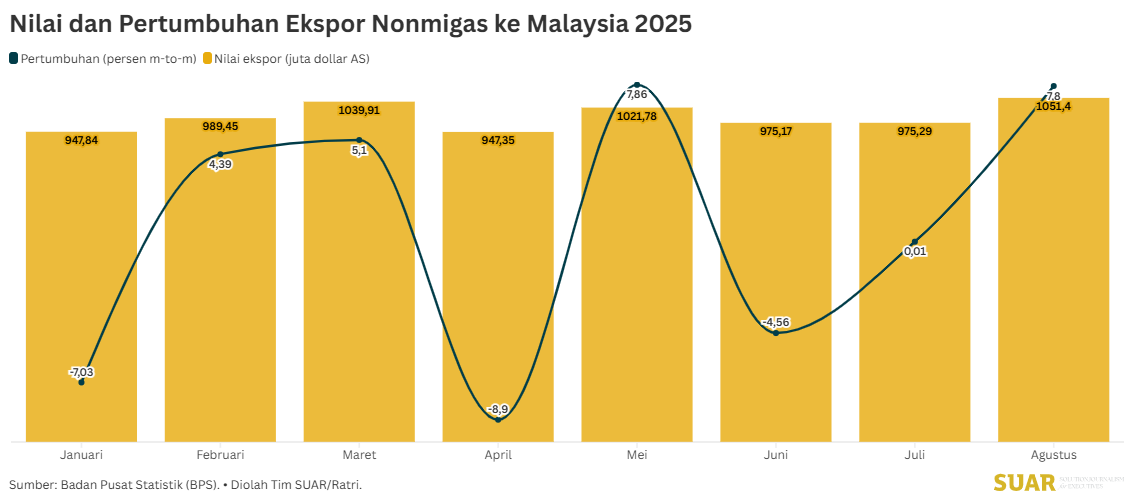

Indonesian exports remained stable, growing by 0.86% after the enactment of President Trump's new tariffs. Several countries supported the stability of Indonesia's export value, one of which is Malaysia. Exports to this neighboring country in August recorded the highest record of US$1,051.4 million (up 7.80%), driven by a surge in downstream commodities such as processed palm oil.

The total value of non-oil and gas exports reached US$23,890.5 million, an increase of 0.33% from July and 6.68% compared to August of the previous year. This growth occurred amidst global trade dynamics, including the impact of newly enacted tariff policies.

Despite a decline in exports to the United States, from US$3,100.3 million (July) to US$2,716.3 million (August) or down 12.39%, export performance to several other partner countries actually increased, such as to China, Malaysia, Australia, and Italy.

Non-oil and gas exports to China jumped 16.03% (month-on-month). Exports to Malaysia also rose by 7.80% (month-on-month), with export value reaching US$1,051.4 million in August. This figure was recorded as the highest figure throughout this year. This increase underscores the importance of the ASEAN regional market, which as a whole is the main destination for Indonesia's non-oil and gas exports with a share of 19.42%.

If we look in more detail, the main commodities of oil and gas and non-oil and gas exports to Malaysia in July and August 2025 experienced changes. In August, superior commodities such as liquid fractions of refined palm oil (HS code 15119037) experienced a significant jump from US$59.63 million to US$135.89 million, making it the second leading export commodity after coal. In addition, fuel oil (HS 27101979) also jumped to US$46.37 million, reflecting an increase in energy demand.

Meanwhile, other commodities also showed strengthening, including industrial monocarboxylic fatty acids (HS 38231919) which rose from US$18.81 million to US$26.38 million, as well as flat-rolled products of stainless steel (HS 72191300) which increased to US$31.92 million.

The presence of vehicle spare parts and processed agricultural products (such as Cocoa and Coffee) in the list completes the picture of Indonesia's export diversification to Malaysia. Other main commodities such as coal (HS 27011900) remain the largest export even though the value slightly decreased from 158.49 million to 146.23 million in August. The increase in various processed and industrial products shows that trade relations with Malaysia do not only depend on raw commodities.

The growth of Indonesian exports to a number of countries including Malaysia shows the resilience of the national economy amidst global uncertainty after Trump's tariffs. Strengthening trade with regional and East Asian partners signifies success in diversifying export markets. The surge in the export value of specific commodities to Malaysia, especially downstream palm oil and industrial products, is a momentum that needs to be maintained through trade promotion and increasing the competitiveness of Indonesian products in the regional market.