In the midst of sluggish sales of cars and motorcycles, automotive component companies still survive and can print profits. One of the recipes for success is to transform to see the growing trend of producing goods that consumers really need.

President Director of PT Astra Otoparts Tbk Hamdhani Dzulkarnaen Salim said that his party remains optimistic that it can maintain sustainable growth with a business foundation that is considered quite good. Astra Otoparts is also transforming and always adapting to the direction of the market and consumer demand.

"In the midst of the dynamics of the automotive industry this year, Astra Otoparts continues to strive to maintain its growth, we really hope that this year we will also set a new record, so the highest year for us for the top line for revenue, as well as for the bottom line," Hamdhani said during the Public Expose event held on Friday (31/10/2025).

Astra Otoparts recorded a positive performance and continued to show growth until the third quarter of 2025. Based on records, Astra Otoparts' revenue rose 4.5% Year on Year (Yoy) to Rp14.8 trillion. This made the company still record a net profit growth of 2.6% YoY to Rp1.56 trillion, when compared to the same period last year.

The manufacturing segment is still the main contributor with a contribution to total revenue of 53%, while the other 47% is from the trading segment.

Hamdhani said that his party can continue to survive and even develop in the midst of the challenges of the sluggish national automotive industry, by making various efforts, one of which is by expanding component production to supporting infrastructure for the national electric vehicle ecosystem.

"We are currently and will continue to produce components used for electric vehicles, both two-wheeled and four-wheeled. Because we consider that these are potential components for the future," he said.

At least, Astra Otoparts has more than 71 part numbers for two-wheeled vehicles. In addition, a number of electrical components for EV and hybrid such as electric oil pump, auxiliary battery, battery case, and other components have also been produced by Astra Otoparts.

Astra Otoparts in producing EV-related components cooperates with companies abroad that already have the ability in this field, so that the products produced are of high quality.

In terms of infrastructure supporting the electric vehicle ecosystem, Astra Otoparts also produces charging machines, namely home charging and ultra fast charging.

" We sell thishome charging to OEM(original equipment market) where we are the only supplier for Toyota and Lexus. We also make ultra fast charging that we install in several public places," he said.

Astra Otoparts continues to transform the company and adapt to technological disruption and changing customer needs, so that the company continues to show positive performance.

Furthermore, Hamdhani said that his company, which is known as a leading automotive component company in Indonesia that produces and distributes various vehicle parts, has now entered another potential sector, namely medical devices.

A number of medical devices ranging from simple to high-tech were developed such as ultrasonography and electrocardiograph.

"We are also trying to diversify, where we consider one of the potential sectors for us is medical devices. We have entered this business, where we started with simple devices to quite sophisticated devices," Hamdhani explained.

Therefore, Astra Otoparts continues to be optimistic to grow better in 2025 compared to previous years, considering the number of two and four-wheeled vehicles in Indonesia is quite a lot so that it becomes a good market potential.

"The unit in operation of the four wheels if we assume that for example from 12 years back the figure is approximately 12 million cars in Indonesia. If we talk about motorcycles, it reaches more than 70 motorcycle units in Indonesia, of course it is a potential market for us," he said.

Entering the era of electric vehicles, the Indonesian government has also prepared policies to encourage battery-based electric motor vehicle programs for road vehicles.

The company's net profit was also recorded by car filter and radiator manufacturer PT Selamat Sempurna Tbk. In the third quarter of this year, the company recorded net sales of Rp 3.92 trillion, growing 2.65% YoY. The majority of sales or 65.04% of sales came from the export market, the rest was just the domestic market.

From the type of commodity, the largest sales were from filter products, which amounted to 75.04%. The rest is divided into other products such as radiators, car bodies, distribution services, and others.

With this performance, PT Selamat Sempurna Tbk managed to record an operating profit of Rp 1.08 trillion, growing 12.47% YoY.

