The healthcare industry in Indonesia is transforming in line with increasing awareness of physical well-being and the challenges of post-pandemic diseases. Despite facing the issue of rising costs, which are often seen as a burden on households, the national healthcare market continues to expand.

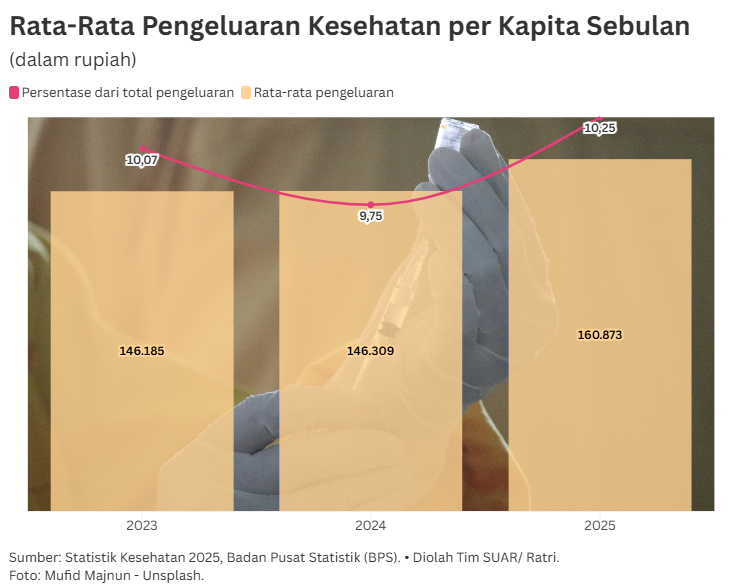

This creates opportunities for healthcare industry players to deliver more comprehensive and competitive innovations and service solutions. Data from the Central Statistics Agency (BPS) on the average monthly per capita healthcare expenditure of Indonesians shows an upward trend every year.

The most significant increase occurred between 2024 and 2025, with monthly expenditure rising from IDR 146,309 to IDR 160,873. This 9.95% increase absorbed a larger portion of people's income, reaching 10.25% of total monthly expenditure. This double-digit figure indicates that the health sector is a priority in household budgets.

More specifically, public health spending is currently still focused on medical or curative services, which account for a very large portion of the total, exceeding 70%. The allocation of funds for treatment is even set to increase between 2023 and 2025, with an estimated rise of between 13 and 16%.

This shows a high dependence on medical facilities such as hospitals and clinics. In addition, in 2024, there will be a 20.3% surge in the cost of medicines, reinforcing the fact that access to pharmaceuticals remains a key pillar in the national health ecosystem.

The expenditure structure appears to shift in 2025. There is a drastic increase in preventive care costs of 56.3% from the previous year. This phenomenon shows that people are becoming more aware of the importance of investing in their health before they fall ill, shifting from simply treating illness to preventing it.

This shift toward prevention has given the healthcare industry a breath of fresh air, allowing it to develop products such as supplements, periodic healthcheck-ups, and self-monitoring health technology.

Looking at this data, the upward trend in healthcare costs opens up opportunities for players in the healthcare industry. High spending on curative care and medicines indicates stable and certain market demand for medical service providers and pharmaceutical companies.

On the other hand, the trend of increasing preventive spending has also opened up new market niches that have not been fully exploited. Healthcare companies that are able to integrate efficient curative services with innovative preventive programs are predicted to win the competition in the Indonesian market.

The growth of the healthcare industry in Indonesia is not only about medical inflation rates, but also about the industry's ability to respond to the dynamic needs of society. With healthcare spending now accounting for 10% of total expenditure, people are now more critical in choosing services.

The industry must take advantage of this opportunity to improve service quality, digitize healthcare systems, and provide more affordable yet high-quality solutions in order to maintain national health resilience. Better healthcare services will discourage people from seeking treatment abroad.