For years, regional budgets have been dependent on funding from the center. Now, with a significant reduction in the allocation of transfer funds to the regions (TKD) in the 2026 Draft State Budget, it could even become a momentum for local governments to realize fiscal independence.

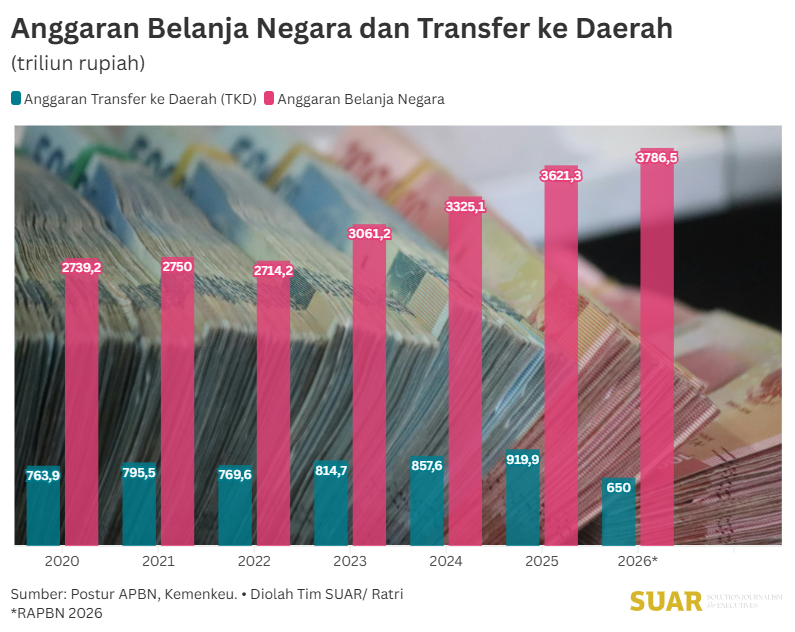

In the 2026 Draft State Budget submitted by the government last Friday (15/8/2025), the allocation of transfers to regions (TKD) fell by around 29% compared to the 2025 State Budget, to Rp 650 trillion. This is a challenge for many local governments that have been heavily dependent on central funds. However, this decline can also be interpreted as a momentum for regions to strengthen their fiscal independence.

The reduction in TKD is part of a shift in central government policy to further streamline state spending. Funds that were previously channeled through TKD are now diverted into central government spending directly aimed at priority programs in the regions. For example, the budget for Sekolah Rakyat programs, the Merah Putih Village Cooperative, national food security, and Free Nutritious Meals (MBG).

To reduce dependence on funds from the center, regions need to optimize revenue from internal sources. One of the main indicators of a region's financial independence can be seen from its own-source revenue (PAD). So far, most regions in Indonesia are highly dependent on central transfers. PAD only contributes around 28.7% of regional income (2024).

Actually, from the 2023-2024 Provincial Government Financial Statistics report by the Central Statistics Agency (BPS), there is optimism that the provincial government will be able to increase regional independence. This can be seen through the contribution of PAD, which increased to IDR 233 trillion or 56.60% of regional income. Most of the revenue was contributed from local taxes (2024). Meanwhile, transfers from the center became the second largest contributor to regional income (42.71%).

The reduction in TKD not only provides an opportunity for local governments to explore the potential of their regions for PAD. But also increase the value of income from the management of regional assets through BUMD and UMKM. This opportunity encourages regions to build stronger fiscal capacity and create more resilient and sustainable local economic models.