Fragrant news comes from Sidomulyo, a village on the slopes of Mount Gumitir, Jember, East Java. The village cooperative, dubbed a "foreign exchange village," has made new history by releasing its first coffee exports to three countries at once – Brunei Darussalam, Hong Kong, and Singapore – last month.

The value of the commitment note or letter of intent (LoI) for the three Indonesian trading partner countries was recorded at US$78,000, which is also proof that village cooperatives can compete in the international market. In detail, US$30,000 came from Brunei Darussalam, US$23,000 from Singapore, and US$25,000 from Hong Kong.

For Kamiluddin, the Head of Sidomulyo Village, this achievement is not just a commercial transaction. "This is not just about coffee, but about the belief that villages can manage cooperatives professionally, transparently, and globally oriented," he said, Sunday (31/8/2025) as quoted by the Jember Regency Government website.

Located in a tropical climate with volcanic mountains, Indonesia is known as one of the best coffee producers in the world. Various superior coffees, such as Arabika Gayo from Aceh, Toraja coffee from Sulawesi, and robusta from Lampung, are found in this country.

The taste of these various types of coffee has its own uniqueness with complex and unique flavors, making it popular with foreign markets – especially in Asia, Europe, and North America.

The taste of these various types of coffee has its own uniqueness with complex and unique flavors, making it popular with foreign markets – especially in Asia, Europe, and North America.

Based on data from the Ministry of Trade, Indonesian coffee exports have experienced a positive trend, with achievements of US$1.35 billion in January–July 2025. It is projected to increase by more than 100% compared to coffee export achievements throughout 2024, which reached US$1.64 billion.

Director General of National Export Development Fajarini Puntodewi said that this surge was driven by several factors. Such as the failure of the arabica coffee harvest in Brazil, the temporary import ban on Vietnamese robusta coffee in Europe due to pesticide notifications exceeding the threshold, and the increase in global coffee prices.

"(European) Buyers are increasingly looking for robusta coffee from Indonesia, especially Lampung coffee," wrote Fajarini in a written statement received by SUAR, Tuesday (02/09/2025).

According to Fajarini, Indonesian coffee is very competitive with coffee from Brazil and Vietnam. One proof of this is the high demand from foreign markets, even though uncertainty is plaguing world trade and the economy.

Previously, at the beginning of August, the US Government imposed a 50% tariff on one-third of Brazilian goods to the United States, which is the highest tariff of any country in the world. This allows Indonesia to take the opportunity to expand exports to other countries.

Fajarini said that her team is helping with business matching, business pitching, and export training.

"With a combination of steps from business actors and government support, we are confident that the competitiveness of Indonesian coffee can continue to increase. Not only in the Southeast Asian region, but also in the global market," said Fajarini.

Productivity and added value

Meanwhile, farmers and exporters hope that the government will also encourage productivity and increase the added value of Indonesian coffee so that it can compete in the global market. According to him, Indonesian coffee has advantages that other countries do not have.

"What distinguishes Indonesian coffee from Brazil and Vietnam is the region of origin (origin). Differences in geographical factors, climate, and post-harvest treatment make the taste of Indonesian coffee very unique, with a wide variety of variations," Ichwan told SUAR.

Ichwan emphasized that most of Indonesia's coffee production capacity is still produced by business units at the level of small and medium enterprises (SMEs). As a result, Indonesian farmers often still export their products in the form of coffee beans, although the number of processed coffee exporters has also begun to increase.

"The competition for processed coffee is quite tight. The capacity to fulfill orders for processed coffee in large quantities can only be done by large companies such as Santos, Top Coffee, Aneka Coffee Industry, and others," he said.

In that industrial-scale production capacity, processed coffee exports have been successfully exported to the Philippines, Malaysia and Japan.

In addition to the United States as the country with the highest demand for coffee beans, Indonesian coffee farmers have sent exports to Egypt, South Korea, Eastern Europe, Russia, Germany, Italy, Belgium and the United Kingdom.

