The International Monetary Fund (IMF) through its October 2025 World Economic Outlook (WEO) projects a slowdown in economic growth in various regions. However,emerging markets in Asia show better resilience due to external factors(good luck) and internal policies(good policies).

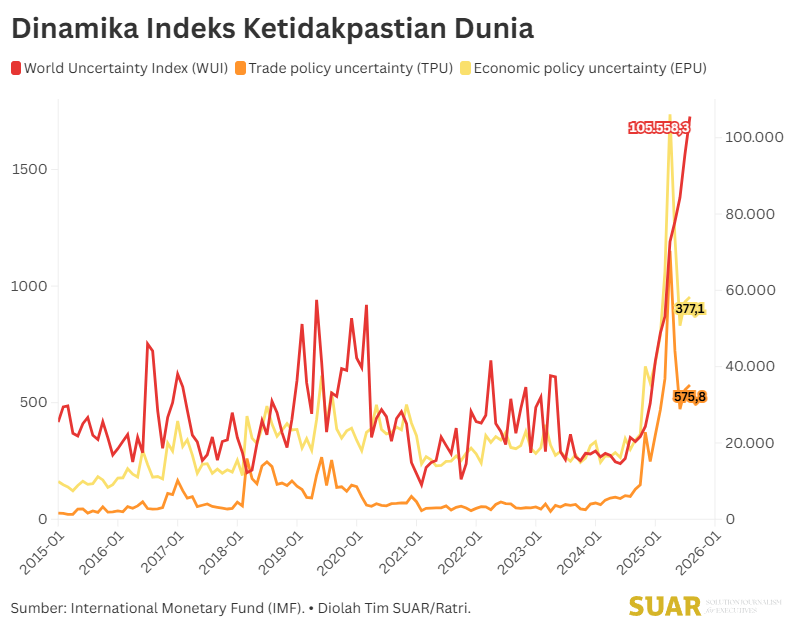

The slowdown in economic growth is triggered by increasing global and regional geopolitical uncertainty. This can be seen through a number of index measurements such as the Global Uncertainty Index (GCI), Economic Policy Uncertainty (EPU) and Geopolitical Risk Index (GPR) which illustrate the increasing uncertainty.

Real Gross Domestic Product (GDP) developments in the WEO report show that Asia as a whole is projected to slow down from 4.6% (2024) to 4.5% (2025) and $4.1 (2026). Emerging and Developing Asia still leads global growth, despite slowing from 5.3% (2024) to 5.2% (2025) and 4.7% (2026). This surpasses the projection forAdvanced Asia of only 1.1% by 2026.

The resilience of emerging markets is explained by two main factors, namely Good Luck and Good Policies. The Good Luck factor refers to temporarily favorable external conditions, such as stable commodity prices or a period of relatively low global interest rates.

However, a more fundamental and sustainable factor is Good Policies. This policy pillar includes an improved monetary policy framework, where central banks in emerging economies, especially those with inflation targeting and exchange rate flexibility, are able to act more quickly and decisively in normalizing interest rates compared to developed economies. In addition, the development and strengthening of deeper local currency debt markets also reduces vulnerability to foreign capital reversals.

The ASEAN region, as an integral part of Emerging and Developing Asia, shows significant resilience. Five ASEAN countries (Indonesia, Malaysia, Philippines, Thailand, and Vietnam) are projected to maintain stable and, in some cases, high Real GDP growth rates.

Indonesia, for example, is projected to show solid and consistent Real GDP growth performance of 5.0% in 2025 and 4.9% in 2026. On the domestic front, Bank Indonesia's monetary policy, including rapid interest rate tightening to stabilize Rupiah, as well as disciplined fiscal framework and sustained infrastructure development, have strengthened its economic bulwark.

Indonesia's resilience is mainly driven by strong domestic demand (household consumption) that accounts for more than half of GDP, as well as the effects of industrial downstreaming that generates added value in export commodities. The combination of strong internal (domestic demand) and external factors (relatively favorable commodity prices, as well as an influx of direct investment) makes Indonesia a key case study for the IMF's thesis on emerging market resilience.

Global challenges centered on uncertainty will continue to pressure and slow down the world's economic growth rate, even with predictions that are still gloomy until 2026. However, the combination of 'Good Luck' and 'Good Policies' is the key to surfing the wave of uncertainty.