The manufacturing industry, which is under pressure, needs a new impetus to become vibrant again. One of them is the certainty of affordable gas prices and guaranteed supply.

The depressed manufacturing condition is reflected in Indonesia's Purchasing Managers' Index (PMI) which continues to contract for the fourth consecutive month. The research released by S&P Global shows that Indonesia's PMI in July 2025 was at the level of 49.2, below the threshold of 50.

This continues the contraction position since April which was at 46.7; May 47.4; and June 46.9. A reading below 50 indicates contraction, while above 50 indicates expansion.

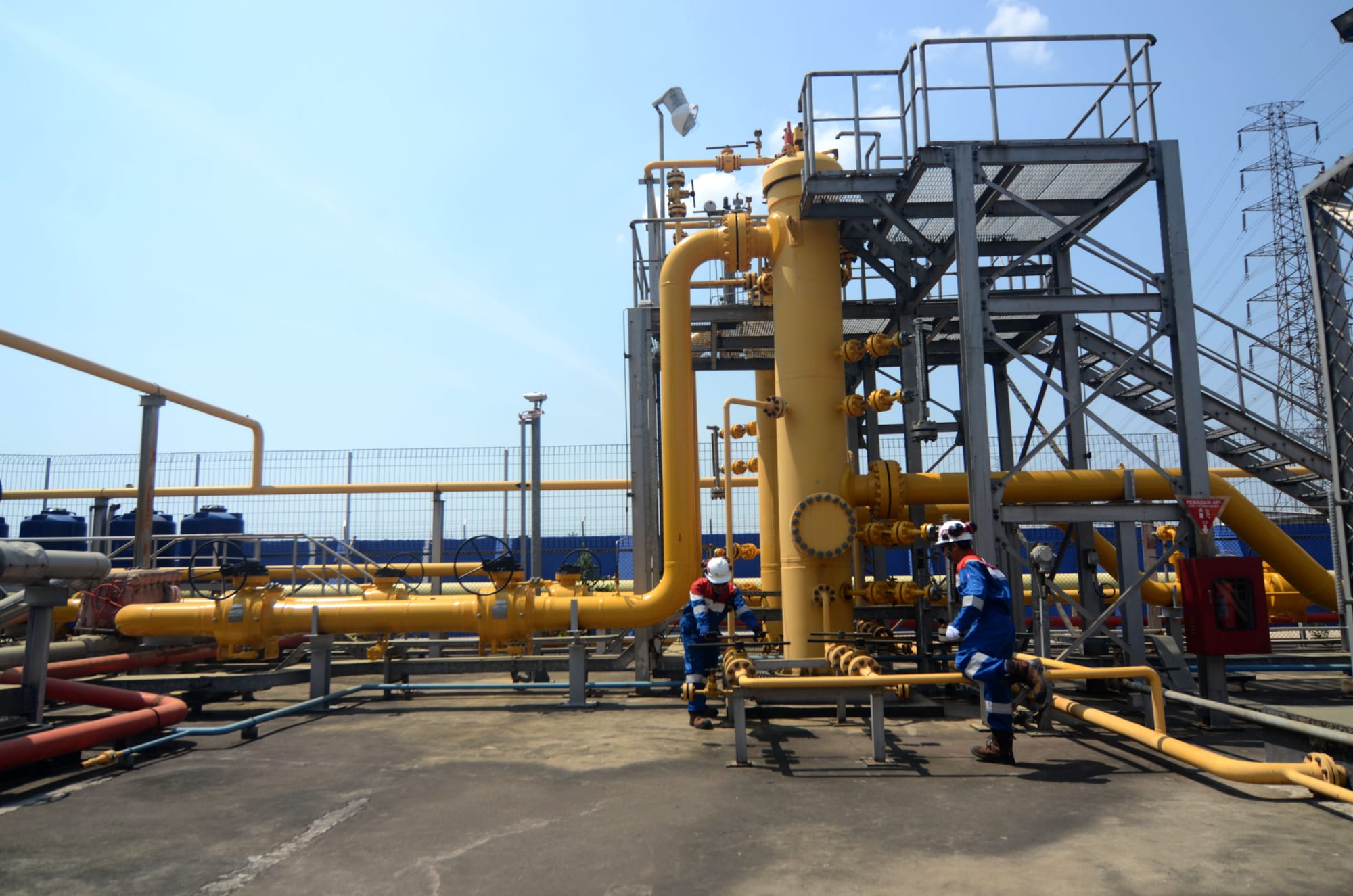

Chairman of the Natural Gas Users Industry Forum (FIPGB) Yustinus Gunawan said that natural gas is one of the main elements in the manufacturing production process. The share of natural gas costs in the production cost structure of the manufacturing industry can reach 15% to more than 50%.

