Minister of Finance Purbaya Yudhi Sadewa emphasized that tobacco excise rates and the retail selling price (HJE) of cigarettes will not be increased in 2026. This certainty was conveyed in order to maintain the stability of the tobacco product industry, which still plays a major role in the national economy. This policy is a continuation of the government's previous year's move, which also did not increase cigarette excise.

Purbaya stated that there would be no adjustment to retail prices if the excise tariff does not increase. He emphasized that the government wants to maintain the consistency of fiscal policy so as not to confuse business actors and the public.

"We have calculated the reasons why. Because I don't want our industry to die. And, we let the illegal ones live," said Purbaya, quoted by Antara, Wednesday (29/10/2025).

In addition to setting fiscal policy, the government is also preparing a strategy to suppress the circulation of illegal cigarettes in the domestic market. This effort is aimed at ensuring that all business actors, including small and medium-scale producers, can enter the monitored official system. The Ministry of Finance plans to implement this measure at the end of the year after discussions with industry players.

Purbaya explained that the government is striving to maintain a balance between economic aspects, state revenue, and public health in formulating excise policies. He realizes that this decision has led to differences of opinion in the community, especially from those who highlight the health impacts. The government continues to encourage consumption control through education conducted in stages.

The government is also preparing a grand concept to combat illegal cigarettes from both domestic and foreign sources. Purbaya explained that most illegal cigarettes are produced by small and medium-scale businesses, so in the future, they will be directed to enter special zones that are legal and supervised. Purbaya mentioned that discussions with business actors have been conducted, and the program's execution is planned to begin in December 2025.

The Indonesian Eliquid Producers Association (PPEI) has expressed its support for the government's decision to hold back on increasing excise rates in 2026. The policy is considered to provide room for industry recovery after several years of experiencing production cost pressures and regulatory adjustments. This step is seen as a positive signal for the sustainability of the eliquid sector in the country.

Chairman of PPEI, Daniel Boy Purwanto, said that the decision demonstrates the government's attention to the condition of the industry, which is still adapting to market dynamics. "With no increase in rates, industry players can focus on improving quality and strengthening competitiveness," he said in a PPEI statement posted on its official website on October 14, 2025.

According to Daniel, the stability of excise rates also plays a role in maintaining affordable selling prices for consumers and not suppressing demand. He believes this situation could open opportunities for business actors to expand their markets domestically and abroad. In addition, he hopes the government will actively involve industry associations in the policy formulation process.

PPEI believes that with no increase in rates, eliquid producers have a wider opportunity to increase production capacity and strengthen the national supply chain. The stable conditions are expected to encourage product innovation and help business actors maintain price balance in the domestic market.

Chief Economist of Bank Pertama, Josua Pardede, believes that the pause in excise increases in 2026 could be a momentum for micro, small, and medium enterprises (UMKM) in the electric cigarette industry to strengthen their business foundations. Josua emphasized the importance of increasing legality, quality standards, and transparent trade management so that industry players are ready to face tighter non-fiscal regulations.

"UMKM that comply from an early stage, use verified raw materials, and manage licensed distribution will be more resistant to tightening regulations and have easier access to formal financing," said Josua when contacted on Thursday (30/10/2025).

According to Josua, the decision to hold excise rates and the Retail Selling Price (HJE) is a tactical policy that provides breathing room for the labor-intensive sector and reduces price pressure in the market. He added that this step also helps to reduce the risk of inflation in low-income household consumption goods. However, the effectiveness of the policy will greatly depend on supervision and structuring of tariff structures so as not to open loopholes for illegal products.

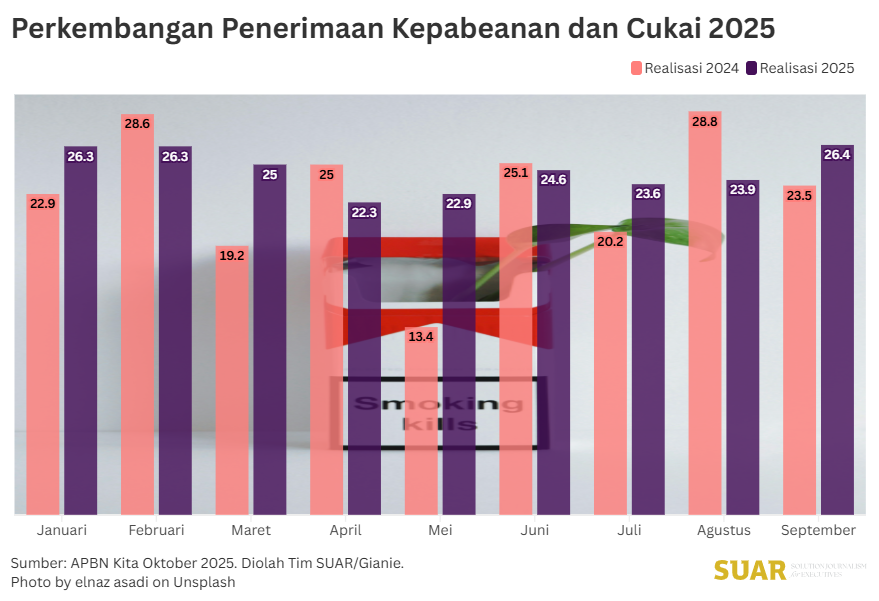

From a fiscal perspective, Josua explained that the growth of excise revenue next year will depend more on increasing legal volume and law enforcement against the circulation of illegal cigarettes.

The government needs to replace the effect of tariff increases with improved administration and strengthened compliance to maintain revenue targets. "The 2026 State Budget (RAPBN) still targets an increase in excise revenue and bases its policies on four pillars: consumption control, revenue, labor protection, and supervision of legal goods," he said.

Read also:

Josua believes in the importance of a clear multi-year excise roadmap so that fiscal policy remains measurable and does not create uncertainty for the industry. According to him, the government needs to accelerate the digitalization of the supervisory system and encourage partnerships between business actors and tobacco farmers to strengthen the labor-intensive sector.

With risk-based supervision and consistent policy support, the balance between state revenue, labor protection, and consumption control can be maintained sustainably.

Criticism

Meanwhile, Senior Researcher at the Institute for Economic and Social Research (LPEM) at the University of Indonesia, Vid Adrison, believes that the government's decision not to increase cigarette excise in 2026 shows a greater bias towards the industry compared to public health aspects. Excise should function as a consumption control instrument because cigarettes are classified as products that have a negative impact on health.

"The main purpose of excise is control. With excise, prices become higher so consumption can be reduced," said Vid.

According to Vid, the decision to hold excise rates will make it difficult to reduce smoking prevalence, especially among young people. Vid believes that prices that remain affordable have the potential to open opportunities for underage children to buy cigarettes on the market.

This condition, according to him, shows that the direction of current fiscal policy emphasizes more on industry protection than consumption control and public health.

Vid also highlighted the inter-group gap in the excise tariff structure, which is considered to be too wide. The difference in excise rates between group one and two cigarette products, which reaches around 60%, according to him, encourages consumers to switch to products with lower excise and potentially puts pressure on state revenue. "If you want to reduce it, reduce the gap. The difference between group one and two should not be that big," he said.