The high demand for electric vehicles (EVs) in Indonesia is a blessing for the local automotive component industry. They are excited to be able to compete and adapt to the electric vehicle ecosystem.

Astra Group, as one of the market leaders in conventional vehicles in Indonesia, inevitably has to keep up with market developments. Through its subsidiary PT Astra Otoparts Tbk, Astra Group develops EV component products.

PT Astra Otoparts Tbk Director Sophie Handili said that her company not only develops components for electric vehicles but is also involved in the supporting ecosystem.

"Astra Otoparts is ready to face the electrification era which is currently busy in the Indonesian automotive industry," Sophie said at the Astra Media Day 2025 event, at Menara Astra, Jakarta (23/9/2025).

AUTO - Astra Otoparts' stock code on the Indonesia Stock Exchange - also took concrete steps to be able to adjust market developments. Namely, presenting Astra Power and Alto which is a charging infrastructure. Currently, more than 48% of Astra Power charging facilities are already in operation.

Astra Otoparts also collaborates with PLN to present a 7 kW pole mounter charger that is installed directly on the electricity pole. Currently, 122 units of pole mounter power are available in West Sumatra and West Java.

On the other hand, Sophie acknowledges that the market for gasoline engine-based vehicles is still very large. Thus, ICE(internal combustion engine) components still have staying power amidst electrification.

As for some special components of electric vehicles that have currently been developed, among others, include battery batteries, drive shafts, caliper assy, duet HV battery intake, EV battery box, battery case, motor unit cover, to hybrid damper and hose cooling inverter & motor.

AUTO currently has more than 15,000 outlets and an export network to more than 50 countries. Asia is the main market with 59.6% contribution, followed by Middle East, South Africa, and Europe. Asia is also the main market with a contribution of 59.6%, followed by the Middle East, South Africa, and Europe.

Astra Otoparts does not directly "foster" UMKM, but through institutions under Astra, such as YDBA (Yayasan Dharma Bakti Astra). They actively support and integrate UMKM into the automotive industry supply chain through coaching and developing the production capacity of vehicle components.

YDBA shows how its fostered UMKM can produce components for cars and motorcycles, which are then supplied to PT Astra Honda Motor (AHM) and Astra Otoparts. Other UMKM also contribute to various manufacturing sectors.

Local component industry must adapt

Chairman of the Automobile and Motorcycle Equipment Industry Association (GIAMM) Hamdhani Dzulkarnaen Salim said that his party appreciated the government for issuing the right policy by revoking incentives for electric cars.

So far, the performance of the local component industry has been severely depressed due to the large number of imported electric car products. The lack of absorption of local components has resulted in the layoff of their employees.

Now, with the discontinuation of electric car incentives, there is a new opportunity for the local industry to grow and be competitive again.

"The golden opportunity is in sight. Electric cars are no longer given incentives, it's time for us to take advantage of this situation by improving performance," he said when met at the Automechanika Jakarta 2026 event, at the Fairmont Hotel, Jakarta (17/9/2025).

Hamdhani said, in every opportunity there must be a challenge. That is, how the local component industry must adapt and be able to produce electric vehicle components in the future.

Enhance capabilities

Automotive observer Yannes Pasaribu suggested that the local component industry should start learning how to develop EV components as the market is already evolving towards EVs.

Yannes admitted that it takes time to improve the ability to develop EV products and components. The strategy is to learn from Japan or conduct research and development in other countries.

"The automotive market has been enlivened by electric vehicles. So it must also be followed by its supporting industries such as the component industry," Yannes told SUAR in Jakarta (23/9/2025).

Yannes sees that the high demand for electric vehicles in Indonesia is due to changes in consumer behavior that have realized the importance of environmentally friendly electric vehicles and low maintenance costs.

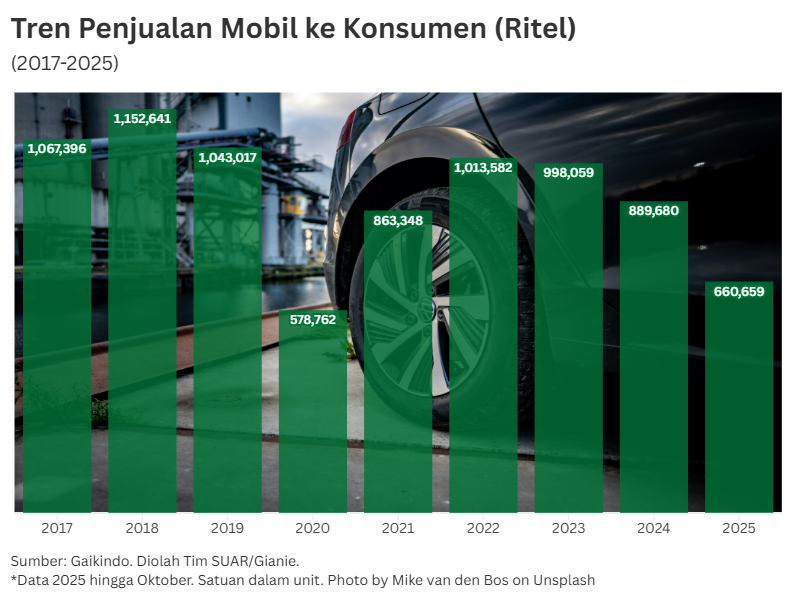

Bank Mandiri Chief Economist Andry Asmoro explained that car sales in August 2025 grew 13.2% YoY. This was supported by the growth of battery-based electric cars which rose 19.3% YoY.

The rapid sales are due to various government incentives for electric vehicles. These include discounted value-added tax (VAT) rates, exemption from luxury sales tax (STLG), and exemption from import duties for completely built up (CBU) imported cars.

The government itself plans to stop incentives for CBU car imports as of January 1, 2026. Previously, the incentives were in the form of import duty, STLG, and VAT relief for car manufacturers that produced electric cars domestically with a 1:1 ratio to the number of imported units. Some manufacturers that have utilized this incentive include: PT National Assemblers (Citroen, AION, and Maxus), PT BYD Auto Indonesia, PT Geely Motor Indonesia, PT VinFast Automobile Indonesia, PT Era Industri Otomotif (Xpeng), and PT Inchcape Indomobil Energi Baru (GWM Ora).

This policy is expected to encourage the development of the automotive component industry and increase domestic production of electric vehicles. Bank Mandiri's economic research team estimates that car sales in 2025 will be around 780,000 units.