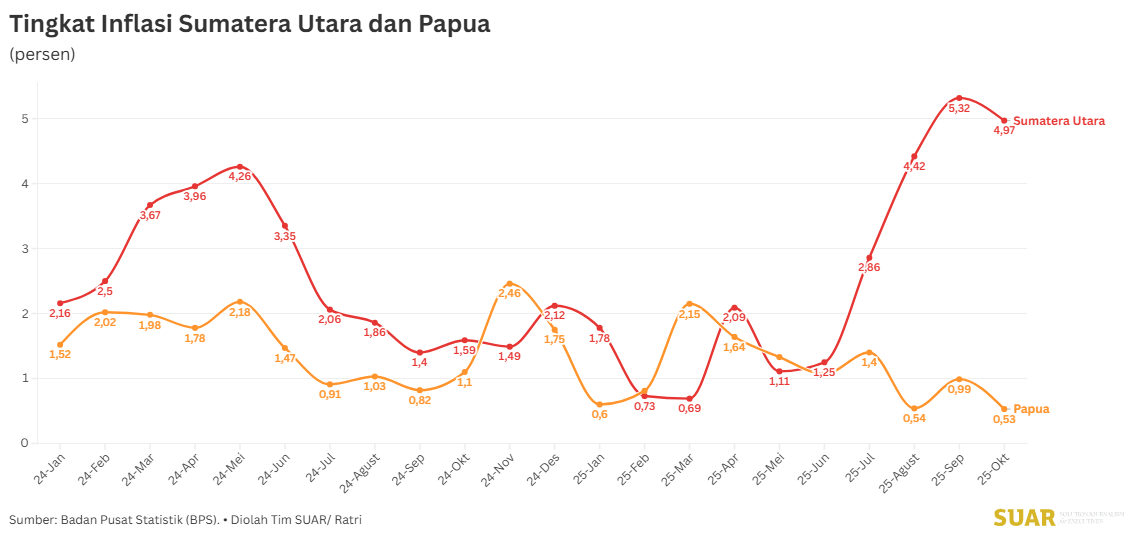

The inflation rate in North Sumatra (Sumut) in October 2025 reached 4.97% (y-on-y) recorded as the highest compared to other provinces. North Sumatra was recorded as the province with the highest inflation for three consecutive months. While Papua was recorded as the province with the lowest inflation rate of 0.53%.

North Sumatra became the province with the highest inflation not only in October. In August and September, North Sumatra also recorded the highest inflation with 4.42% and 5.32% respectively.

In contrast, Papua Province recorded annual inflation of only 0.53% in October 2025. Although not always the province with the lowest inflation, Papua is included in the group of five provinces with low inflation.

The high inflation in North Sumatra of 4.97% (y-on-y) was driven by strong demand and cost pressures. BPS reported that the main factor driving inflation in North Sumatra (October 2025) was a sharp increase in the Food, Beverage, and Tobacco group (9.58%). This reflects the movement of volatile food due to supply imbalances, large domestic demand, and distribution problems. In addition, inflation was also driven by significant increases in the Personal Care and Other Services (13.03%) and Health (4.06%) groups.

Meanwhile, the low inflation in Papua (0.53% Y-on-Y) was due to a combination of price intervention, availability, and price reductions in several strategic groups. On a monthly basis, Papua recorded -0.24% M-to-M deflation and even -0.92% year-to-date (YTD) deflation until October 2025. This price decline was triggered by important expenditure groups such as Transportation (-4.16%) and Clothing and Footwear (-1.12%).

Despite index increases in Personal Care and Other Services (7.23%) and Food, Beverages, and Tobacco (1.22%), the large decline in transportation, which is often influenced by subsidies oradministered prices in the archipelago, dampened the overall inflation rate, placing Papua's CPI at the lowest level nationally (104.69).

A comparison of these two provinces reveals two distinct economic challenges. North Sumatra, with its trade-led economy and high population density is sensitive to food volatility and logistics costs. Price increases are one indicator of demand and cost pressures. Persistently high inflation rates will affect people's purchasing power and consumption. This in turn will affect economic growth.

In contrast, low inflation in the Papua region is the result of massive government intervention on prices for stabilization purposes, where the decline in transport prices is very significant in containing the index. While low inflation in Papua is risky if the intervention is unsustainable or unsubsidized or indicates a low multiplier effect of development.

The challenge for authorities is to maintain balance. For North Sumatra, the policy focus should be on addressing the structural causes of core inflation and food prices. Rising service and food prices point to the need to increase local food production capacity and supply chain efficiency. As for Papua, the challenge lies in ensuring that this price stability does not hamper real sector growth and private investment. The government must ensure that the M-to-M deflation in Papua does not continue to be a prolonged deflation that hinders investment and production activities.

North Sumatra needs to pay attention to strengthening supply chains through Inter-Regional Cooperation (KAD) to import food from surplus areas and investing in market modernization to reduce distribution price markups. The transportation sector needs to be monitored so that M-to-M deflation in North Sumatra (which is still minus) can continue.

Meanwhile, for Papua Province, the policy focus should be on stimulating local food production through food security programs and strengthening BUMDs to reduce supply dependency from outside the island. Price interventions in the transportation and energy sectors remain selective, while encouraging economic diversification so that price stability is created from efficiency rather than subsidies.