Good morning Chief...

The following is important information related to the development of the business universe that needs attention today based on the curation of the SUAR Team.

Waiting for Economic Acceleration from IDR 200 Trillion Injection

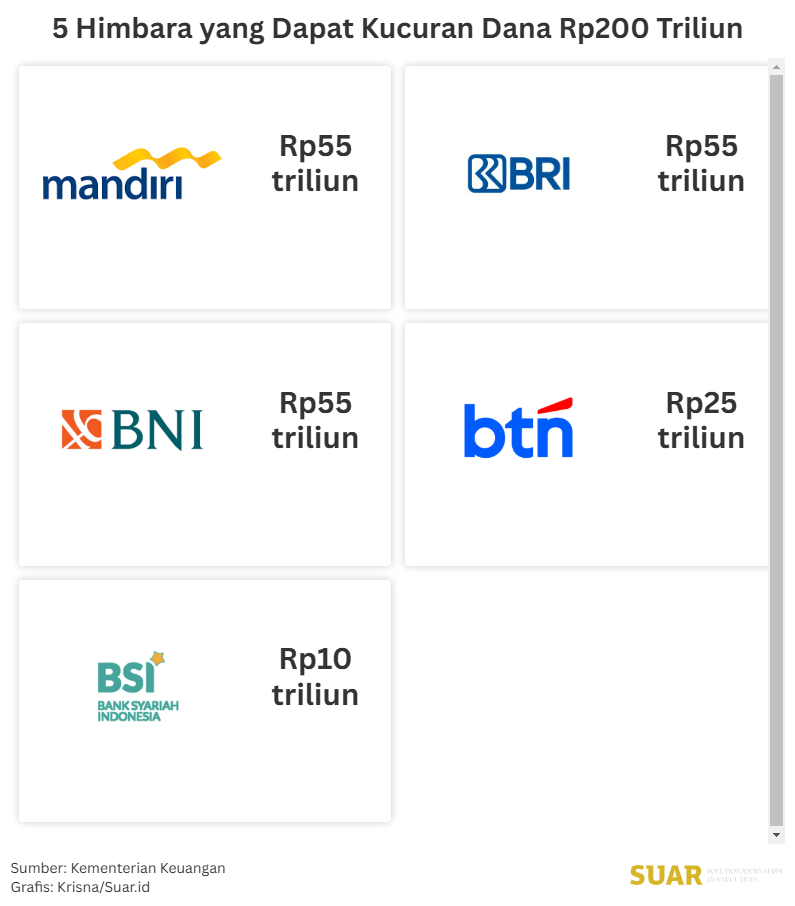

- The government claims to have injected Rp 200 trillion into five state banks on Friday last week. According to Finance Minister Purbaya Yudhi Sadewa, the aim is to accelerate the economy to pursue growth. The readiness and creative strategies of banks will be tested to target potential and productive sectors so that the injection can be useful and right on target.

- Bankers from state banks contacted by Suar.id welcomed this fund injection. They said they would use the additional capital to support the government by financing strategic programs. Meanwhile, lending will still be carried out through risk calculations and through the principle of prudence.

- Apart from Purbaya's progressive policies that should be appreciated, an important aspect that should not be forgotten is to solve the problem of economic slowdown upstream. The funds stored in the Excess Budget Balance (SAL) are a problem of non-optimal spending. The effort to encourage credit growth with additional capital is also not right, because of the sluggish demand factor that makes credit growth slow down.

Read more here.

