Good morning, Chief...

The following is important information related to the development of the business universe that needs attention today based on the curation of the SUAR Team.

Exclusive Interview with the Indonesian Ambassador to the UAE Regarding Economic Cooperation Between the Two Countries

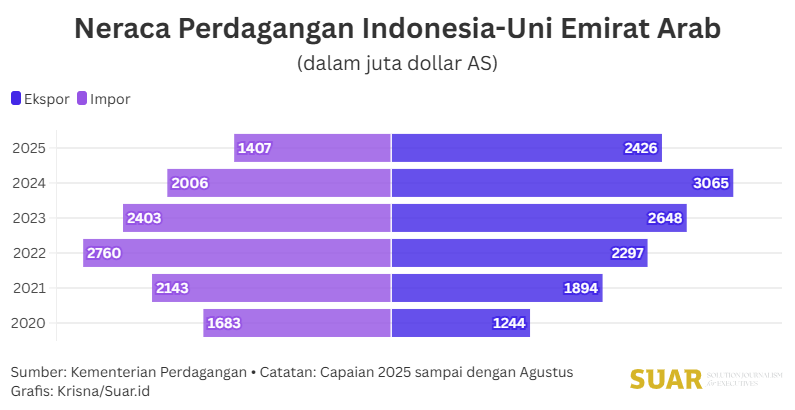

- Indonesia has a close relationship with the United Arab Emirates (UAE). This is reflected in President Prabowo Subianto's frequent visits to the Gulf country. Since taking office last year, Prabowo has visited the United Arab Emirates three times. Through the Indonesia-United Arab Emirates Comprehensive Economic Partnership Agreement (IUAE CEPA), the cooperation between the two countries covers various fields, such as energy investment, oil and gas, petrochemicals and ports, defense industry (cooperation with PT PAL, PT Pindad), as well as the development of halal products and education.

- In January—August 2025, the total trade between the two countries reached US$ 3.83 billion, with Indonesia's exports to the UAE amounting to US$ 2.42 billion and Indonesia's imports from the UAE amounting to US$ 1.40 billion. To find out more about the direction of cooperation between the two countries in the future, SUAR journalists Sutta Dharmasaputra, Tria Dianti, Agung Mahesa and video journalist Ahmad Afandi, had the opportunity to talk with the Ambassador Extraordinary and Plenipotentiary (LBBP) of the Republic of Indonesia to the UAE Judha Nugraha at the Ministry of Foreign Affairs Office on Tuesday, 28 October 2025.

Read the full story here.

Sharia Banking Financial Performance in the Third Quarter Soars, Supported by Financing Growth

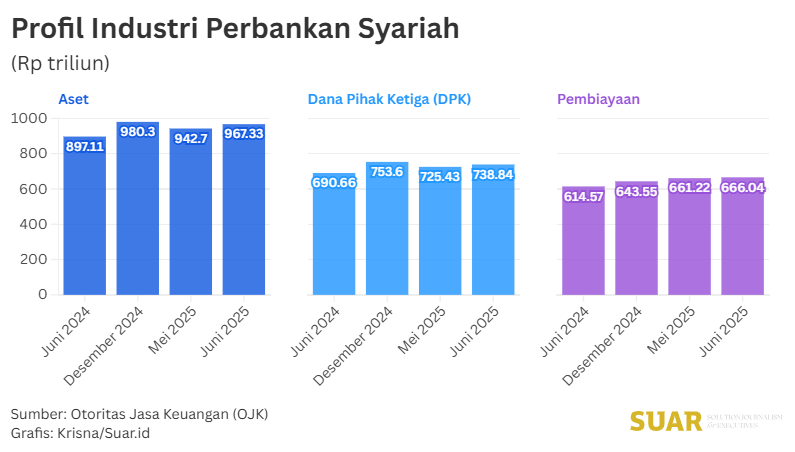

- The financial performance of sharia banking in the third quarter of 2025 showed a positive trend. This can be seen from the soaring financing growth of PT Bank Syariah Indonesia Tbk (BSI), PT Bank BTPN Syariah Tbk, and PT Bank Aladin Syariah Tbk. PT Bank Syariah Indonesia Tbk (BSI) recorded a net profit of IDR 5.57 trillion or grew 9.04% YoY. Meanwhile, PT Bank BTPN Syariah Tbk (BTPS) posted a consolidated net profit that grew by double digits, namely 23% YoY reaching IDR 945 billion. PT Bank Aladin Syariah (BANK) also recorded business growth by posting a profit of IDR 128.15 billion. This figure jumped 262.21% compared to the same period last year which was minus IDR 79 billion.

