The Financial Services Authority (OJK) has announced plans to increase the proportion of public share ownership, or free float, in the Indonesian capital market, with implementation targeted to begin this year.

The policy will not be implemented simultaneously, but gradually. The decision was made to accommodate the readiness of each company or listed issuer. The goal is none other than to strengthen liquidity and market depth.

The Chief Executive of Capital Market, Derivatives, and Carbon Exchange Supervision at OJK, Inarno Djajadi, emphasized that the implementation of free float requires careful preparation from the company and funding sides.

"This year, yes, it must be this year. But of course, there must be thorough preparations for the free float," he said after attending the opening ceremony of the 2026 capital market at the Indonesia Stock Exchange (IDX) Building on Friday (2/1/2026).

He explained that the increase in the portion of shares released to the public would be carried out gradually and incrementally in line with increasing funding needs. In other words, the higher the free float portion, the greater the capital preparation that must be made by the company.

In addition, Inarno also highlighted the importance of strengthening the demand side by increasing the role of domestic institutional investors to create a balance with the current more than 20 million retail investors.

The OJK's efforts have received support from Commission XI of the Indonesian House of Representatives. Previously, Deputy Chairman of Commission XI of the Indonesian House of Representatives, Dolfie Othniel Frederic Palit, stated in a Working Meeting with the OJK and IDX that the House of Representatives approved the strategy to increase free float as part of strengthening big caps, transparency, and investor confidence.

"Commission XI of the Indonesian House of Representatives approves the efforts of the OJK and IDX to increase free float as part of deepening the capital market and strengthening the national economy," said Dolfie on Wednesday (3/12/2025).

In the agreement, the Indonesian House of Representatives also approved the OJK's proposal to raise the free float limit for continuous listing obligations from 7.5% to a minimum of 10%-15% in accordance with market capitalization. Companies listed on the exchange will be given time to prepare for this adjustment.

In addition, the new policy to be drafted by OJK includes calculating free float at the time of initial listing only from shares offered to the public, excluding pre-IPO shareholders. New companies are also required to maintain a minimum free float for one year from the date of listing.

IDX Finalizes Free Float Study

Meanwhile, IDX President Director Iman Rachman said that the review of the free float increase is currently in its final stages. Once completed, the IDX will begin the rule-making process by seeking input from securities companies, institutional investors, and prospective issuers before submitting it to the OJK for approval.

"We will do this as soon as possible in 2026, and we will implement it in conjunction with the adjustment of Exchange Regulation No. I-A," said Iman at a press conference on the Closing of Trading on the Exchange in 2025, Tuesday (12/30/2025).

Iman emphasized the importance of comparing these provisions with other exchanges so that the rules are effective and attract domestic companies to conduct IPOs in Indonesia, rather than in foreign markets.

In line with Iman, Eddy Manindo Harahap, Deputy Commissioner for Capital Market and Securities Institution Investment Management Supervision at OJK, said that the minimum free float requirement must take into account many aspects. These include investor protection, liquidity, and the interest of domestic corporations in going public.

"Our direction is clear to increase the minimum free float limit. We expect to see real progress in early 2026, possibly in the form of new regulations from the IDX," he said.

The planned increase in the minimum free float limit is projected to be between 10% and 15% for listed issuers, along with a revision of the free float calculation for IPO issuers.

According to OJK data as of September 30, 2025, if the minimum free float limit is set at 10%, then 751 issuers are already compliant with the regulation. Meanwhile, the remaining 192 issuers only need to increase their outstanding shares by around Rp 21 trillion.

However, if the free float increase reaches 15%, then 673 issuers will already be compliant, while the remaining 270 issuers will have to add shares worth around Rp 203 trillion.

Is the Stock Market Ready for a New Free Float?

The plan to raise the minimumfree float requirement to 10%-15% is considered to be on the right track to improve the quality of the Indonesian stock market.

Bank Permata economist Josua Pardede believes that the main problem with the domestic capital market is not solely its capitalization size, but rather the limited depth of transactions, which are concentrated in a handful of large-cap stocks.

