Indonesia will achieve a balanced budget. That was one of the new intentions rolled out by President Prabowo Subianto, during his state speech on the submission of the 2026 State Budget Bill and Financial Memorandum at the Opening Plenary Meeting of the First Session Period of the House of Representatives for the 2025-2026 Session Year at the Nusantara Building, Jakarta, on Friday, August 15, 2025.

The 2026 State Budget Architecture is designed with State Expenditure of Rp3,786.5 trillion, State Revenue of Rp3,147.7 trillion, and a deficit of Rp638.8 trillion or 2.48% of GDP. The President stated that his administration will overhaul the allocation of the state budget, so that it can be more efficient and effective to prosper the nation.

In his presentation, the President emphasized that he would make savings in state expenditures, and prevent budget leaks that have been costing the state a lot of money.

"The government that I lead promises in front of this assembly, we will continue to carry out efficiency so that we want to reduce this deficit as small as possible. And it is my hope, it is my aspiration that one day whether in 2027 or 2028, I want to stand in front of this assembly, on this podium to say that we succeeded in having a state budget that has no deficit at all," the President said.

Eight Priority Programs for Prabowo's Government

- Food security as the foundation of national independence.

- Energy security for national sovereignty.

- Free Nutritious Meals (MBG) for the next generation.

- Quality education for globally competitive human resources.

- Quality health that is fair and equitable.

- Strengthening the people's economy through the Merah Putih Village Cooperative (KMDP).

- Universal defense to maintain the nation's sovereignty.

- Accelerated global investment and trade.

The 2026 Draft State Budget (RAPBN) is considered an ambitious plan, with total state expenditure exceeding Rp3,786 trillion.

This fantastic figure is prepared to fund eight priority programs, including the free nutritious meal program, strengthening defense, and accelerating investment.

Big budget without leaks

In the speech, President Prabowo also asked for the support of all political forces to eliminate budget leakage. He also highlighted the need to optimize state revenue through fair taxation, as well as productive management of assets and natural resources.

In addition, the quality of state spending must also be improved. Inefficient operational spending will be cut, while spending that provides real benefits, creates jobs, and strengthens public services will be prioritized. "Every rupiah must provide real benefits," said the President.

State Budget Architecture 2026

- State revenue Rp3,147.7 trillion;

- State expenditure of p3,786.5 trillion; and

- The 2026 state budget deficit is IDR 638.8 trillion or 2.48 percent of gross domestic product (GDP).

In this case, the Government will rely on digital transformation and improved governance to eradicate corruption, increase state revenue and help prevent leakage of state finances. The Government will also rely on digital transformation and improved governance to combat corruption, increase state revenues, and help prevent leakage of state finances.

It will also strive to improve services through digital transformation and continue to encourage bureaucratic reform. One of them utilizes the Electronic-Based Government System (SPBE) as an important tool to prevent and eradicate corruption by increasing transparency, efficiency and accountability in the delivery of public services.

There is also integration and digitization of services in ministries and agencies and in local governments, one of which is through the Local Government Information System (SIPD). With this system, synchronization of central and regional development programs can be controlled directly through the same system.

Since the beginning of his administration, President Prabowo has also emphasized the efficient use of the budget. The Head of State instructed government officials at all levels to combat budget leakage.

Wasteful spending and things that do not directly address the difficulties of the people and that are not productive, are prohibited. President Prabowo also called on all elements to reduce budget spending on ceremonial activities. "Reduce activities that are studies or seminars. Now is the time to address problems directly," the President said at the State Palace in December last year.

Prudent and innovative budget management

In the financing sector, President Prabowo emphasized that the state budget will be managed in a prudent and innovative manner, keeping the debt ratio at a safe limit, while empowering the role of BPI Danantara Indonesia and the private sector to boost economic growth.

With sound fiscal management, the Government is targeting 2026 economic growth of 5.4% or more, inflation under control at 2.5%, and open unemployment rate down to the range of 4.44%-4.96%. "We will reduce the poverty rate to 6.5 percent to 7.5 percent, and the Gini ratio to 0.377 to 0.38. Our Human Capital Index is targeted at 0.57," the President said.

The 2026 Draft State Budget (RAPBN) is considered an ambitious plan, with total state expenditure exceeding Rp3,786 trillion.

Growth financed by taxes, customs, and excises

Explaining the direction of the 2026 Draft State Budget, Finance Minister Sri Mulyani Indrawati emphasized that this fiscal policy is expansionary and directed. "The 2026 Draft State Budget is prepared to encourage inclusive and sustainable economic growth," she said.

High Target 2026 Draft State Budget

- The 2026 Draft State Budget deficit is targeted at IDR639 trillion (2.48% of GDP), lower than the 2025 projection of IDR662 trillion (2.78% of GDP).

- Economic growth in 2026 is set at 5.4%; the biggest risk if it is not achieved is that state revenue misses, the deficit widens, and the government is forced to cut spending.

- Macro assumptions: 10-year SBN yield of 6.9% and exchange rate of IDR16,500/US$

The government has also determined that the largest budget, Rp3,136.5 trillion, will be allocated for central government spending. Among the agendas that will be injected with large funds are food security, energy, education, health, village development, and the development of cooperatives and UMKM.

