Good morning Chief...

The following is important information related to the development of the business universe that needs attention today based on the curation of the SUAR Team.

To Pursue Growth, State Spending Must Be Accelerated with Appropriate Steps

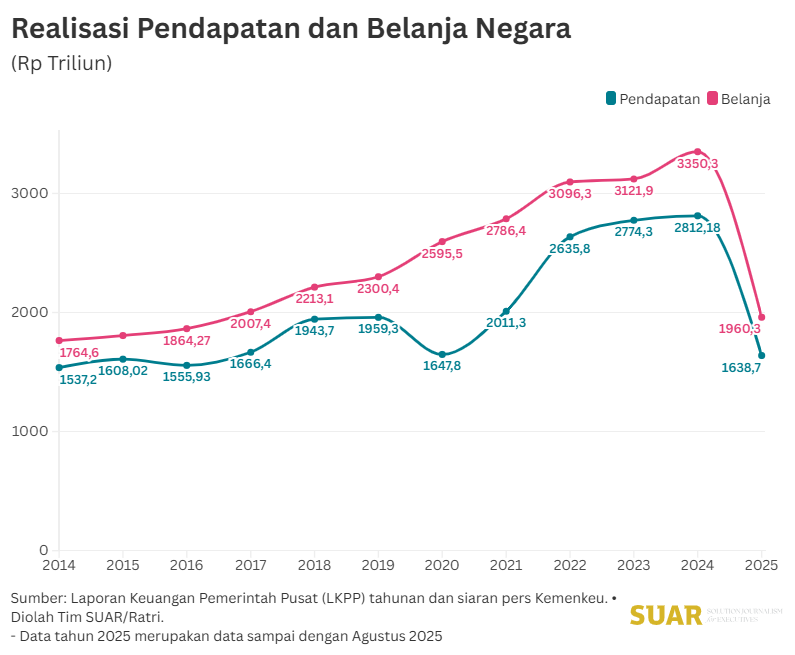

- Looking forward to the last quarter of 2025, the Ministry of Finance revealed that state spending absorption has only reached half of the outlook APBN. In fact, there are still growth targets that must be pursued in the next three months. Accelerating state spending is important, even though it must be done carefully and appropriately targeting priority programs.

- As of August 31, 2025, state revenue realization has only reached Rp 1,638.7 trillion, or 57.2% of the outlook for the 2025 State Budget. Meanwhile, state spending realized in the same period has only reached Rp 1,960.3 trillion, or 55.6% of the outlook for the 2025 State Budget. The deficit amounts to Rp 321.6 trillion, or 1.35% of GDP.

Read more here.

Following BI Rate Decline, LPS Rate also Decreases

- Following Bank Indonesia's (BI) move to lower the benchmark interest rate (BI Rate) by 25 basis points at the BI Board of Governors Meeting (RDG) last Thursday in September, the Deposit Insurance Corporation (LPS) also lowered the deposit insurance interest rate (LPS Rate). On Monday (22/9/2025), LPS decided to cut the deposit insurance rate (TBP) by 25 basis points (bps), to 3.50% for rupiah deposits in commercial banks, foreign currency (forex) deposits in commercial banks at 2.00%, and rupiah deposits in rural banks (BPR) at 6.00%.

- The determination of this TBP is based on the relatively maintained performance of the domestic economy. However, it needs to be strengthened, especially from the consumption and production sides in a more balanced way.

Read more here.