Josua explained that although the average free float ratio in Indonesia has reached around 23.9%, the minimum free float requirement has been relatively low. This condition has resulted in many stocks remaining in limited supply in the market, making them prone to wide bid-ask spreads and minimal investor participation.

"An increase of 10%-15% is, in principle, the right direction because it increases the supply of shares that can actually be traded," Josua told Suar.id on Saturday (January 3, 2026).

Read also:

However, in terms of affordability, Joshua considers 10% to be a more realistic figure for the majority of issuers than 15%. In the 10% scenario, the number of companies that do not yet meet the requirements is still in the hundreds.

Meanwhile, if the threshold is raised to 15%, the number of issuers that do not meet the requirement will increase significantly, along with a surge in public funding absorption needs. Therefore, he believes that this policy should ideally be implemented gradually, differentiated based on capitalization size, and accompanied by stronger demand, particularly from domestic institutional investors.

Switching to the issuer side, Josua said that the biggest challenge is not only the technical issue of increasing the portion of outstanding shares. He also highlighted the concerns of controlling shareholders regarding potential dilution (a decrease in the percentage of share ownership due to the company issuing new shares), limited market absorption capacity when the increase is carried out, and the risk of price pressure if the supply of shares is released suddenly.

Another challenge that is often overlooked is the free float calculation plan during the initial public offering (IPO), which is based solely on shares that are actually offered to the public, as well as the obligation to maintain a minimum portion for one year after listing.

"In a sluggish market, that one-year deadline can feel burdensome. Companies are faced with the choice of selling shares at less than ideal prices or facing compliance penalties," said Josua.

When compared to practices in the region, Josua believes that Indonesia's policy direction is actually moving closer to more mature stock exchange standards. The Singapore Stock Exchange, for example, requires that at least 10% of a class of shares must always be held by the public.

Meanwhile, in Malaysia, the public float requirement is generally 25%, although there are concessions for large-cap companies. In Indonesia, the target of 10%-15% is accompanied by a relatively strict definition of outstanding shares, as it excludes controlling shareholders, affiliated parties, management, and certain large holdings.

According to Josua, increasing the portion of outstanding shares will almost certainly deepen the market if done with the right design. The additional supply of shares will reduce the bid-ask spread, improve price formation, and enhance market credibility.

More evenly distributed liquidity is also an important prerequisite for institutional investors to become more active, as they require sufficient transaction capacity without disrupting prices.

However, he warned of short-term risks. If the additional supply is released simultaneously and on a large scale, price volatility could increase as the market has to absorb new shares, especially those that previously had limited supply.

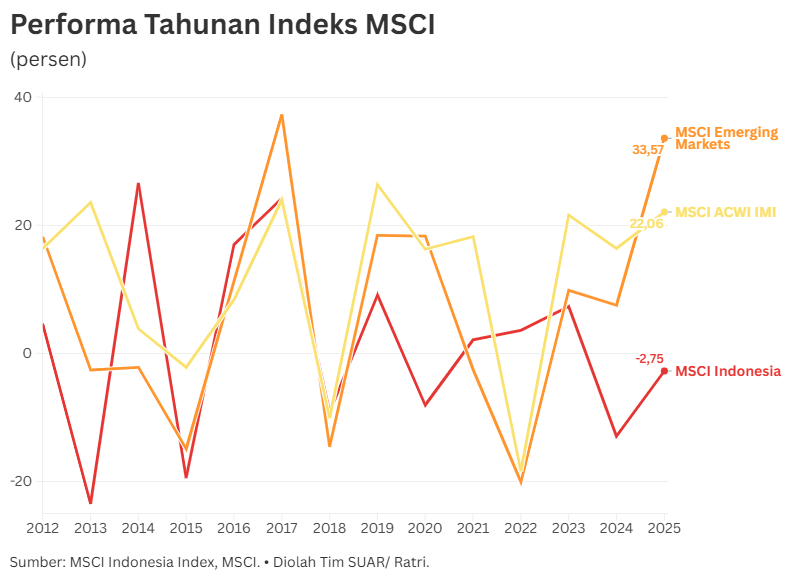

"The issue of real share availability has also become the focus of global index providers, who have begun to tighten their free float calculation methods for Indonesia, potentially triggering index weight adjustments and fund flows in the short term," said Josua.

