In the midst of rapid climate change and efforts to encourage green financing, Indonesia can learn from the global green financing model of Singapore's sovereign wealth fund (SWF) Temasek Holding and Norway's North Fund. Both focus on financing green finance projects to achieve zero emissions.

Executive Director of the Center of Economic and Law Studies (Celios) Bhima Yudhistira said Indonesia could emulate concrete examples of successful green financing models, such as Temasek Holding from Singapore and North Fund from Norway.

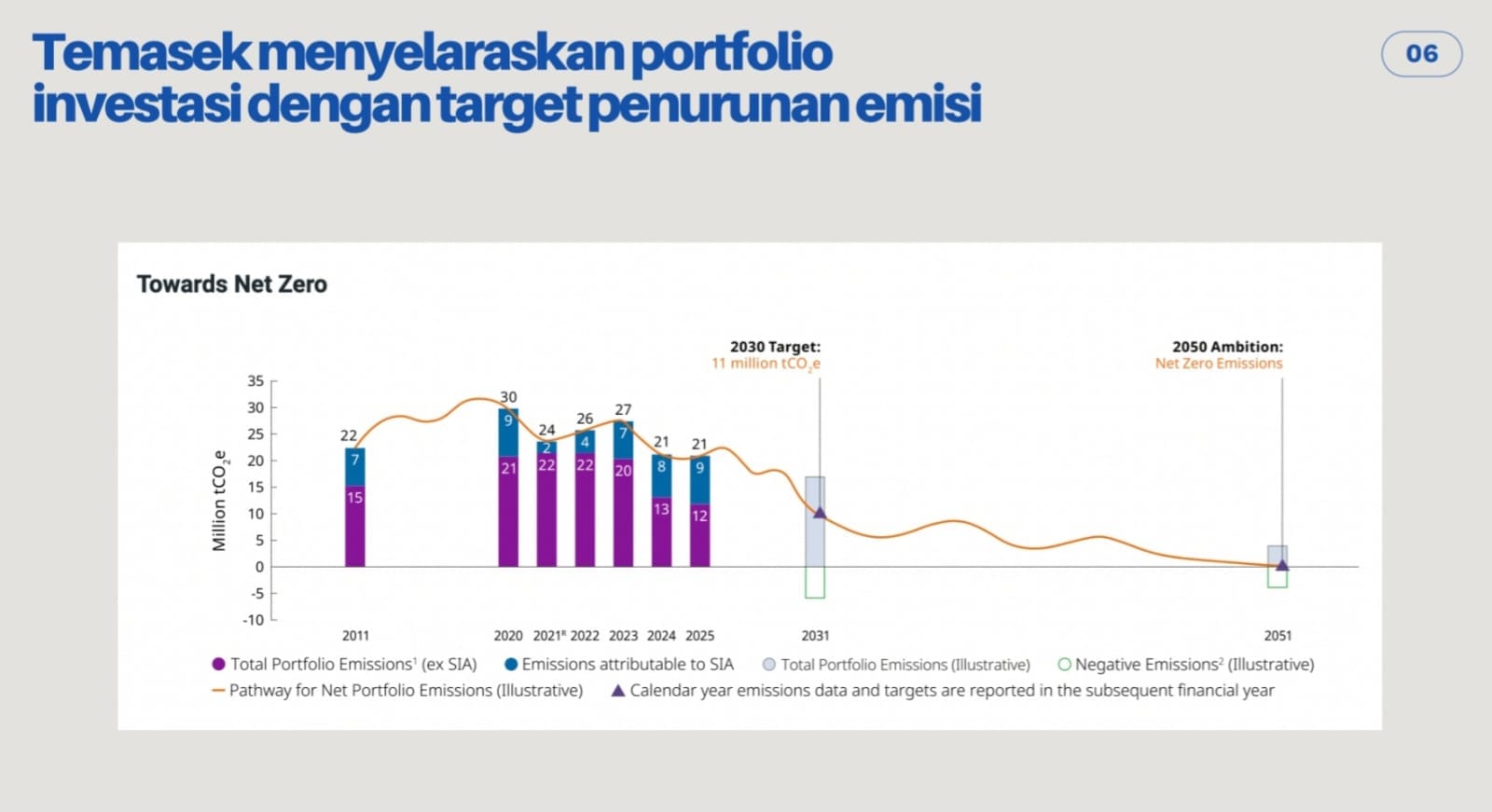

He explained that Temasek has five strict policy rules regarding funding, including a ban on entering the fossil energy sector and ensuring that each entity financed achieves its net zero 2050 ambition. They do not only fund only to banks but also enter to open financing for project-based industries and activities.

