In order to overcome the potential sluggishness of exports after the implementation of reciprocal export tariffs to the United States (US), Indonesian exporters need to look for new market destinations. One potential market that the government is exploring is trade to Africa.

The countries on the Black Continent have stable economic growth and love to receive imported products from abroad. Africa's market is as big as China's. Africa's population is estimated at 1.3 billion - representing 16% of the world's population.

Trade Minister Budi Santoso said that so far, Indonesia has only focused on the American and European markets. In fact, many countries in Africa have stable economic growth and accept imported products from abroad. Some potential countries that will be targeted are South Africa, Kenya, Morocco and Egypt.

After successfully conducting trade negotiations with Peru, the government is ready to negotiate with countries in Africa. The country that has expressed interest in conducting bilateral negotiations with Indonesia is South Africa.

"We have started negotiations with the first step of studying the country profile," he said when met at the "Jakarta Muslim Fashion Week 2026" event in Jakarta, Wednesday (13/8/2025).

Interestingly, the African market is also growing. According to UN estimates, Africa's population could reach 2.49 billion by 2050 or about 26% of the world's total population. Then, it will grow to 4.28 billion by 2100 or about 39% of the total world population. This means that Indonesia has strategic potential to strengthen diplomatic relations, establish economic, trade and investment cooperation with African countries.

Citing data from the Ministry of Trade, Indonesia's largest export destination to Africa is Egypt. In January-June 2025, Indonesia's total non-oil and gas exports to Egypt reached USD 967.8 million (IDR 15.66 trillion). This figure is only equivalent to 0.75% of the national export share.

Indonesia finalizes three trade agreements

Director General of International Trade Negotiations (Dirjen PPI) of the Ministry of Trade Djatmiko Bris Witjaksono said that Indonesia has finalized three trade agreements. Namely, with Canada, Eurasia, and Tunisia.

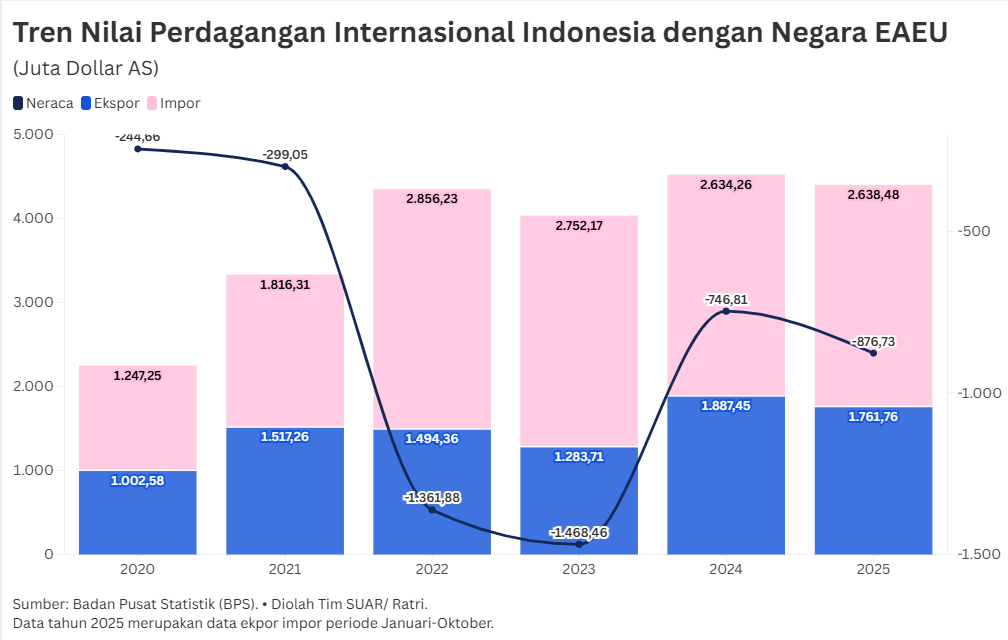

The Indonesia-Canada Comprehensive Economic Partnership Agreement (ICA-CEPA), Indonesia-Eurasian Economic Union Free Trade Agreement (I-EAEU FTA), and Indonesia-Tunisia Preferential Trade Agreement (IT-PTA) have been finalized, but not yet signed.

Tunisia has an important role to play. The country has the advantage of opening market access for the North African region, such as Morocco, Libya and Egypt.

Djatmiko said that Indonesia is also finalizing the Indonesia-European Union Comprehensive Economic Partnership Agreement (CEPA). He hopes it can be finalized within the next few weeks.

Indonesian Palm Oil Association (Gapki) Chairman Eddy Martono said the African market is quite sexy and growing rapidly. Not surprisingly, his party is exploring the market potential in the African region.

Currently, the largest export destinations for Indonesian CPO are still India and China. As long as global economic conditions are stable, then India and China remain excellent. On the other hand, if global economic conditions affect India and China, Gapki is ready to shift the CPO export market to Africa.

"We are still monitoring developments in the world economy, but Africa is on our radar," Eddy told SUAR (17/8).

Indonesia's crude palm oil (CPO) export performance fell by 3.08% during January-April 2025. Based on Gapki data, until April 2025, total CPO exports fell from 9.715 million tons in the same period last year to 9.416 million tons this year.

The highest decline was recorded for the Indian market which dropped by 1.055 million tons or equivalent to 68%, followed by the European Union by 818,000 tons (-62%), China by 746,000 tons (-62%), and Pakistan by 385,000 tons (-42%).

Market alternatives

Economic Observer at the Institute for Development of Economics and Finance (Indef) Fadhil Hasan assesses that the African market has enormous potential as an alternative export destination for Indonesia, especially for the first export market for national manufactured products, before expanding to traditional export markets such as the United States, the European Union, or China.

Although the purchasing power of African markets is still far below that of traditional export markets, Africa is promising in terms of market size growth, trade competition, and tradebarriers.