From a strategic perspective, Josua emphasized the importance of a gradual and planned approach. Issuers are advised to break down the increase in free float into several stages during periods of strong market liquidity, combining stock sales through the market with evenly designed public offerings, and avoiding large releases at a single price. Transparency of plans, clarity of corporate action objectives, and consistency of performance are considered crucial to maintaining investor expectations.

"In the medium term, an increase in free float has the potential to boost the confidence of domestic and foreign investors, especially if it is accompanied by improved liquidity, more reasonable price formation, and reduced room for manipulation," he explained.

According to Josua, the success of this policy can be measured in the next 1-2 years through the level of issuer compliance, a more even increase in daily transaction values, a narrowing of the bid-ask spread, a strengthening of the domestic institutional investor share, post-action price stability, as well as the dynamics of foreign capital flows and Indonesia's weight in global indices.

Meanwhile, Senior Market Analyst at Mirae Asset Sekuritas Indonesia, Nafan Aji Gusta, believes that this policy is not entirely realistic for all issuers, especially family-owned companies and small-cap issuers.

Currently, Nafan said, the average portion of shares circulating in the public is around 7.9%. An increase to 10%-15% would mean a significant addition to the number of shares in circulation, especially for large issuers. The impact of this increase in free float is not only in terms of the number of shares in circulation, but also changes the control structure of the company, as the controlling ownership will be diluted with the entry of new investors into the market.

"For large issuers, this increase is relatively realistic, but for small or family-owned companies, second or third tier stocks, the challenge is much greater," Nafan told Suar.id on Saturday (3/1/2026).

He added that more than 70% of issuers in Indonesia are still family-owned, so concerns about losing control are a major psychological barrier. For controlling shareholders, additional shares purchased by public investors will reduce their ownership percentage, while also affecting their effective control over the company.

In addition to ownership challenges, liquidity issues are also a concern. This is because Nafan believes that many stocks are not very liquid, so the market needs time to absorb the additional shares in circulation to prevent prices from being depressed.

This is also related to the minimum free float requirement that must be met for one year after listing, so companies need a long-term strategy to comply with the rules.

In facing these challenges, Nafan emphasized the need for a gradual and well-planned strategy. One way to do this is through corporate actions such as private placements, where strategic investors can purchase additional shares directly.

In addition, companies can also conduct phased public offerings to increase investor participation. Thus, additional outstanding shares can be absorbed more optimally without causing significant price pressure.

He added that this strategy is in line with the principles of good corporate governance, where transparency and openness of information are key to maintaining market expectations. In practice, the ownership structure can be adjusted so that not only the controlling shareholders are affected, but also employees and management who have the potential to acquire shares. This is expected to increase the participation of retail and institutional investors, thereby making the domestic capital market more active and liquid.

Furthermore, Nafan emphasized that the success of the new free float implementation will be seen within 1 to 2 years, through several key indicators.

First, the level of compliance of issuers with the new free float threshold. Second, increased liquidity and equal distribution of transactions outside the largest stock groups. Third, price stability after the addition of shares in circulation, as well as the active role of institutional investors in absorbing new shares. Fourth, the movement of foreign funds and the weight of stocks in global indices that are sensitive to the availability of tradable shares.

He emphasized that this policy is actually aimed at deepening the Indonesian capital market, increasing liquidity, and strengthening long-term investor confidence. However, the process still requires careful control and monitoring, as well as gradual adjustments so that the market can absorb the changes smoothly.

"If implemented correctly, this increase in free float can promote a healthier and more credible market, attract domestic and foreign investors, and provide opportunities for more equitable participation by retail and institutional investors," concluded Nafan.