Amid the slowing purchasing power of the people, there is a trend of increasing sales of electric vehicles. This raises new hopes for the automotive industry to achieve a positive performance target this year.

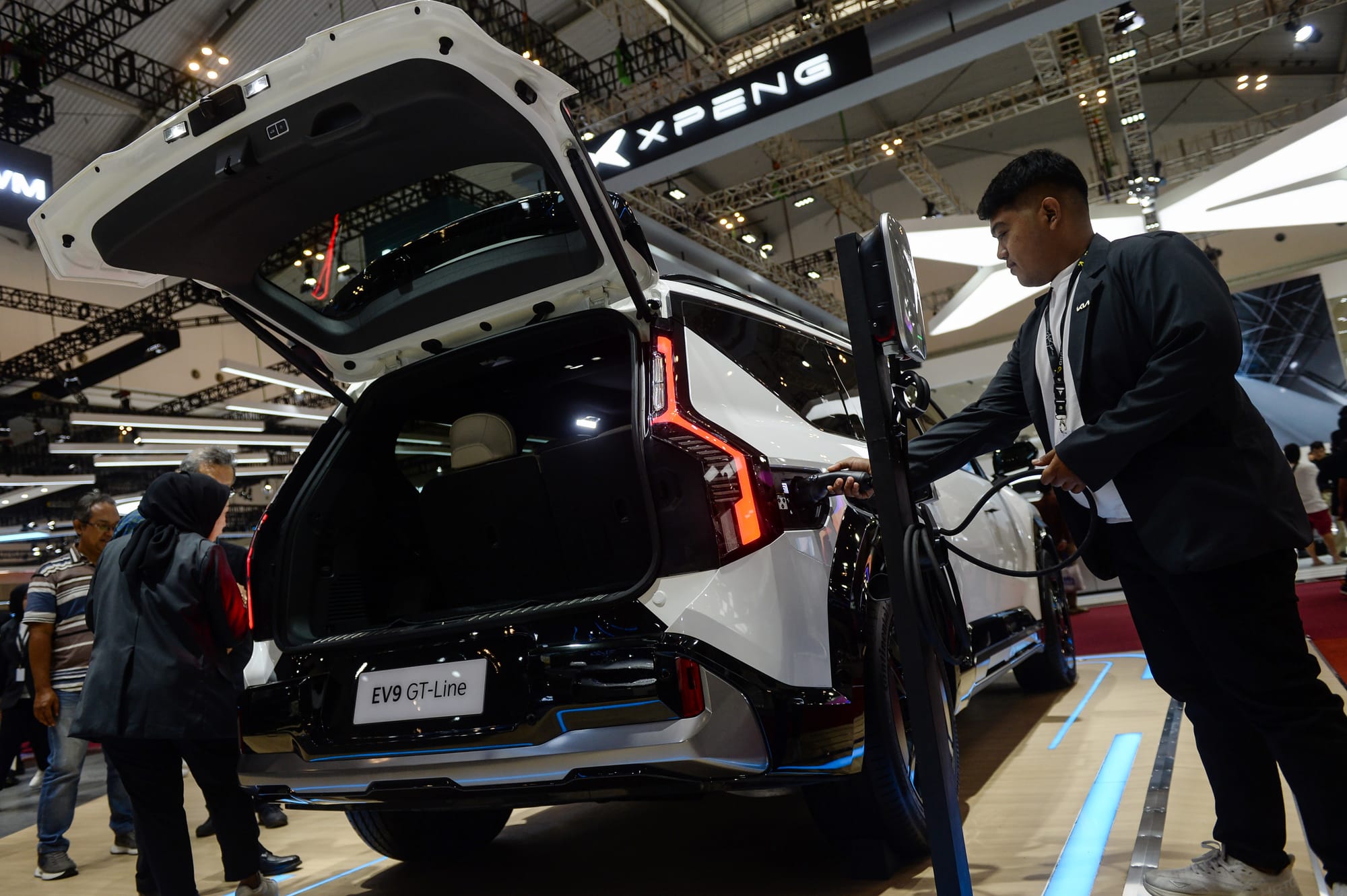

Consumer interest is not only in hybrid cars or hybrid electric vehicles (HEV). Vehicles with battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) types are also attracting electric vehicle enthusiasts.

If we trace it based on data from the Association of Indonesian Automotive Industries (Gaikindo), vehicle sales in 2023, which reached around 1 million units, fell to around 800,000 units in 2024. The decline in public buying interest in the automotive industry has raised concerns about the slowing growth of the industry this year.

Despite the slowdown in the automotive market, sales of HEV, BEV and PHEV electric cars are showing a promising trend. According to sales data from factories to dealers (wholesale), total sales of electric cars were 66,187 units in the first semester of 2025.

The percentage of sales of these types of vehicles grew by up to 17% in the first semester of this year. The growth in consumer interest in electric vehicles is consistent from year to year.

Sales of BEV and PHEV electric cars, in particular, showed very rapid growth. Total sales of BEVs and PHEVs in 2025 reached 37,370 units, far exceeding sales figures in 2023, which were only 17,179 units. This jump underscores a shift in consumer preferences that are increasingly interested in electric vehicle technology.

On the other hand, interest in hybrid cars (HEV) also remains strong, although there was a slight decrease in sales data in 2025. With total sales of 28,817 units in 2025, the HEV segment is still a popular choice for many consumers. The stability of HEV sales shows that this type of vehicle still has a stable market, especially for those who are not fully ready to switch to pure electric cars.

Meanwhile, electric vehicle brands such as Wuling, BYD and Denza in the first half of this year managed to lead the BEV and PHEV markets, with significant sales in 2025. Meanwhile, Toyota and Suzuki still dominate the HEV market.

The availability of new models at more affordable prices and increasingly advanced battery technology are major driving factors behind this growth. The increasing trend is also supported by government and private infrastructure, such as the expansion of SPKLU (electric vehicle charging stations) facilities and regulations for prospective electric vehicle users.