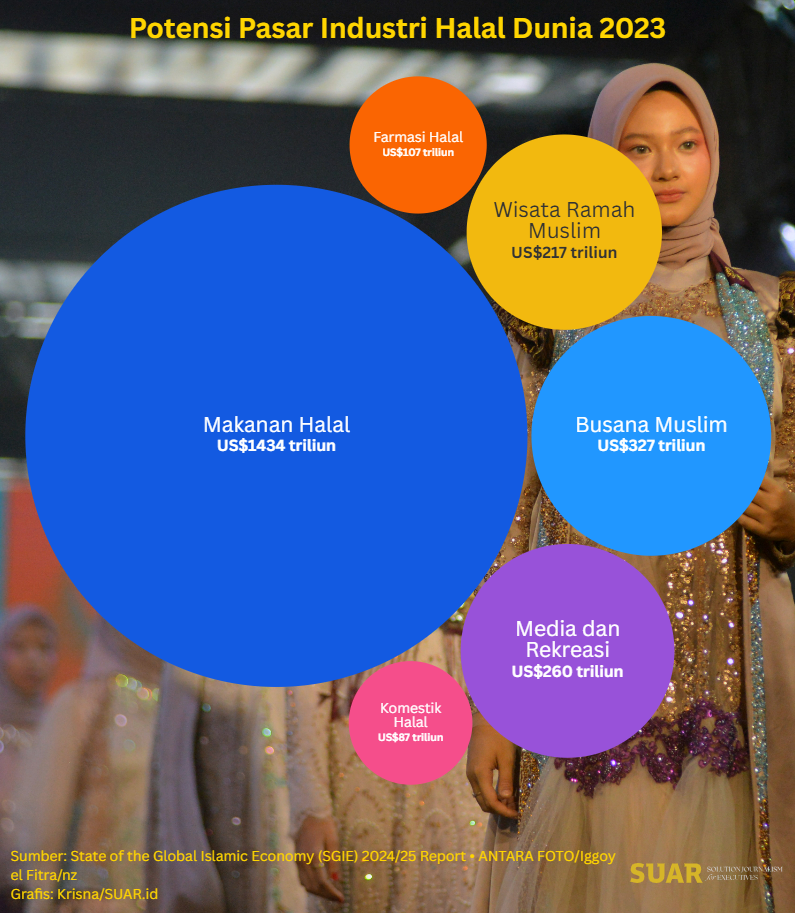

Halal Industry Strategies for Capturing the Potential of US$2 Trillion in the Global Market

- Indonesia is not only the country with the largest Muslim population, but also a center for halal-labeled food, fashion, and tourism. However, becoming a leader in the global halal industry with a global trade value of more than US$ 2 trillion remains a challenge.

- The contribution of the halal sector to the Indonesian economy continues to increase. In 2024, the halal industry contributed 5.03% to economic growth, with export values reaching US$ 64 billion.

Read more here.

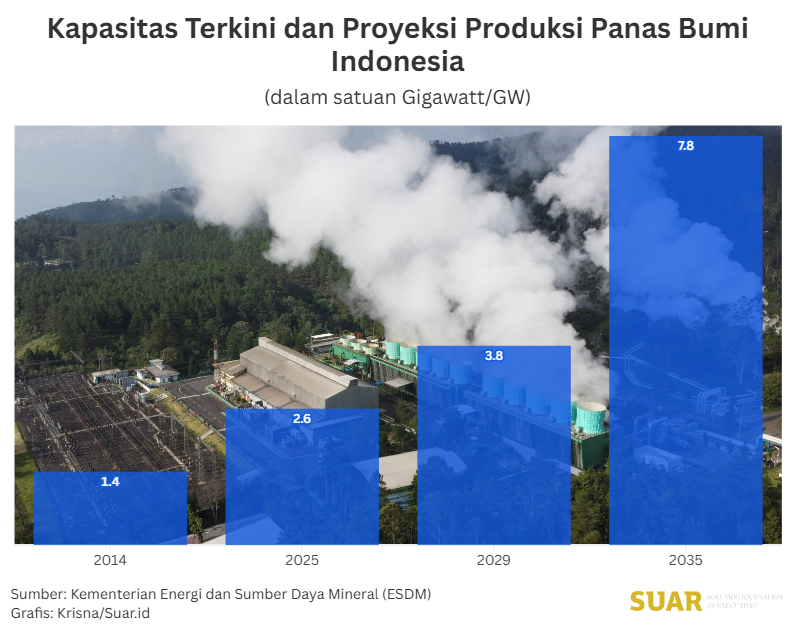

Geothermal Business Actors Need Partiality to Carry Out Investments

- Indonesia is known to have the largest geothermal potential on earth, which is 23.74 gigawatts (GW). However, as stated by the Ministry of Energy and Mineral Resources (ESDM), currently only 2.7 gigawatts have been optimized. Companies continue to expand to fulfill this potential.

