Five weeks before the end of 2025, the government is making every effort to ensure that state revenue is in line with the outlook set by the 2025 State Budget, which is IDR3,005.1 trillion or 12.36% of Indonesia's GDP. Diversification of revenue sources is one of the steps taken, in addition to ensuring increased compliance of individual taxpayers and institutional taxpayers through Coretax optimization.

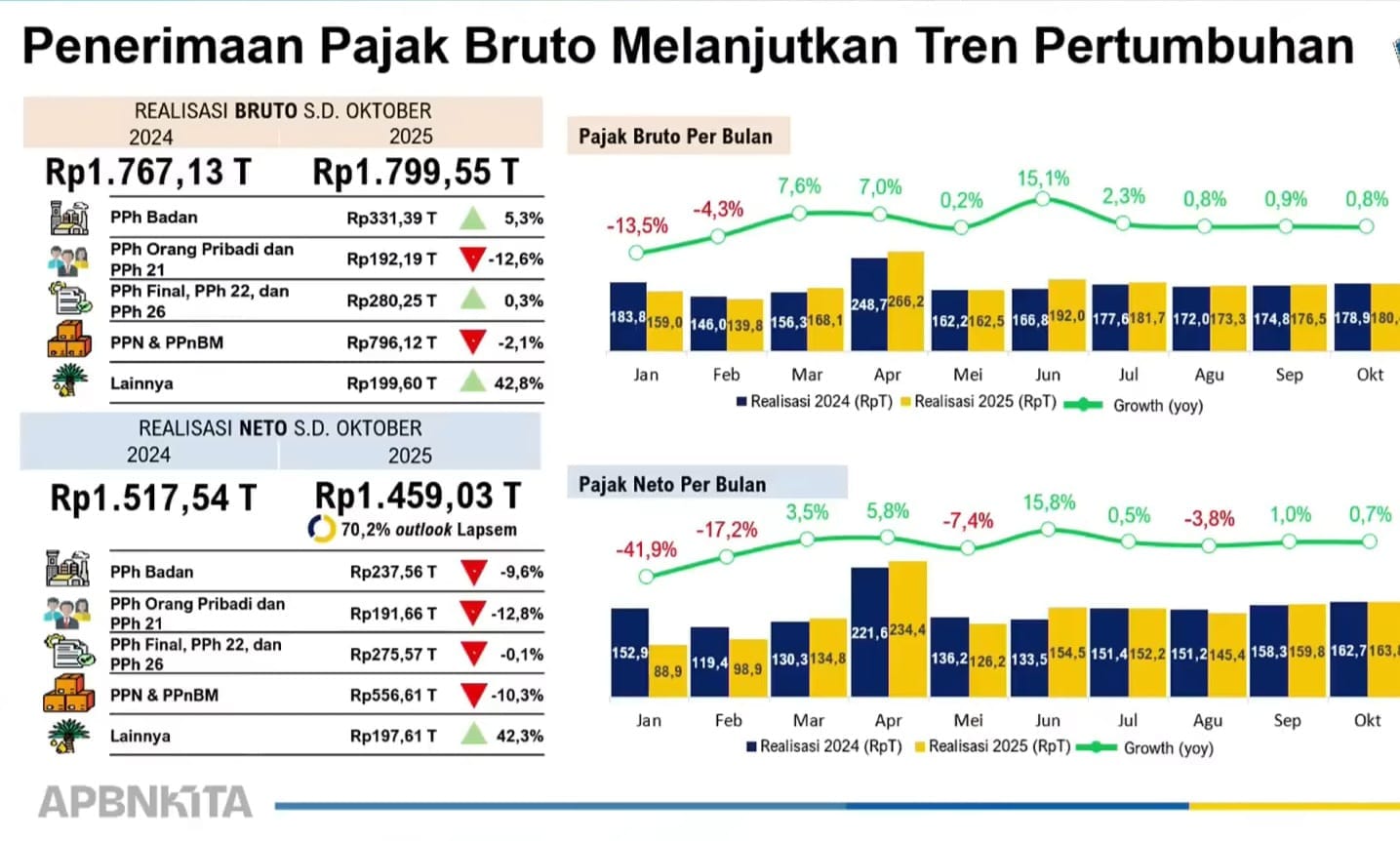

Deputy Minister of Finance Suahasil Nazara stated that as of October 31, 2025, state revenues have collected Rp2,113.3 trillion or 73.7% of the 2025 State Budget target. Of this amount, gross tax realization reached Rp1,799.5 trillion, while net realization after restitution reached Rp1,459.03 trillion or 70.2% of the target. From this calculation, net corporate income tax growth is still negative, even though net tax growth reached 0.7% year-on-year (YoY).

In addition to taxes, customs and excise revenue grew 7.6% to Rp249.3 trillion or 80.3% of the target. The biggest growth continued to be in export duties, reaching 537.4% of the target at IDR24.0 trillion due to the increase in CPO prices, palm oil export volume, and copper concentrate exports. Meanwhile, import duties slowed relatively due to the decline in food commodity imports and the utilization of a number of free trade agreements (FTAs).