Meanwhile, the projection of state revenue also jumped, pegged at IDR3,147.7 trillion, with tax revenue being the mainstay. However, the government must anticipate a budget deficit of IDR638.8 trillion, or around 2.48% of GDP, which will be covered through debt financing.

Transfers to regions also received a significant portion, amounting to Rp650 trillion, with the aim of harmonizing national fiscal policy and encouraging regional independence. The 2026 Draft State Budget is expected to be a vital instrument in maintaining economic stability and promoting equitable development in the country, despite the looming global challenges.

Minister Sri Mulyani explained that the source of state revenue will be targeted to come from tax revenue of IDR 2,357.7 trillion, customs and excise of IDR 343.3 trillion, and non-tax state revenue (PNBP) of IDR 455.0 trillion.

Regarding the state revenue target of Rp3,147.7 trillion or an increase of 9.8% in 2026, Minister of Finance Sri Mulyani explained that the source of state revenue will be targeted to come from tax revenue of Rp2,357.7 trillion, customs and excise of Rp343.3 trillion, and non-tax state revenue (PNBP) of Rp455.0 trillion.

"The state revenue target is quite large. If we look at the performance over the last three years, the increase is only about 5.6 percent [2023]. In fact, this year the possibility is only 0.5 percent, so reforms in the fields of tax, non-tax revenue, customs and excise are very important," he explained.

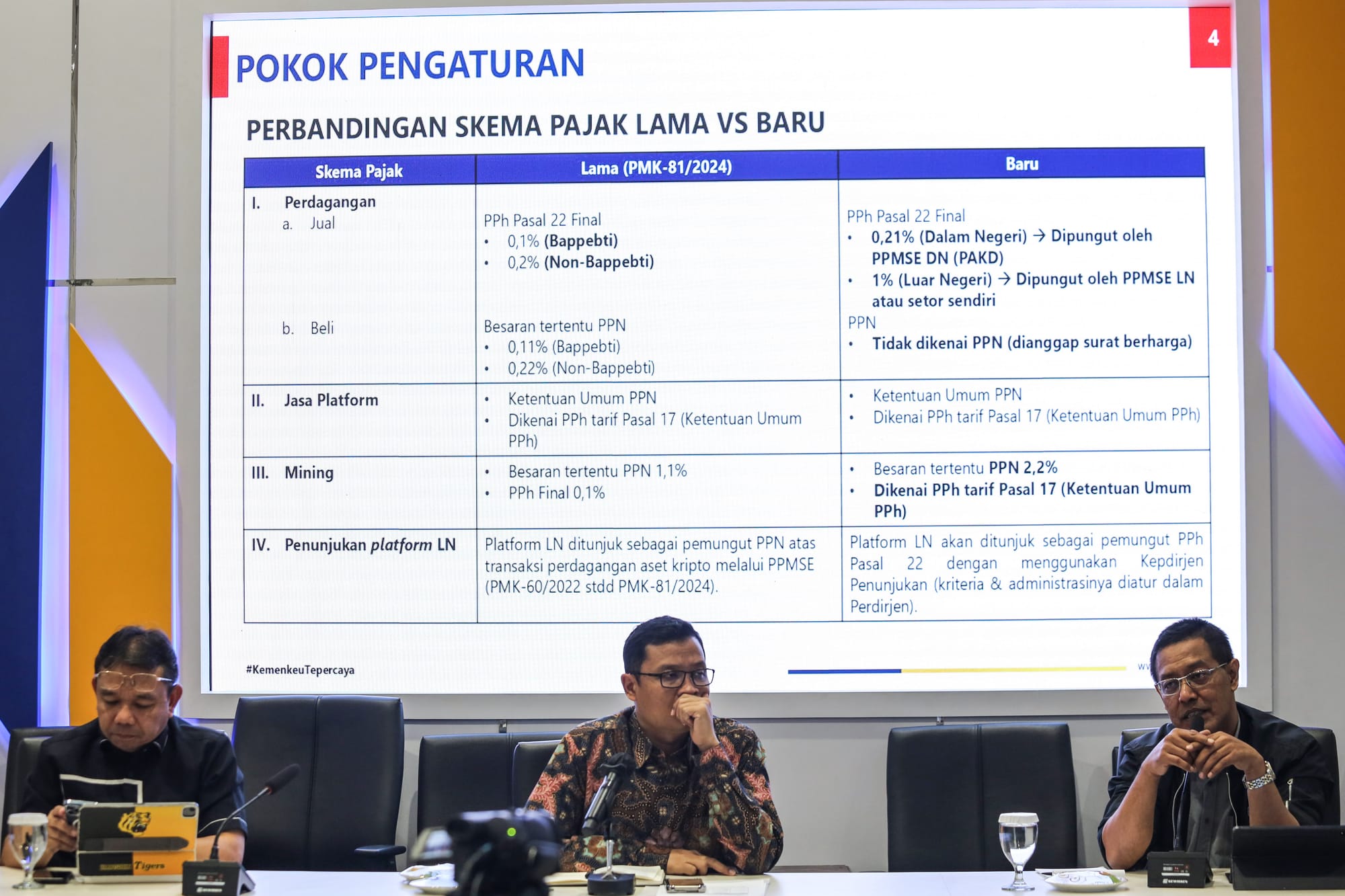

He revealed that the strategy to achieve the tax revenue target will be carried out by the government through the optimization of the latest digital taxation system, namely Coretax, and the synergy of exchanges from ministries / institutions (K / L), as well as domestic and foreign digital levy systems.

