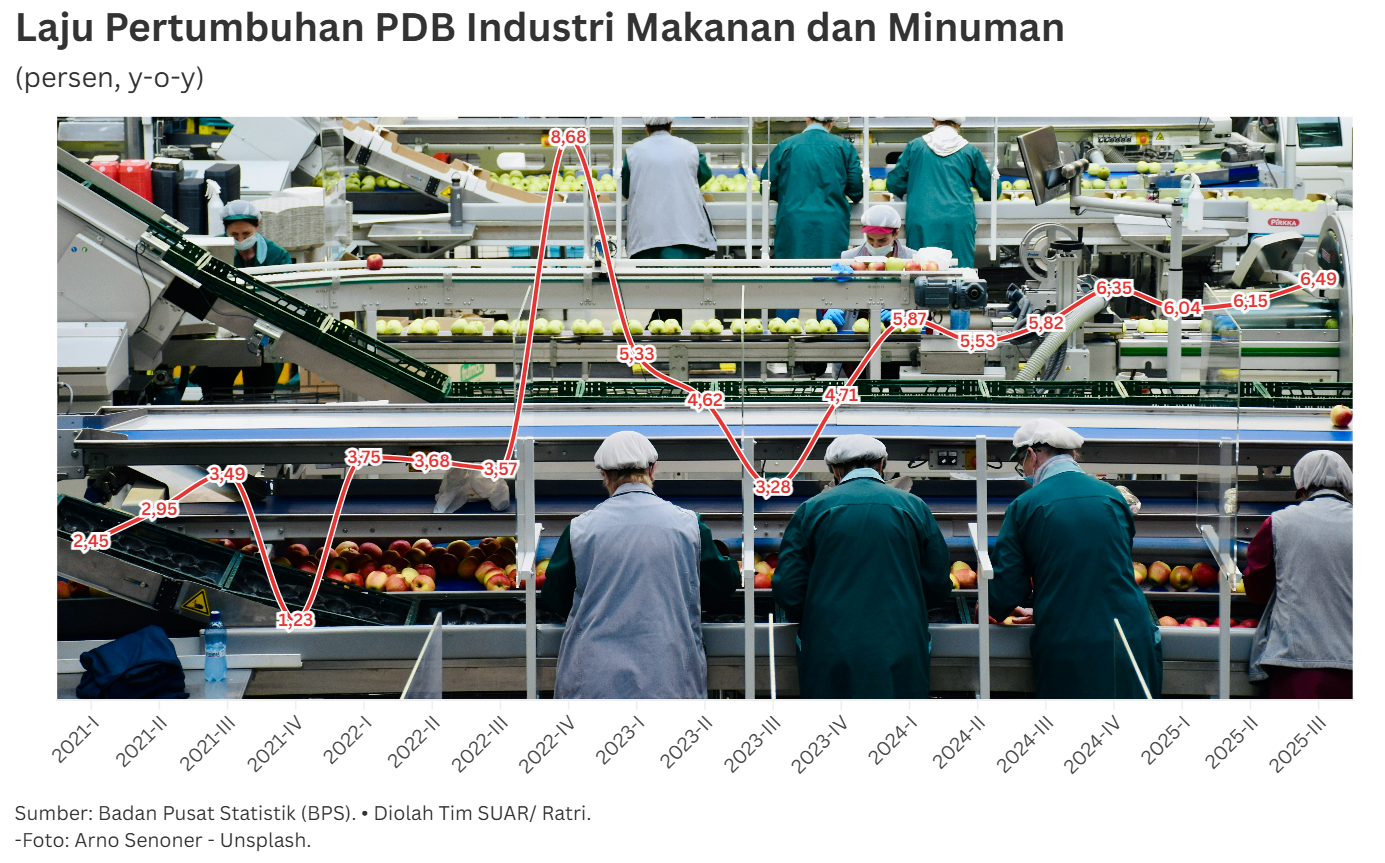

Based on historical data from the Central Statistics Agency (BPS), the food and beverage industry showed remarkable recovery after the pandemic. This was marked by a surge in GDP growth of 8.68% in the fourth quarter of 2022.

This drastic increase was triggered by a surge in household consumption during the year-end holidays. This proves how sensitive and strong the domestic market's absorption capacity is for food and beverage products when people's activities return to normal.

Entering the normalization phase in 2023, the growth of the food and beverage industry corrected to 5.33% in the first quarter before finally reaching its lowest point in the third quarter at 3.28%. However, instead of declining, this period became a turning point for an "uninterrupted upward" growth trend.

The resilience of this industry is evident in its consistent upward climb, breaking through the psychological barrier of 5% and achieving an impressive performance of 6.49% in the third quarter of 2025, reflecting solid long-term stability.