To ensure financing is targeted and effective, they also track the direction of funding.

"So Temasek ensures that every individual(internal sales order) financed by Temasek has direct equity participation. Whether it is a bank, whether it is a project base, industry, etc., will it not achieve net zeo emission in 2050?" Bhima said at the public discussion Greening the Portfolio: Opportunities and Challenges for Indonesian Banking in the Energy Transition Era, Jakarta (31/7/2025).

Norway's North Fund is also an inspiration. This institutional fund, which comes from oil and gas management dividends, is known for its high transparency. The general public can access detailed information about the investment portfolio, project list, and returns.

The adoption of transparent and science-based green financing models, such as those successfully implemented by Temasek and the North Fund, is key to driving a green economy and achieving Indonesia's net zero emissions target.

In the same discussion, Managing Director of Energi Shift Institute Putra Adhiguna underlined that the global shift of capital towards renewable energy is very clear. Although the road to transition will be bumpy, the direction is undeniable.

He highlighted that global energy transition investments are dominated by mature sectors such as renewable energy (solar and wind) and electric vehicles, while discussions in Indonesia still revolve around "emerging sectors" - such as carbon capture, hydrogen, and nuclear, which are much smaller in scale globally.

"We need to monitor the allocation of our banks' funds. Don't let them pour their money into the energy transition but to the right [emerging sector]," he said.

He also highlighted the price of electricity in Indonesia, which is still very dependent on coal compared to other countries that have switched to solar or wind as the cheapest energy source. "We have protections against the coal market, why we are very coal heavy," he added.

Although the latest Electricity Supply Business Plan (RUPTL) looks greener, Putra stressed the importance of looking at investment realization. "For the last seven to eight years, investment in new renewable energy has been flat and declining in Indonesia," he regrets.

He urged stakeholders to focus on short-term plans, "What do you want to do in the next twelve months?"

Putra also highlighted the huge profits made by the coal sector in Indonesia yet it only accounts for 3.6% of GDP. With low debt levels, these coal companies have a lot of money that could otherwise be allocated to diversification or a better energy transition.

"We have to create a situation where Indonesia encourages them (coal companies) to also transition," he said.

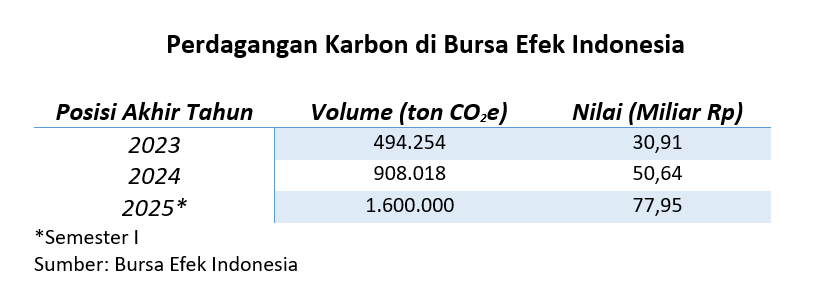

Carbon market

Carbon expert and practitioner Paul Butar Butar highlighted the issue of quality of carbon credits that is of global concern. He referred to a Guardian report alleging"overestimation" in some projects' emission reduction claims, leading to a significant drop in demand for carbon credits, especially for older projects.

Buyers are now looking for"high quality carbon credits" that result from a very detailed and socially considerate process.

One good initiative that has successfully addressed this demand is the implementation of the Gold Standard. This standard, he says, ensures that a carbon project is built with full and transparent community involvement.

"If there is a company or a carbon project that gets the gold standard, it ensures that the process to get the carbon project is really high quality considering the community aspect. This also has an impact on the price of carbon credits which tend to be premium," he said.