"As of the end of October, 15,845 crackdowns on illegal cigarettes have been carried out, confiscating 954,000,000 sticks by the Directorate General of Customs and Excise and related agencies. This figure is up 41% compared to last year, although it is still very far below the estimated illegal cigarettes circulating in the market," Suahasil said at the KiTA State Budget press conference in Jakarta, Thursday (20/11/2025).

The largest revenue component came from Non-Tax State Revenue (PNBP) which has reached 84.3% of the target, amounting to IDR 402.4 trillion. This achievement is relatively large, considering that the decline in crude oil prices, natural gas lifting , price moderation and a decrease in coal production volume have caused a considerable contraction, 13.2% YoY and 9.4% YoY for oil and gas and non-oil and gas PNBP, respectively.

"PNBP of oil and gas natural resources contracted as a result of weakening world crude oil prices and a decline in natural gas lifting . In addition, the decline in coal demand from China and India, as well as reduced domestic coal consumption, also drove the contraction in non-oil and gas natural resources PNBP revenues," he said.

As a counterweight, the PNBP component of Ministries/Institutions grew by 17.6% YoY, including revenues from the Ministry of Communications and Digital through frequency and telecommunications operating rights fees (BHP); the Attorney General's Office (AGO) through tipikor and CPO restitution deposits; the Ministry of Immigration and Corrections through visa and passport services; and state bond premiums.

Complementing Suahasil's explanation, Director General of Taxes of the Ministry of Finance Bimo Wijayanto explained that his party will implement a multi-door approach as a strategy to deal with tax crimes, corruption crimes, and money laundering in an integrated manner. Coretax optimization and mass payment supervision will also be implemented to ensure payment compliance, both personal taxpayers and corporate taxpayers.

"So that there is no more criticism of hunting in zoos, we maximize database intensification, expand the tax base for electronic commerce, other digital transactions, also encourage human resource development strategies, organizational and institutional development according to economic dynamics," said Bimo.

With the basis of matching NIK, NPWP, and Business Identification Number (NIB), Bimo stated that DGT has been able to detect the gross turnover of individual/corporate taxpayers who are entitled to receive incentives and not. With the closure of new applications for corporate income tax using the 0.5% incentive, DGT will ensure that the income tax regulation applies the anti-avoidance rule optimally.

"As of October 31, 2025, Coretax account activation for corporate taxpayers has been around 569,000 taxpayers, while individual taxpayers have been around 2.6 million, so that a total of 3.18 million taxpayers have activated accounts or 21.6% of the total target. However, from individual taxpayers who have registered the authorization code, there are already 1.6 million or 11.92% of registered taxpayers," he added.

To accelerate Coretax activation, DGT in collaboration with the Ministry of Administrative Reform and Bureaucratic Reform (KemenPAN-RB) issued a circular letter requiring all ASNs to activate Coretax accounts, no later than December 31, 2025, as well as promoting voluntary Coretax registration activities in their respective work environments.

"Regarding tax evaders, we can say that the collection acceleration has collected 11.49 trillion, there was a significant increase in the last week. Especially for those who are inkracht, the payment commitment has been submitted to us and is still awaited until the end of December," said Bimo.

Be wiser

In the face of potentially slower revenue conditions, expenditure balancing and compliance improvement strategies are expected to be wiser. In addition to the need to evaluate fiscal risk management that may occur, the government's cooperative attitude towards taxpayers will determine the willingness of citizens to deposit obligations to the government.

Center of Law and Economic Studies (Celios) Fiscal Policy Researcher Galau D. Muhammad assessed that with limited state revenues, a quarter of the state budget is now forced to be allocated for debt interest payments with an increasing trend. In other words, in addition to revenue, evaluation also needs to be done on spending, which must be of high quality.

"It must be seen that state revenue today is relatively stagnant and there is no potential for progressive revenue and targeting the upper class. So far, the tax ratio is stagnant and still targets the middle class through consumption tax and income tax. In fact, there are many large ownership assets that cause leakage from the extractive sector," Galau said when contacted. SUARFriday (11/21/2025).

Galau reminded us that when state revenues fall, the narrative of populist programs that are imposed without fiscal discipline actually makes the state budget limp. Careful efficiency needs to be done so as not to reduce productive sectors that require massive budget allocations.

"We already have Danantara for investment and asset consolidation. How does this boost productivity, which is the main contributor to GDP, tax revenue, and non-tax revenue? In addition, there are still external risks, which must be taken into account for their impact on the real sector and on the macroeconomy as a whole," he said.

Previously, Chairman of the Economic Policy Analyst Committee of the Indonesian Employers Association (Apindo) Ajib Hamdani assessed that the positive synergy between the Directorate General of Taxes, taxpayers, and tax consultants will build the willingness of entrepreneurs to contribute to state revenue, instead of making the business world avoid.

"In the midst of an uncertain economy, tax authorities who collect repressively have the potential to reduce compliance and create taxpayer resistance in carrying out their obligations," Ajib explained when contacted by SUAR, Friday (10/10/2025).

He reminded that currently, 80% of state revenue in terms of taxes mainly comes from business activities, with 28% of taxes generated from the processing industry. Optimal collaboration between the government and the business world with open and transparent communication will foster trust between interested parties.

"An approach that is collaborative, persuasive, thoughtful, and fair will better encourage increased voluntary compliance," he concluded.