Measuring the Benefits of the "8+4" Economic Stimulus

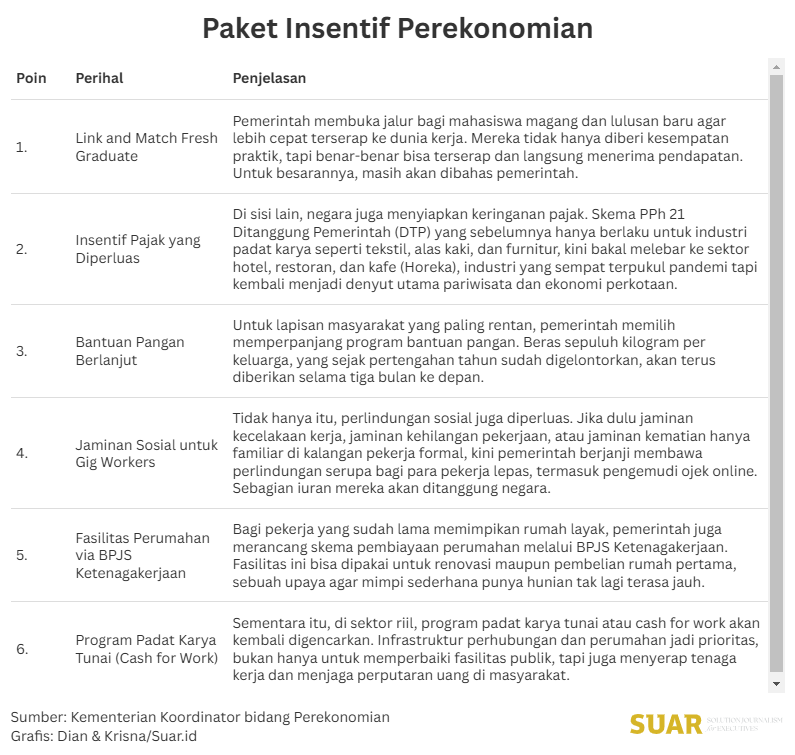

- In the midst of tight budget efficiency, the government is once again pouring ammunition to maintain people's purchasing power and boost economic growth. Coordinating Minister for Economic Affairs Airlangga Hartarto announced plans to launch an economic stimulus package for the fourth quarter of 2025, labeled "8+4", on Friday (12/9/2025). The package, which was prepared at the direct direction of President Prabowo Subianto, is expected to support and accelerate the economy until the end of the year.

- This policy package has received mixed responses, from entrepreneurs, workers, and economists. Each of them understands the government's good intentions to boost the economy, but the types of incentives are still considered not to have touched the basic needs of business actors and the community.

Read more here.

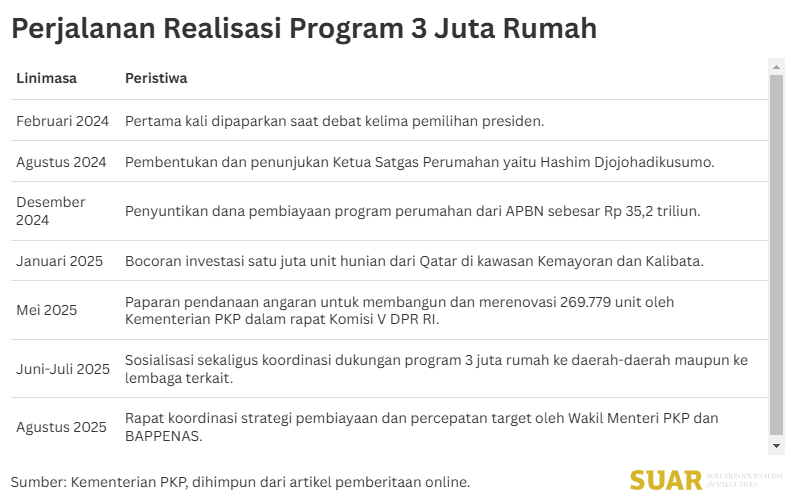

All Parties Work Together, Housing Program Must Be Completed

- All parties, ranging from the Ministry of Housing and Settlement Areas (PKP), the Provincial Government of the Special Region of Jakarta, the Daya Anagata Nusantara Investment Management Agency (BPI Danantara), to the business world, issued various initiatives to meet the housing needs of residents. Among other similar programs are the Housing Credit Program (KPP) and People's Business Credit (KUR) for housing.

- Chairman of the Indonesian Chamber of Commerce and Industry (Kadin) Anindya Bakrie said that the 3 million housing unit project could create jobs for up to 9 million people working in housing construction services. Each house involves 5-6 workers, plus around 140 vendors, ranging from cement, steel, to transportation services. So the multiplier effect is very large.

- The Ministry of PKP and the Jakarta Provincial Government are also working together to encourage the KUR Housing program for UMKM to upgrade.

Read more here.

