Rather than simply exporting raw coconuts, businesses are now encouraged to downstream the "tree of life" into a variety of high-value products. This strategic move not only has the potential to increase the value of exports by trillions of rupiah, but also create new jobs for millions of people and improve the welfare of farmers.

Minister of Agriculture Andi Amran Sulaiman also emphasized the importance of downstream agriculture as the key to improving farmers' welfare, increasing employment, and strengthening the national economy.

Amran explained that the downstream program has great potential to absorb 1.6 million new workers in the next three years. In addition, downstreaming will also increase farmers' exchange rate (NTP), which directly impacts farmers' welfare.

"If downstreamed, coconut exports could be worth up to Rp 400 trillion. This industry has been awaited by the global market, especially China and India," Amran said at the Indonesian Chamber of Commerce and Industry's Rakornas for Cooperatives and UMKM, Jakarta (20/8).

One of the triggers for the surge in the potential for downstream coconut exports is because the price of coconut commodities is currently soaring. Quoting the Latest Statistics on Agricultural Economics released by the Ministry of Agriculture, the average price of coconut is IDR 5,645 per kilogram, up 51.24% from 2024 which is in the range of IDR 3,728 per kilogram.

The increase in coconut prices is due to weather disruptions in coconut supplying countries, resulting in decreased supply. Indonesia also benefits from being one of the coconut supplying countries. This is because coconuts cannot grow in export destinations such as Europe.

In line with the Minister of Agriculture's explanation, Chairman of the Indonesian Coconut Processing Industry Association (HIPKI) Rudy Handiwidjaja revealed that the coconut processing industry in Indonesia has grown rapidly.

"Downstreaming for our coconut tree industry is already advanced. All from processing. From coconut, we can make products, because the downstream products have been produced in Indonesia," Rudy told SUAR (22/8/2025).

He explained that all parts of the coconut, from the shell, coconut meat, to coconut water, have been processed into various downstream products. These include coconut cooking oil, coconut milk,desiccated coconut, bottled coconut water, and activated carbon, also known as coconut activated charcoal, as an industrial raw material for water purification.

According to Rudy, the market for processed coconut products is still in high demand, both at home and abroad. This is because there is an increasing trend in the consumption of healthy foods, such as coconut and coconut water.

Rudy gave an example of the shift in people's consumption patterns in Bamboo Curtain Country. "Even in China, they drink milk drinks made from coconut milk. In China it has happened like that because they avoid or reduce consumption of animal milk," he said.

Meanwhile, he explained that the coconut processing industry in Indonesia still faces serious challenges, especially related to the availability of coconut raw materials. According to him, this condition has been going on since September 2024 and has not shown significant changes.

"The condition of the coconut processing industry in Indonesia from September 2024 until now is not much different. That is, we lack raw materials [coconut]," Rudy explained.

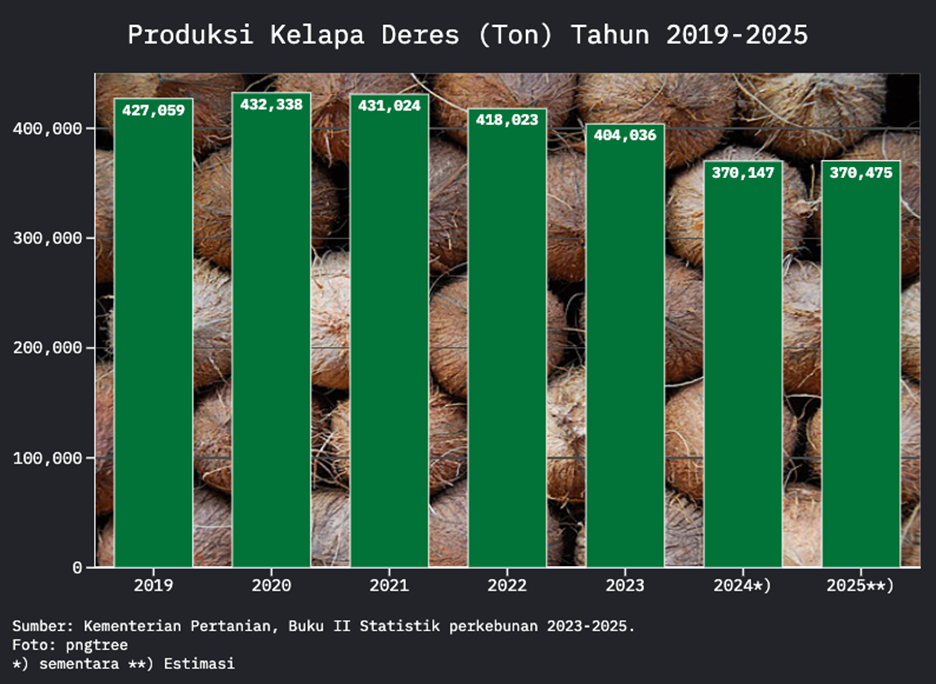

According to Rudy, the reason why the coconut processing industry lacks raw materials is because the export capacity is still large, so the availability of coconut for domestic production is reduced. Another factor, Rudy added, is the condition of farmers' coconut plantations which have not returned to normal after the long drought in 2023. And, the effect is still felt today, resulting in decreased production at the farm level.

To overcome the challenges of raw material supply, HIPKI hopes that the government can take strategic steps such as creating a national coconut industry roadmap. Another proposal is to implement a coconut export levy (PE), so that funds from export levies are expected to be returned to farmers for the provision of seeds and fertilizers, as well as replanting programs.

Referring to data from the Ministry of Agriculture (MOA), the largest coconut deres producing centers in Indonesia are spread across the provinces of Central Java, West Java, Special Region (DI) Yogyakarta, Bali, and West Kalimantan.

Furthermore, Rudy emphasized that the coconut processing industry is a labor-intensive industry, so it can absorb labor and contribute to national economic growth.

"So this is an opportunity for the government if it wants to create jobs, let's support the coconut processing industry to be able to produce optimally," he said.

HIPKI's proposal is in line with the findings of Chairman of the Indonesian Association of Seed Banks and Farmer Technology (AB2TI) Dwi Andreas. He explained that Indonesia's coconut export trend has shown a significant increase since 2021. Based on his records, the volume of coconut exports rose from 2 million tons in 2021 to 2.3 million tons in 2024.

On the other hand, he also observed that the area of coconut land continues to shrink, directly resulting in a decline in national coconut production. "In the last 10 years alone, our coconut land has decreased from 3.65 million hectares to 3.33 million hectares. So it has decreased by an average of 1 percent per year. We are experiencing a serious problem," he explained to SUAR (22/8/2025).

Furthermore, the Professor of Bogor Agricultural University (IPB) explained that the main challenge is not only the shrinkage of land, but also the productivity of existing coconut plantations.

Another challenge, according to Andreas, is the existing coconut trees. There are already many old coconut trees in farmers' plantations. "For this reason, the average productivity in the last 10 years is very low, only 1.12 tons per hectare per year, and there is no increase," said Dwi Andreas.

According to Andreas, most of the coconut trees in Indonesia are old and susceptible to pests and diseases, hence the need to replant using superior coconut varieties that have the potential to increase productivity to 1.5 tons per hectare per year.

Andreas emphasized the need for collaboration between the government and farmers to overcome the existing challenges, especially through coconut replanting programs and the provision of superior seeds to increase productivity, and ensure the sustainability of the coconut industry in the future.