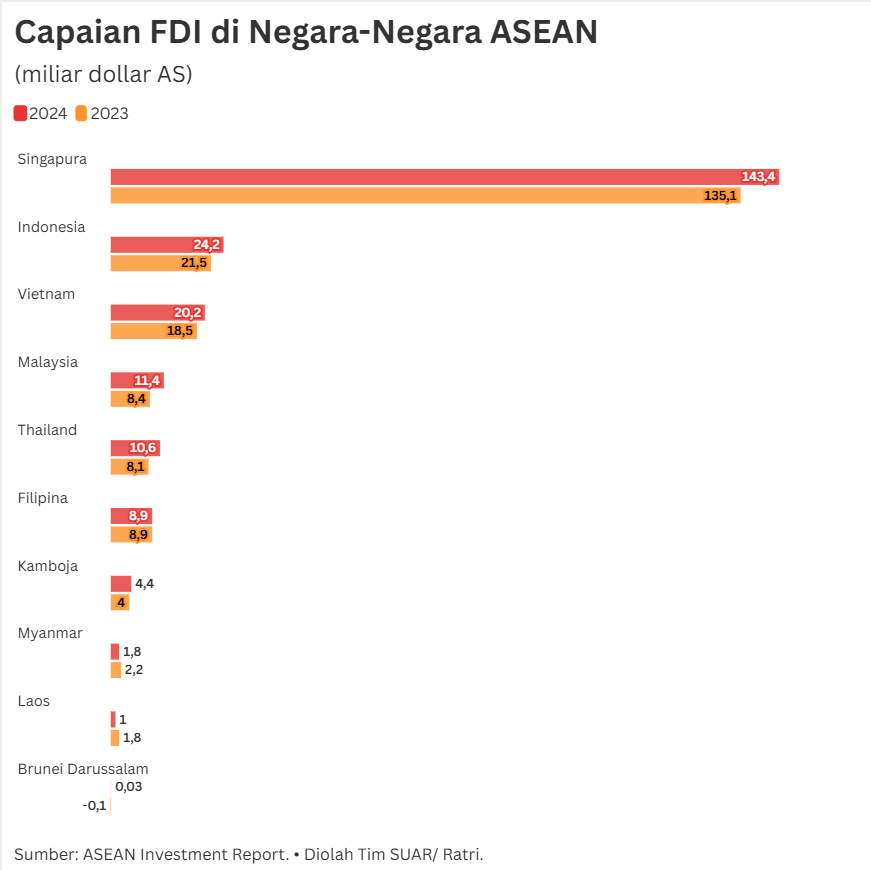

Data from the Ministry of Investment and Downstreaming/BKPM noted that throughout 2025, the realization of US investment in Indonesia has reached US$2.3 billion (January-September), with a total of 3,664 projects.

In the third quarter of 2025, the United States was the 5th investor country with investment realization in Indonesia with a value of 768.5 million US dollars. There are a total of 2,435 ongoing projects. However, accumulatively, during the first- third quarters of 2025 the value of investment from the US which reached USD $2.325 billion ranked 6th largest after Singapore, Hong Kong, China, Malaysia, and Japan.

In the last five years, US investment realization reached its highest value in 2024, with a value of US$3.696 billion. On a quarterly basis, the highest investment was recorded in the first quarter of 2024 with a value of US$1,087 million. In 2024, the value of US investment in Indonesia grew by 8.5%(year-on-year).

After its peak in 2024, investment realization in 2025 showed a downward trend. In the third quarter of 2025, US investment realization stood at USD 768.468 million, down 8.4% compared to the third quarter of 2024. Cumulatively, three quarters have only realized USD 2.325 billion. In this regard, the moment of the US-Indonesia Investment Summit 2025 is important for policy reform in encouraging investment to develop more in the future.

By sector, the largest US investments in Indonesia are in four sectors: mining, manufacturing, information and finance. Since the last five years, the trend of investment in the mining sector has started to shrink to 65% in 2025. The percentage of investment is shifting to the manufacturing or processing and information sectors. The government's focus on downstreaming in the minerals/base metal processing sector has driven US investment into the manufacturing sector.

The percentage increase in the information sector, which includes digital technology, was triggered by the commitment of US technology giants (Microsoft, Oracle, Amazon) to build data centers and cloud infrastructure in Indonesia, making this sector a top priority for cooperation.

While investment in the mining sector still dominates, the contribution of other sectors indicates business diversification. The dominant concentration of investment in mining and manufacturing emphasizes the importance of more stable policies in both sectors that the Indonesian government is promoting.

To support the investment climate and smoothness, the Indonesian government needs to strengthen governance and policy ecosystem through regulatory harmonization, tax reform, compliance strengthening, and digitization of budget and service processes.