BI Rate Continues to Fall, Lending Rates Should Fall to Spur Real Sector

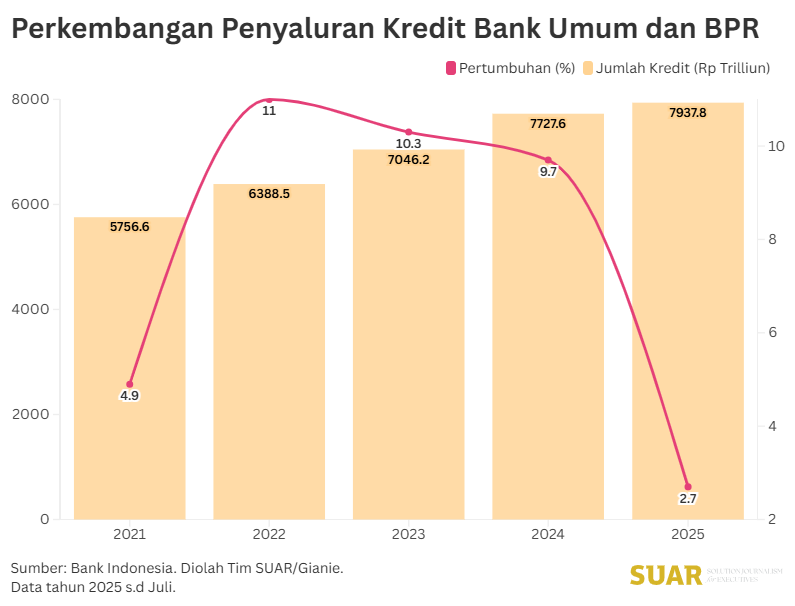

- Throughout this year, Bank Indonesia (BI) has lowered the benchmark interest rate or BI Rate by a total of 100 basis points, so that the BI Rate is now at 5.00%. Throughout this year, BI has lowered the benchmark interest rate four times, namely in January, May, July, and August 2025. Each reduction amounted to 25 basis points or 0.25%. The decline in the BI Rate should also translate into a decrease in bank lending rates so that they can be lower.

- Financial Services Authority (OJK) Banking Supervisory Executive Head Dian Ediana Rae said that the decline in the BI Rate has been followed by a decline in bank interest rates. Compared to the previous year, the average rupiah lending rate in July 2025 was recorded down 36 bps for investment loans and down 20 bps for working capital loans. "Generally, a decrease in the BI Rate will be followed by a decrease in lending rates with a time lag of several periods. Therefore, lending rates are expected to continue to decline in response to the BI Rate cut in 2025," Dian said.

Read more here.

PR to Disburse Rp 200 Trillion when Productive Credit is Sluggish

- The Rp 200 trillion fund placed by the government in five state banks is expected to encourage lending. Banks receiving funds can channel them to the real sector so that the economy moves. The funds are not allowed to be used to buy government securities (SBN) or Bank Indonesia rupiah securities (SRBI).

- In 2025, although credit growth was still small during the first seven months, the share of productive credit was around 71.3%. In detail, working capital loans accounted for 43.3% of total loans, investment loans for 28%, and consumption loans for 28.7%.The monetary policy breakthrough made by the Minister of Finance to mobilize the real sector has not been fully believed by the public, even economic observers. There are still fears that the large funds will be used by banks not to channel credit,

Read the full story here.

Publication of Indonesian Foreign Debt Statistics (SULNI) July 2025: This publication, which is a routine agenda of Bank Indonesia and the Ministry of Finance, will be released on Monday (15/9/2025). The SULNI data provides a comprehensive picture of Indonesia's external debt position, which is a crucial indicator in analyzing national economic resilience. The report, which contains important information for economists, investors and analysts, will be available for online access through Bank Indonesia's official website.

Seminar "Navigating the India-Indonesia Bilateral in a Changing Global Order": The event will be organized by the Center for Strategic and International Studies (CSIS) in collaboration with Gateway House on Monday, September 15, 2025, 10:00-12:00 pm, at CSIS Auditorium, Jakarta. The seminar will discuss India-Indonesia bilateral relations and its role in the changing global order, featuring prominent speakers, such as Indonesian Foreign Minister Sugiono, Indian Foreign Minister Shri Pabitrah Margherita, and ambassadors of both countries. For those interested, participants can register to attend in person by RSVPing, or watch the live stream of the event via the CSIS YouTube channel.

"Action is the basic key to all success." (Pablo Picasso - Spanish painter and sculptor)

Have a good day Chief.

Team SUAR