Read the full story here.

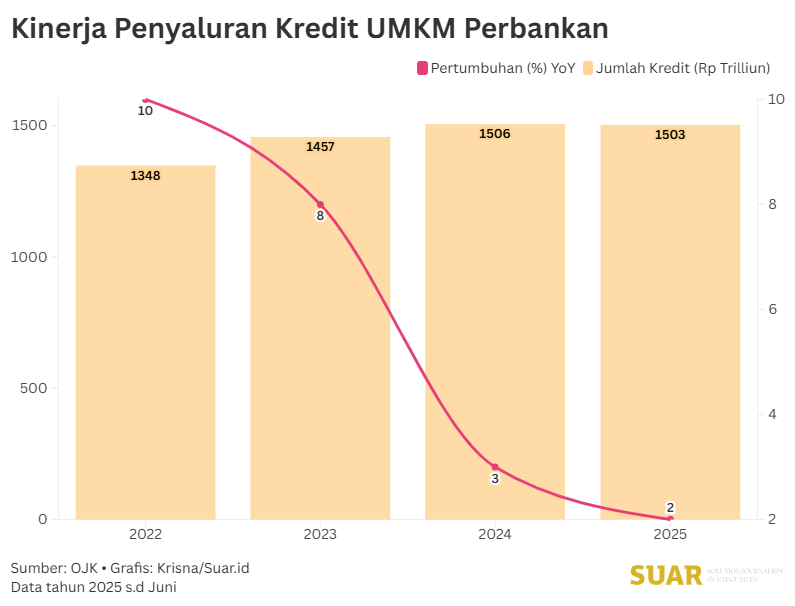

Banks Anticipate When Ojol is Categorized as UMKM

- The government's discourse to include online motorcycle taxi (ojol) drivers in the category of micro, small and medium enterprises (UMKM) is being responded to carefully by the banking sector. The national banking system is basically ready to accommodate ojol drivers as recipients of financing, as long as the expansion is carried out in stages and based on data. The resilience of the banking sector is currently quite strong with high capital and low non-performing loan ratios. Banking has its own standards in distributing credit, including for ojol drivers. Each bank already has a credit scoring system to assess the feasibility of borrowers and can utilize alternative data such as total income.

Read the full story here.

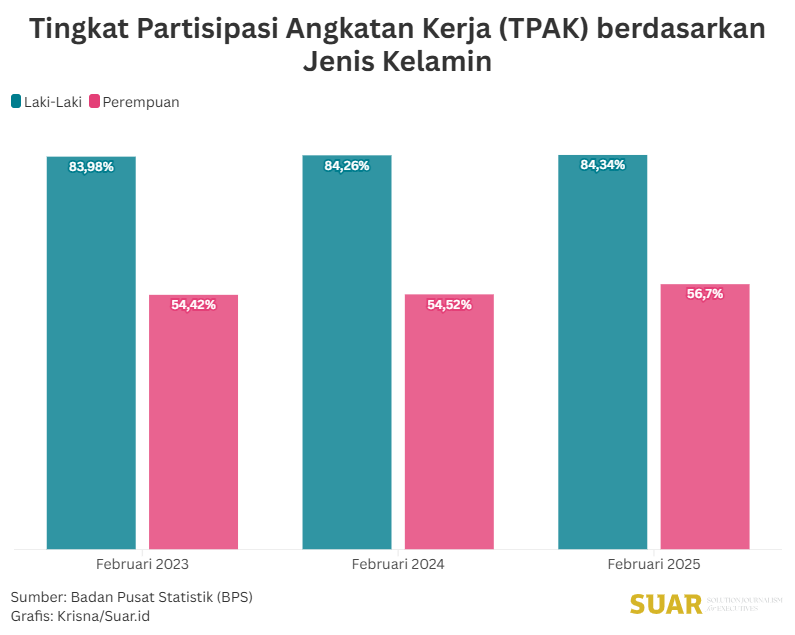

Flexible Work Arrangements Increase Productivity of Working Parents

- A 2023 study by the Institute for Fiscal Studies (IFS) revealed that the loss of an average of 4 days per worker per year due to family care responsibilities equates to 1.7% of the total payroll burden for companies. If this 1.7% is multiplied by the GDP, this is also a loss opportunity for our country. The discussion about working parents is highly relevant in the Indonesian context, given that family care responsibilities are currently a factor limiting the mobility and productivity of workers, especially women. Among the various factors affecting worker productivity, the obligation to care for family members, both children and the elderly, is a significant one. Therefore, flexible work arrangements can be one solution, in addition to the provision of daycare facilities.