- In the 2025–2034 Electricity Supply Business Plan (RUPTL), Indonesia is targeted to have an additional power plant capacity of 69.5 GW. Of this amount, 5.2 GW comes from geothermal energy. The investment requirement for additional power plant capacity for 2025–2034 reaches Rp 2,967 trillion. Of this amount, investment from PLN power plants is Rp 567.6 trillion.

Read more here.

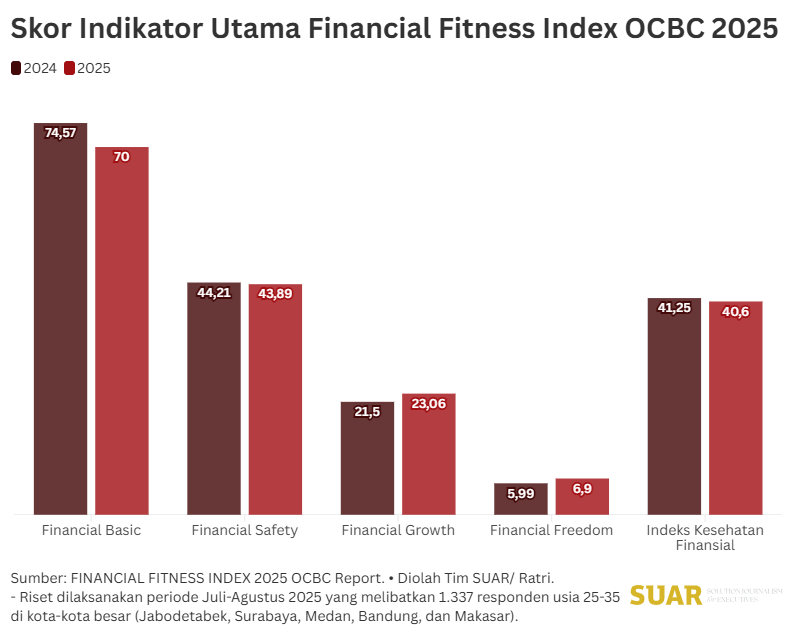

The Younger Generation is also Aware of Preparing Pension Funds

- The Financial Fitness or OCBC 2025 Financial Health research report indicates a decline in the financial health of Indonesian society. However, the research, which targets those aged 25–35 years, sees a tendency for long-term investment and preparation for retirement funds as an effort to ensure future stability.

- The research, conducted in the July–August period, does show a slowdown in the achievement of financial health of Indonesian society in general. The score decreased slightly: from 41.25 to 40.60. This decline was triggered by crucial indicators, such as a decrease in the ability to shop beyond daily needs, a reduction in routine saving habits, and a weakening of emergency fund resilience.

Read more here.

Publication of the August 2025 Money Supply Development Report: Through this routine agenda, Bank Indonesia (BI) will release statistical data that describes the position and development of money supply in Indonesia. The data release, scheduled for Tuesday, September 23, 2025, will be published online and free of charge through the official Bank Indonesia website.

BAREKSA BUSINESS FORUM 2025: Taking the theme "Build Big. Scale Smart. Outlast the Chaos", this event aims to provide insights and practical strategies for business actors to survive, thrive, and identify opportunities amidst rapid global economic changes. This event will be held on Tuesday, September 23, 2025, from 10:00–16:00 WIB, at Pantai Indah Kapuk, Jakarta. The forum will feature leading experts and practitioners, such as Kang Deni Ridwan, Rivan Kurniawan, Sucor Asset Management, Albertus Axel, Reksadana Syailendra, Holika Holika Indonesia, and We Are Treasury. For information on how to participate in the event and other series, you can directly access Bareksa's Instagram social media.

"Everyone thinks acquisition strategies are very risky because no one has ever succeeded in doing them. In other words, it's an innovative step." (Larry Ellison-Founder of Oracle)

Have a good day Chief.

Team SUAR