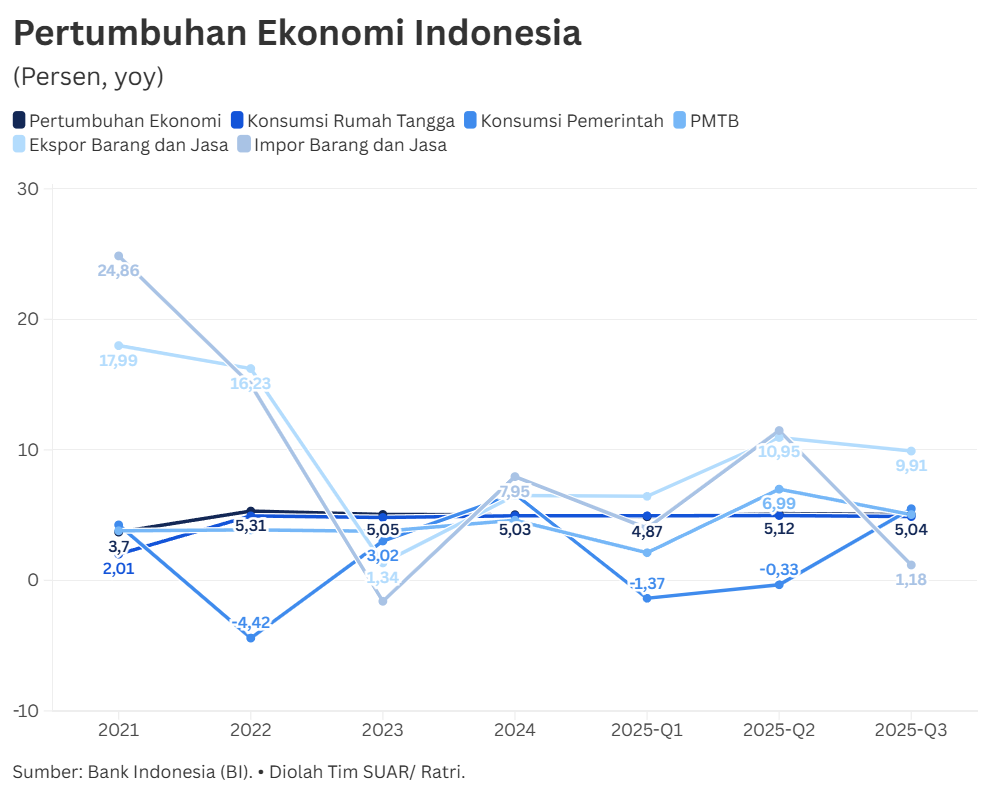

One proof of the strength of the food and beverage sector is its ability to exceed national economic growth. For example, in the third quarter of 2024, the food and beverage industry grew by 5.82%, far surpassing the national GDP growth rate of 4.95% in the same period. With a dominant contribution to the non-oil and gas manufacturing industry's GDP in the range of 38.4% to 40.17%, the food and beverage sector is no longer just a complement, but the main engine that keeps Indonesia's manufacturing expansion momentum stable.

The resilience of this sector is also reflected in Bank Indonesia's Prompt Manufacturing Index (PMI) indicator. Throughout the period from 2023 to 2025, the food and beverage industry PMI index has consistently remained in the expansion zone, above 50. Although there is a slight downward projection to 51.8 at the end of 2025, this figure remains above the average performance of the manufacturing industry as a whole. This indicates that business actors still have high confidence to continue production despite being faced with global economic fluctuations.

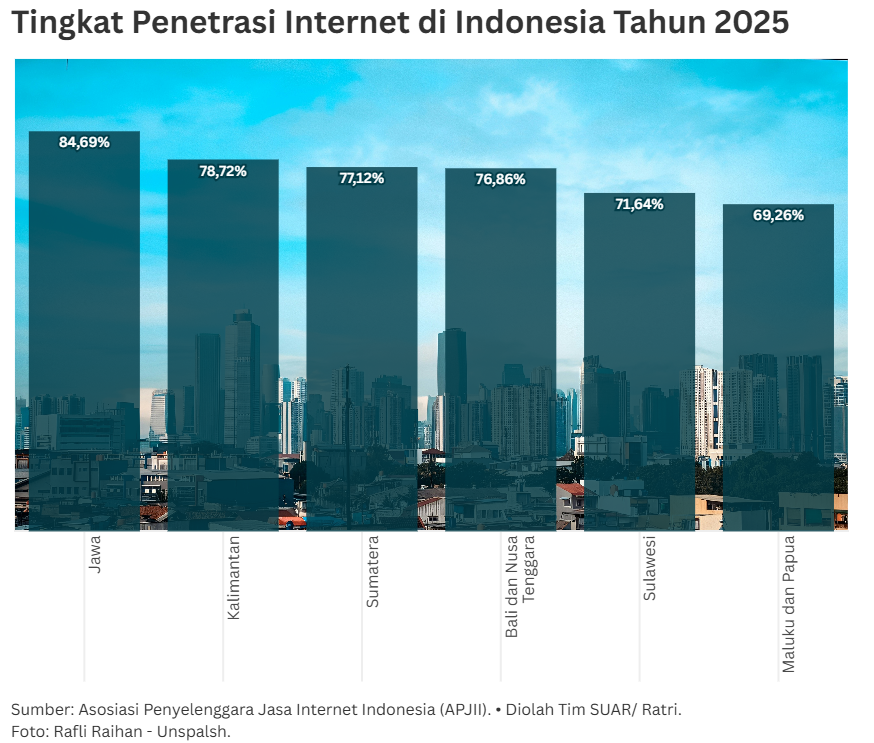

Looking ahead to 2026, the potential of the food and beverage industry remains wide open, driven primarily by healthier product innovations and increasingly efficient supply chain digitalization. As a sector that supports primary needs, this industry is predicted to continue to be a magnet for investment and a major driver of national economic growth. Stable domestic demand and improved export product quality standards are strong assets for the food and beverage industry to accelerate its growth as a key player in the regional market.

However, major challenges still loom in the coming year. Uncertainty in global raw material prices due to climate change and geopolitical dynamics requires the industry to be more adaptive in managing production costs so that prices remain affordable for the public.

In addition, meeting increasingly stringentsustainability standards and nutrition labeling regulations will test the creativity of manufacturers. If these challenges can be converted into opportunities, the food and beverage industry is certain to continue growing and remain a pillar of manufacturing that is resilient to shocks in 2026.