Adaptation

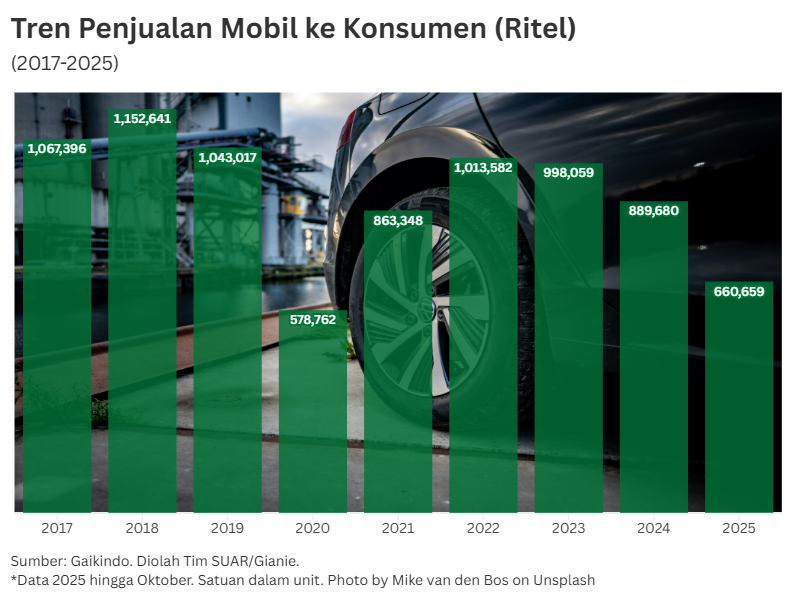

Automotive observer, Yannes Martinus Pasaribu, believes that the current condition of the automotive industry in Indonesia has begun to reach the starting point of recovery, starting from the reduction in interest rates from Bank Indonesia (BI) which provides flexibility in credit financing.

"This decline provides breathing space for the automotive sector, which is highly dependent on credit financing, which is around 80% of the total transaction," Yannes said in an interview on Friday (31/10/2025).

Despite the easing interest pressure and hopes that the automotive industry will improve macro-wise, the still-depressed consumer purchasing power is said to take some more time to recover.

The market-dominating internal combustion engine (ICE) car market also remains at risk of a slowdown due to the transition to electric vehicles (EVs).

"The weakening purchasing power and EV transition have a significant impact, but it differs between market segments. The largest segment is in low cost cars and entry level vehicles that are ICE. While EVs are in the use segment that has multiple cars and mostly not the middle low segment," he explained.

Reduced car purchases and real income are said to reduce the number of parts orders, depressing factory utilization and supplier cash flow. However, the aftermarket side is still supported due to maintenance of older cars.

"The EV transition also seems to change the demand structure, although it is still small, but in the future it will grow. The decline in demand for conventional components such as engines, exhausts, is replaced by an increase in demand for batteries, BMS(battery management systems), inverter motors, Hv connectors, and thermal management," he continued.

Companies supplying ICE components may slowly fall behind if they do not adapt and transform. Companies in Indonesia are also said to need to establish new technology partnerships with overseas companies that have proven themselves in the development of components and EVs.

One of the companies in Indonesia that do so, is PT Astra Otoparts Tbk. Although in 2025 the Indonesian automotive industry was faced with various challenges, Astra Otoparts continued to record positive performance until the third quarter of 2025.

Electric vehicle

Minister of Industry, Agus Gumiwang Kartasasmita, said this was stated in Presidential Regulation No.55 of 2019 concerning the Acceleration of the Battery-Based Electric Motor Vehicle Program for Road Transportation. In addition, the government has also issued Minister of Industry Regulation No.27 of 2020 concerning Technical Specifications, EV Roadmap, and Calculation of Domestic Local Content Level (TKDN) as a roadmap for the development of the electric vehicle industry.

"In the National Industrial Development Plan, the priority for the development of the automotive industry in the 2020-2035 period is the development of electric vehicles and their main components such as batteries, electric motors, and inverters," said Agus, Friday (15/10/2025).

Indonesia, as a country with the world's largest nickel reserves and with reserves of other primary raw materials such as cobalt, manganese, and aluminum, can also be utilized to increase the demand for electric vehicle batteries, which will support a strategic role in the global supply chain of the electric vehicle industry.

"Currently, there are nine companies supporting the battery industry, which include five companies providing battery raw materials consisting of pure nickel, pure cobalt, ferro nickel, mixed hydroxide deposits, and others, and four companies are battery manufacturers," he said.

In 2030, the government targets the production of EVs for four wheels to reach 600 thousand units, while for two wheels as many as 2.45 million units. The production of electric vehicles is expected to reduce CO2 emissions by 2.7 tons for four or more wheels and by 1.1 million tons for two wheels.