In addition, there will be simultaneous strengthening of joint programs in terms of data analysis, supervision, tax audits, intelligence, and tax compliance. "The government also provides incentives for purchasing power, investment, and downstreaming," Sri Mulyani added.

Meanwhile, the strategy to achieve the customs and excise revenue target is to intensify international trade import duties as well as export duties to support downstream products.

Partially, implementing the tobacco excise tax (CHT) policy and strengthening law enforcement for the eradication of excisable products and smuggling.

"In the PNBP sector, we will optimize improvements in governance, innovation, supervision and law enforcement of natural resources (SDA). Then strengthen the synergy of K / L and the Inter-Ministry / Agency Mineral and Coal Information System (Simbara)," said Sri Mulyani.

Tight budget for new direction of development

President Prabowo Subianto's policy direction in the 2026 Draft State Budget shows a budget allocation centered on priority programs. Apart from being an economic instrument, the state budget is also considered a new direction of Indonesia's economic development with an emphasis on the dominant role of the state.

But what triggers the question, with the budget posture set, is it enough to finance the big program with the jumbo budget. In his speech, the President said that there are several main focuses that become priority programs, namely education, free nutritious food programs, and strengthening village cooperatives. In addition, he will also strengthen the defense sector, health and increase investment.

Center for Strategic and International Studies (CSIS) researcher Deni Friawan assessed that there are several points that need to be strengthened from the 2026 Draft State Budget, namely the very limited fiscal space.

The deficit is set at 2.48% of GDP, so to finance major programs, the government could potentially raise tax revenue aggressively or sacrifice other spending.

This can lead to crowding out of private consumption and investment. Especially if Bank Indonesia or banks are forced to participate in financing through credit or the purchase of Government Securities (SBN).

The trend of state spending is also increasingly centralized in the central government, while transfers to the regions are actually shrinking. As a result, capital expenditure is getting smaller, while goods expenditure, energy subsidies, and other expenditure items continue to swell. In fact, large energy subsidies, around Rp400 trillion, are mostly enjoyed by the well-off, while the impact of agricultural subsidies is still minimal.

On the other hand, with the debt burden continuing to rise, at nearly Rp9,000 trillion or 39 percent of GDP, and tax revenues that are difficult to increase significantly because the informal economy base is still large, the room for maneuver in the state budget will be narrower.

Therefore, Deni said, the government should emphasize efficiency, transparency, and divert subsidies from goods to people who really need them. "That way, the state budget can support priority programs without compromising macroeconomic stability," he explained.

No need to pile eggs in one basket

Meanwhile, Riandy Laksono, Head of Economic Department CSIS, sees that the 2026 Draft State Budget still lacks an industrialization strategy. Large expenditures are more capital intensive, even though the biggest challenge lies in creating labor-intensive jobs. If there is no diversification, dependence on the Free Nutritious Meal (MBG) program risks causing mismatch spending.

MBG realization so far is also low, only Rp8 trillion from the target of Rp71 trillion. Even though the large funds were withdrawn from other posts such as infrastructure and official travel. As a result, government spending can actually dampen growth.

Therefore, the government needs to be more careful. Never pile eggs in one basket. It does not only depend on the state budget for MBG, but needs to channel the budget to other sectors that are more ready to absorb, so that the benefits are directly felt by the community.

Finally, President Prabowo's large political capital should be used for difficult structural reforms. Such as deregulating trade, investment, and labor, so that labor-intensive industries can revive.

This is because Indonesia's main problem is not just about eating, but how to provide decent employment. Meanwhile, the strategy of extensification or expansion of the tax base will be difficult to do in the near future, unless there is an acceleration of industrialization or an increase in the number of formal workers.

"The question is, where will the deficit be covered from in 2026? The tax revenue target that is set to increase by 13% I think is unrealistic, because historically our increase is only 5%-6%, except when there is a commodity boom like in the early era of President SBY," he said.

Riandy also reminded that state revenue is difficult to increase significantly without industrialization. Labor-intensive sectors, ranging from textiles, footwear, automotive, to chip testing, need to be the focus. For this to happen, the government must have the courage to carry out regulatory reforms: trade in raw materials and capital goods must be facilitated, labor policies reformed to be fair to workers while attracting investors, and legal certainty strengthened.

If the industrial sector grows, formal workers increase, the tax base expands, only then can revenue increase sustainably. "Without that, the revenue increase target of 13% will only be a number on paper," he said.

Authors: Mukhlison, Harits Arrazie, and Dian Amalia Ariani