Post-pandemic, the trend of lending tends to decline. Likewise, so far this year, lending has only grown 2.7%. Now, the government hopes that funds worth IDR 200 trillion placed in five state banks can encourage lending to stimulate the economy.

The placement of the IDR 200 trillion fund is stated in the Decree of the Minister of Finance Number 276 of 2025 concerning the Placement of State Money in the Context of Managing Excess and Shortage of Cash to Support the Implementation of Government Programs in Encouraging Economic Growth.

So, the distribution of these funds is homework for the management of five government-owned banks. In detail, BRI received IDR 55 trillion, BNI IDR 55 trillion, Bank Mandiri IDR 55 trillion, BTN IDR 25 trillion, and BSI IDR 10 trillion.

Banks receiving funds can channel them to the real sector so that the economy moves. The funds are not allowed to be used to buy government securities (SBN) or Bank Indonesia rupiah securities (SRBI).

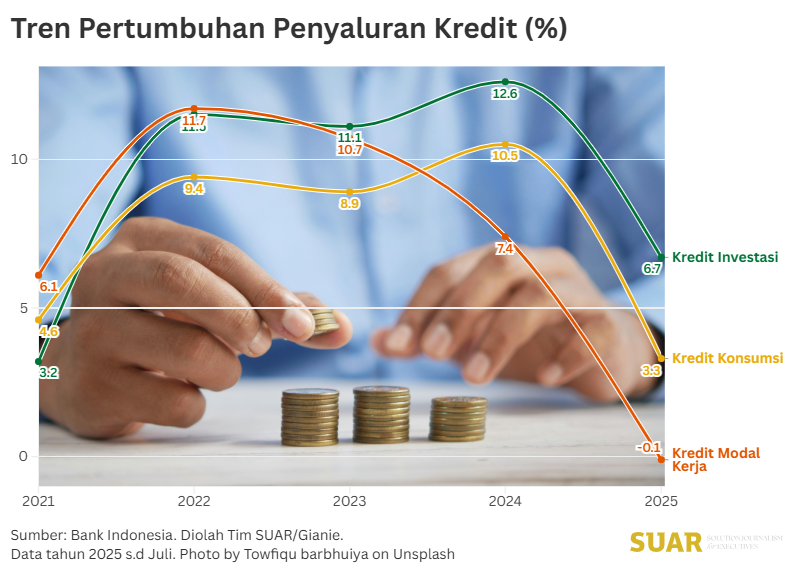

This injection of state cash is fresh blood for the economy. Based on Bank Indonesia data, the nominal credit disbursed by commercial banks and BPRs has indeed increased over time. However, the growth tends to shrink.

This is especially evident post-pandemic. In 2022, total credit disbursed reached IDR 6,388.5 trillion or grew by 11% compared to the previous year. However, total credit in the following year, 2023, reached IDR 7,046.2 trillion, growing by only 10.3%.

Credit growth in 2024 also declined to 9.7%. The decline is likely to continue until the end of 2025. This is because in the January-July period, total lending, which reached IDR 7,937 trillion, only grew by 2.7%, very low compared to previous years. Working capital lending until July 2025 even fell by 0.1%.

When broken down by usage, the largest portion of loans were channeled to productive activities - as investment loans and business capital loans. That is, around 70%-71% of total loans. This share has been stable over the past five years.

The largest portion of loans is channeled to productive activities - as investment loans and business capital loans. That is, around 70%-71% of total loans.

During the first seven months of 2025, although credit growth was still small, the share of productive credit was around 71.3%. In detail, working capital loans accounted for 43.3% of total loans, investment loans 28%, and consumption loans 28.7%.

The monetary policy breakthrough made by Finance Minister Purbaya to mobilize the real sector has not been fully believed by the public, even economic observers. There are still concerns that the large funds will be used by banks not to channel credit.

Close supervision is needed so that the government's goal of encouraging the economy through lending to the real sector can run according to the target. Meanwhile, for the business world, this is an opportunity to get additional funds for expansion.