With this reach, Ichwan said, the government can facilitate increased exports by increasing promotions and trade contacts abroad.

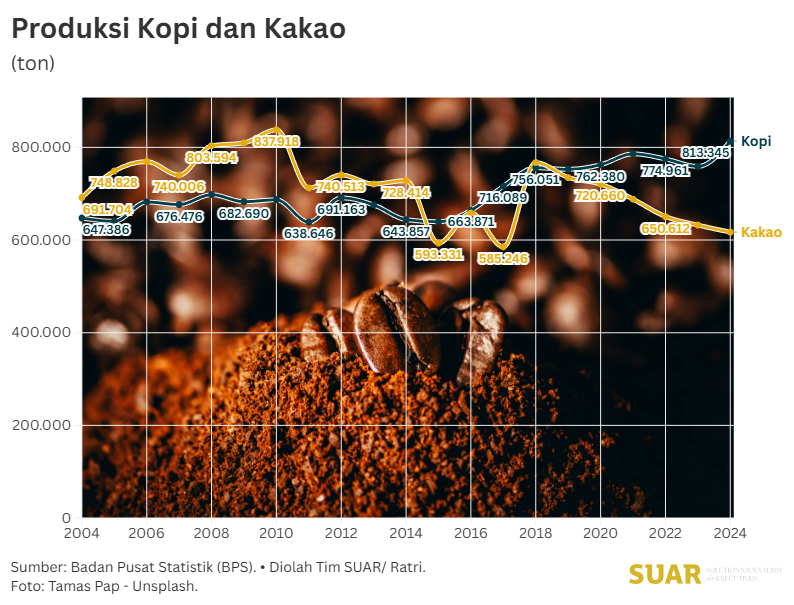

"Actually, the obstacle for Indonesian coffee is the production issue. In the last ten years, the volume of Indonesian coffee production has been relatively constant without a significant increase," Ichwan concluded.

The Head of the Downstream Industry Compartment of the Indonesian Coffee Exporters Association, Moelyono Soesilo, noted that the productivity of coffee produced by Indonesian farmers is relatively far behind compared to competitors in terms of volume, even though they compete on price.

He noted that currently, robusta coffee production is only 1 ton to 1.2 tons per hectare, far lower than the productivity of Vietnamese farmers who are able to produce 3.6 tons per hectare - let alone Brazil, which can reach 4.5 tons to 4.8 tons per hectare.

Moelyono admitted that farmers' planting patterns still do not want to change, only continuing their parents' patterns. Extension workers and supervision in the field are relatively lacking, fertilizers are difficult to obtain when needed, and the economic strength of farmers is still weak.

"As a result, because they plant for needs, the yield at harvest is relatively low," he said.

Free market needs rules

In addition to the challenges from farmers, the absence of regulations makes the coffee market ecosystem in Indonesia run without regard to the interests of the actors in it.

Coffee entrepreneur from Garut, West Java, Aries Sontani, stated that high market demand is indeed beneficial for farmers. Because currently, raw coffee can be priced at IDR 17,500 per kilogram, a significant increase compared to a few years ago. However, on the other hand, the behavior of buyer who want to buy coffee directly from farmers makes the middlemen scream.

"Wherever there is a plantation, the buyer immediately buys it suddenly. Even though in the plantation there are farmer groups who take care of it, there are rules, and there are people who have been instrumental in processing coffee from harvest to ready to enter the market," said Aries when contacted by SUAR, Wednesday (03/09/2025).

Fajarini added that strengthening processing to increase added value along the supply chain could be one way out so that coffee farmers can export more than just beans.

A number of strategies he has taken include stabilizing prices and availability of basic commodities, improving domestic trade facilities, and facilitating product development and certification.

According to Fajarini, the Ministry of Trade is focused on opening up foreign market access for Indonesian products. "The efforts made include strengthening international trade diplomacy and increasing export promotion and information," she said.