. The impact on manufacturing remained, but was considered lower than in the previous month. This condition was reinforced by the trend of rising inflation until the end of the year, which also affected raw material costs and industrial production structures.

Another factor that has weighed on manufacturing performance is the slowdown in production due to raw material shortages. Eko emphasized that the availability of raw materials is a crucial component in the industrial production process. When supplies are disrupted, national manufacturing performance is also affected.

On the external demand side, Eko noted that export orders also contracted. This condition has caused domestic demand to once again become the main driver of the industry. In general, domestic demand remains relatively high and is capable of supporting growth, but it is not yet strong enough to drive greater expansion.

"If it's just about survival, then yes, but if it's about medium-term sustainability and achieving good industrial growth, then relying solely on the domestic market is not enough. We must encourage greater exports," said Eko.

Read also:

Similarly, Galau D. Muhammad, a researcher at the Center of Economic and Law Studies (CELIOS), believes that the downward trend in the PMI and IKI reflects the pressures currently facing the national industrial sector, even though both indicators remain above the expansion threshold.

According to Galau, the PMI and IKI basically represent the sentiment and perception of business actors and industries towards economic conditions. The weakening of these two indices indicates that the progress of the national industry is currently facing real challenges, especially amid real industry issues directly related to the production process.

"Generally speaking, these two indices show the sentiment and perception of business and industry players, indicating signs of weakness in relation to national industrial progress," said Galau.

He explained that these conditions illustrate a pattern of industrial growth that is "short-lived." The vulnerability of the national industry is still considered high, mainly due to fluctuations in raw material prices, weakening global demand, and a decline in domestic purchasing power that has not yet fully recovered.

Galau emphasized that the aggregate PMI and IKI figures do not yet reflect equitable performance across industrial subsectors. A number of sectors are still facing productivity pressures, indicating that the leverage of the national industry is fundamentally not yet strong enough.

Responding to the question of whether the weakening of PMI and IKI is seasonal or structural, Galau said that seasonal factors at the end of the year did play a role. However, he assessed that the pressure that occurred was not solely seasonal in nature.

"When you look at it, this has indeed become a structural pressure. Upstream sub-sectors such as basic metals, chemical industry, electronics, and several labor-intensive industries have actually experienced a decline in productivity," he said.

On the supply side, Galau highlighted the significant impact of raw material scarcity on industrial performance. The national industry's dependence on imported raw materials makes the manufacturing sector highly sensitive to fluctuations in exchange rates and global commodity prices.

"There are factories that are not operating at full capacity, but are actually holding back production. There are reductions in working hours, order delays, and various adjustments," he said.

On the demand side, the contraction in export orders has caused the domestic market to once again become the mainstay of the industry. However, Galau believes that dependence on domestic demand is short-term, especially amid the continuing pressure on household finances.

"Today, the burden on the middle class and households is still very heavy. Food prices are rising, installments are increasing, so we are solely dependent on the domestic market," he said.

According to Galau, weak export competitiveness amid the global economic slowdown and rising protectionism increase the risks to national industrial growth. Entering 2026, Indonesia is considered to be in a phase of economic vulnerability, no longer experiencing high growth euphoria, with global and geopolitical uncertainties still looming.

Future prospects

Regarding future prospects, Galau believes that industrial expansion is still possible, but the challenges are growing. The weakening of the PMI and IKI needs to be interpreted carefully, as business optimism has not yet been fully converted into real production expansion.

"Optimism may still exist, but the real industry conditions today are facing worrying projections," he said.

He added that in recent years, the business optimism index has tended to be high, but investment realization and capacity expansion have been slow. This indicates a gap between perception and actual action in the industrial sector.

From a policy perspective, Galau believes that the urgent steps that need to be taken are to ensure that logistics and energy costs remain at an affordable level, while accelerating import substitution in upstream sectors such as petrochemicals, steel, and electronic components. As long as import dependency remains high, global turmoil will continue to directly impact the national industry.

In addition, incentives and financing are still considered important, but need to be targeted more precisely so that they are not only enjoyed by the big players.

Galau also highlighted the importance of promoting downstreaming that truly increases domestic added value, industrial technology modernization, energy efficiency, and strengthening local economic involvement in the national industrial supply chain.

Similarly, Eko from INDEF projects that the manufacturing industry will remain in the expansion zone in the first quarter. The momentum of Eid al-Fitr is expected to drive an increase in production, especially in February and March. However, challenges are expected to arise in the second quarter, when domestic demand is likely to return to normal after the Eid al-Fitr period.

"In the second quarter, the challenge is the post-Eid period, because demand usually declines," said Eko.

This situation has the potential to further pressure industry performance if global pressures do not subside. Export opportunities are still considered to be highly dependent on global dynamics, including increased geopolitical tensions. Eko mentioned the escalation of international conflicts that could affect global trade stability and Indonesian export demand.

"If global pressures do not improve, this will pose a challenge to manufacturing industry performance, particularly in the second quarter," he added.