The World Economic Forum (WEF) 2025 survey found that short-term geoeconomic instability across sectors has a long-term impact. However, the outlook for economic growth due to disruption is different in each region or area.

The World Economic Forum (WEF) Chief Economists' Outlook September 2025 survey - which highlights various global and regional economic issues - also reveals that the pillars of the global economy that are of concern to world economists are now centered on trade vulnerabilities.

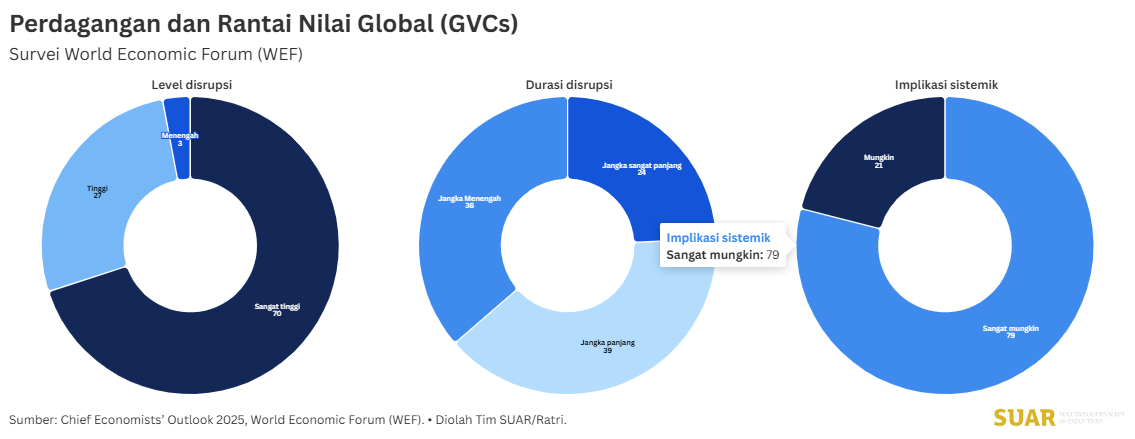

In assessing the pillars of trade and global value chains (GVCs), 70% of respondents who are economists rated the level of disruption as very high. In fact, as many as 79% of these economists considered it to have a very systemic impact.

Most worrisome is the impact of geoeconomic fragmentation and tariff wars that threaten the integration of global value chains (GVCs). For Southeast Asia, especially Indonesia, this situation is not just a threat, but an invitation to redefine its regional role on the world stage.

On the one hand, Southeast Asia as a whole is in the depressed East Asia and Pacific group. The WEF report explicitly mentions the mounting trade headwinds weighing on the East Asia and Pacific region. The ripple effect of tariffs imposed by developed countries, such as the US on China and Japan and others, ripples through regional export networks.

Inevitably, this has an impact on resource-rich Indonesia, which depends on the stability of the global market for its commodities. If export demand from major trading partners slows down, Indonesia's predicted stable (but revised down) growth will also be hampered.

Behind these risks, however, lie strategic opportunities. Global fragmentation is forcing multinational companies to undertake arealignment of supply chains in search of a more secure and resilient base of operations. In this context, Indonesia has the advantage of being part of a developing country.

As a developing country, Indonesia's growth relies heavily on natural resources. As a major global player in key commodities - such as nickel or other natural products - these assets are not enough to manage on its own, requiring access to capital (FDI).

The shift to GVCs allows Indonesia to leverage these resource assets to attract high-tech investment in the downstream sector. Transforming it from a mere supplier of raw materials to a center of value-added production.

Although Indonesia's foreign direct investment (FDI) has increased in the past decade, from around IDR 92.5 trillion in the first quarter of 2015 to IDR 230.4 trillion in the first quarter of 2025. A significant increase of approximately 149%. At its peak, the increase in FDI over the past decade occurred in the fourth quarter of 2024, which reached Rp 245.8 trillion. However, entering 2025 this actually decreased by 12% (q to q) in the second quarter of 2025.

To secure this golden opportunity of investment relocation, Indonesia must seriously address the institutional barriers identified in the survey. In the findings of the survey, WEF warned that constraints such as weak institutions and governance as well as difficulties in access to finance are major barriers for developing countries.

This means that capital fleeing from China will not automatically enter Indonesia, unless the business environment and legal certainty support a stable business ecosystem. Therefore, Indonesia's current challenge is to turn fragmentation into accelerated domestic reforms, ensuring infrastructure, regulation and transparency are on par with its natural resource advantages.