The Composite Stock Price Index (JCI) again recorded an all-time high (ATH) on Monday trading (24/11/2025) at 8,570.25. This is the 19th time the JCI has recorded an ATH throughout 2025.

Throughout Monday, the JCI gained 156 points or 1.85%. Total trading on the trading floor on Monday reached Rp45.65 trillion, which came from trading as many as 51.65 units of shares, with a trading frequency of 2.55 million times.

Since trading opened, the JCI ranged from 8,429.46 to the highest level in just one day. The total transaction value on that day from Exchange-Traded Funds (ETFs), Real Estate Investment Funds (REITs), stocks, warrants, and structured warrants reached up to IDR 45.6 trillion.

Director of Development of the Indonesia Stock Exchange (IDX) Jeffrey Hendrik, said that currently the increase in the JCI has begun to be evenly distributed, not only supported by a number of conglomerate stocks.

"It looks like today (Monday) that it depends on the market mechanism. If we see that it is evenly distributed, the increase has been supported by multi-sectors. So hopefully this growth will be sustainable," Jeffrey said in an interview on Monday (24/11/2025).

As is known, the IDX has transformed into a multi-asset exchange, by providing various investment instruments such as debt securities, carbon units, and other equity-based products, not just stocks.

"For stock securities, as we know today the average transaction value has reached Rp16.9 trillion per day. We also organize trading of debt securities and sukuk, and today the average transaction value has also reached Rp5-6 trillion per day," he said.

JCI last week also touched the highest level at 8,490, precisely on Thursday (11/20/2025). Behind the strengthening of the JCI, foreign investors are also known to have made purchases or inflows with a value of IDR 2 trillion in the regular market.

Despite the rally, investors should remain vigilant about market movements, as currently amid global uncertainty, global market volatility is increasing. This highly volatile stock market can drastically change its price in a short period of time, especially since the ATH point can trigger stock price volatility in the short term.

Equity Analyst PT Indo Premier Sekuritas (IPOT) David Kurniawan, urged traders and investors to continue to monitor global market volatility sentiment, where volatility has risen sharply again (VIX +18.16%) amid global uncertainty. Investors should also be more cautious in taking risks, due to the sharp movement.

"Global market volatility has increased again. This is evidenced by the increase in the VIX indicator by 18.16% in the past week. With high volatility , traders must be prepared for the ups and downs of market dynamics and should take positions with a very measured risk-reward," said David through his written statement, Monday (11/24/2025).

The strengthening of the market itself in recent times was influenced by a number of sentiments such as the performance of the state budget where it was reported that the state budget deficit reached Rp479.7 trillion as of October, and Bank Indonesia (BI) which decided to hold its interest rate (BI Rate) at 4.75%.

On the one hand, various investment instruments and structured products also continue to be developed by the IDX so that investors can diversify their portfolios and allow them to get greater profit potential.

Award

In addition to recording the ATH record, the IDX also gave a number of awards to exchange members on Monday. The Investor Reward Program (IRP) 2025 is a form of appreciation from the IDX to Exchange Members (AB) who actively contribute to increasing education, socialization, and trading activities of structured products in the Indonesian capital market.

"This activity was supported by 23 participating Exchange Members and managed to record encouraging results. During this period, there were more than 42,000 individual investors who traded ETFs, structured warrants, and REITs, with a total value of Rp707 billion," Jeffrey explained.

Through IRP 2025, IDX hopes to encourage the spirit of innovation from all Exchange Members in presenting investment products that are competitive in the capital market.

"Exchange members have shown extraordinary commitment through the implementation of promotional activities, education, and other activities. We recorded more than 240 activities that have been carried out during the period April to October this year," he said.

Read also:

The transaction value and investors themselves managed to grow significantly. The average daily transaction growth of 2025 structured warrants and ETFs increased 3 times when compared to 2024.

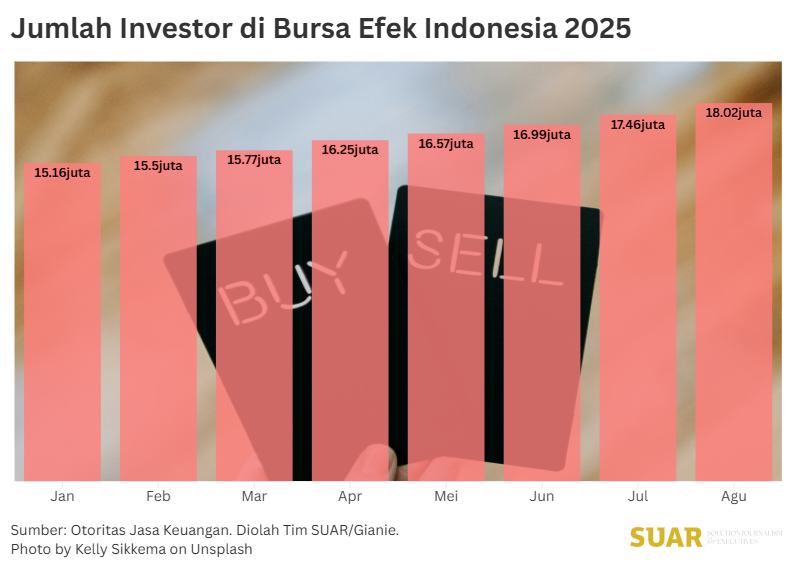

IDX Head of Business Development Division 2 Ignatius Denny Wicaksono, revealed that the number of transactions and investors also continued to grow from Q1-2025 to Q4-2025. When compared to last year, daily transactions in Q4-2025 grew 5.4x and investors grew 11.6x.

"If we look at Q4, the highest increase was 11.6 times, with one month reaching 48 thousand monthly active investors, so it's quite encouraging," Denny added.