Read the full story here.

Featured Video: Realizing Asta Cita Through Indonesia-UAE Diplomacy

Indonesia's Great Potential to Dominate the Global Sharia Economy and Finance

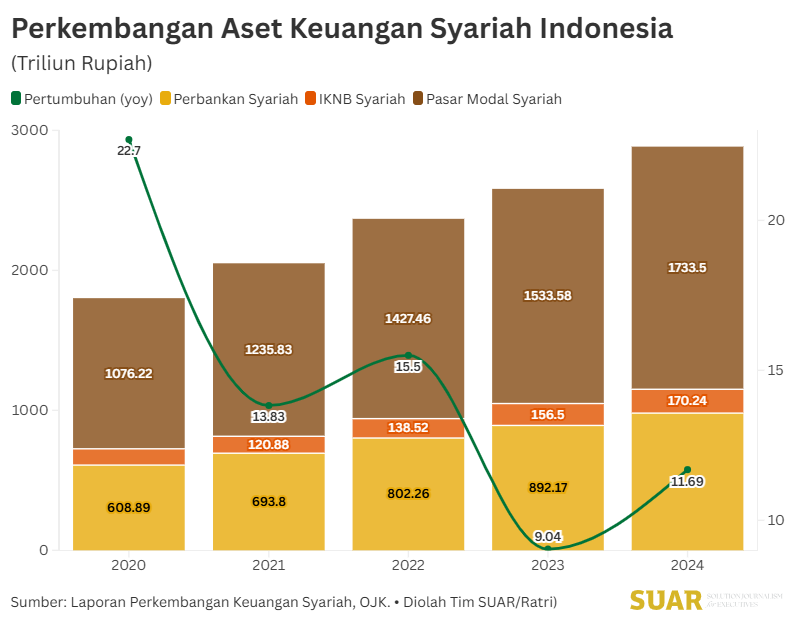

- Up to this year, sharia financial assets have been growing rapidly, and are even projected to exceed Rp 9,529 trillion by early 2025. This sector has become a priority in the National Long-Term Development Plan (RPJPN) 2025-2045. With a focus on strengthening the role of sharia finance, optimizing sharia social funds for poverty alleviation, and strengthening halal industries and UMKM, it is key to realizing Indonesia's ambition to dominate the global sharia economy and finance.

- The growth of sharia financial assets in Indonesia shows a consistent positive trend from year to year. Based on data published by the Financial Services Authority (OJK), the total assets of Indonesian sharia finance (including Sharia Banking, Sharia Non-Bank Financial Institutions, and Sharia Capital Markets) reached Rp 2,884 trillion in 2024. Compared to five years prior (2019), the total assets have increased significantly by 28.3% (from Rp 1,468.07 trillion). The highest increase occurred in 2020 with a growth of 22.70% (year-on-year). This indicates the increasing public trust and interest in sharia services and products in the country.

Read the full story here.

The Indonesian Digital Economy Festival (FEKDI) 2025 together with the Indonesia Fintech Summit and Expo (IFSE) 2025. Bank Indonesia and the Financial Services Authority (OJK) are again organizing this event on October 30 – November 1, 2025, at Hall B JICC Senayan, Jakarta. FEKDI is an annual event that serves as a primary platform to showcase and discuss innovations, collaborations, and policies in Indonesia's digital economy and finance sector, including exhibitions, talk shows, competitions (hackathon), and announcements of strategic government initiatives. Information on how to join and the series of events can be accessed through the official FEKDI website.

The Press Conference on the Third Quarter Financial Performance of 2025 of PT Bank Rakyat Indonesia (Persero) Tbk (BRI) will be held virtually via the Zoom Meeting platform on Thursday, October 30, 2025, starting at 08.30 WIB. This event is considered important because BRI is one of the largest banks in the country.

"Business is about finding opportunities in every problem and turning them into opportunities." (Richard Branson – Founder of Virgin Group)

Have a good day, Chief.

Team SUAR