"So affordable natural gas prices and guaranteed supply are what we need," said Yustinus, Sunday (10/8/2025).

The government is trying to fulfill this effort through the Specific Natural Gas Price (HGBT) program. Through this program, gas supply will be allocated to seven manufacturing industry sectors including fertilizers, petrochemicals, oleochemicals, steel, ceramics, glass, and rubber gloves. They will receive gas supply at USD 6.5-USD 7 per MMBTU (million metric British thermal unit).

Bank Permata Chief Economist Josua Pardede assessed that in this situation, the Specified Natural Gas Price (HGBT) functions as an automatic stabilizer on the cost side. The set gas price is able to contain the energy component of production costs, reduce input cost pressures, and help keep factory utilization from falling further when demand weakens.

"In other words, HGBT provides a cushion on the cost side so that the decline in output does not deepen," he said.

Josua added that the PMI contraction since the beginning of semester 2025 confirms the weakening of new demand and rising input prices. Intervention on the energy cost side is becoming increasingly urgent to prevent a deeper decline in production.

The HGBT position of USD 6.5 per MMBTU for feedstock and USD 7 per MMBTU for fuel is in the lower range compared to liquefied natural gas (LNG)-based gas prices in Asia as well as domestic LNG prices that can reach USD 16.77 per MMBTU.

This difference, says Josua, "can reach 40% to 60% and is a material factor in maintaining the competitiveness of selling prices and the decision of factories to continue operating."

However, Josua stated that the non-full realization of HGBT creates a two-tier energy price on the factory floor, making production costs more volatile and affecting business strategies. The impact of this supply limitation can be seen in the ceramics industry, one of the HGBT user sectors.

Not as expected

Yustinus from FIPGB assessed that the realization of the HGBT volume must be 100% in accordance with the allocation stipulated in the Decree of the Minister of Energy and Mineral Resources in order to really have an impact on the industry. However, according to him, until July 2025, the realization by PGN was still far below the allocation.

The same complaint was also conveyed by the Chairman of the Indonesian Ceramic Association (ASAKI) Edy Suyanto. He said that the realization of the HGBT quota for the ceramic industry was only around 60% in the Western region and 40% in the Eastern region.

The rest of the time, the industry has to buy LNG regasification gas at USD 14.8 per MMBTU, far above the HGBT price. He warned that if this situation continues, production capacity will be increasingly limited and will risk reducing the workforce.

"This condition erodes competitiveness and makes many factories produce to the extent of the gas quota given," said Edy.

Executive Director of Indonesia Development Energy and Sustainability (IDEAS) Zinedine Reza said that although this policy has provided price certainty in the range of USD 6.5 to USD 7 per MMBTU for seven strategic industrial sectors, there are still a number of reports from industry players regarding actual prices that are higher than the provisions.

He assessed that information on beneficiaries, volume, and distribution flow of subsidized gas needs to be disclosed systematically to maintain public and business confidence.

Price disparities and volume mismatches received by the industry are considered indicators of the need to evaluate the current distribution mechanism.

"If distribution information can be accessed openly, then the participation of civil society and industry players in monitoring policies can be strengthened," he said in a press release, Friday (8/8/2025).

In terms of industry players, Executive Director of the Alumni Corps of the Islamic Student Association (KAHMI) Textile Rayon, Agus Riyanto, believes that access to industrial gas at affordable prices determines the competitiveness of labor-intensive sectors such as textiles.

"But in practice, there are still many textile companies that have not benefited from the gas price of USD 6 per MMBTU consistently. The clarity of the distribution mechanism and the guarantee of supply certainty are things that we really hope for," he said in a press release.

IDEAS is also pushing for an independent audit of the implementation of HGBT distribution as well as periodic publication of distribution data and its impact on the industry. This step is expected to strengthen energy justice and maintain the efficiency of state subsidy allocations.

"We believe that by improving governance and building a culture of transparency, our energy policy can contribute more to the competitiveness of national industries and the welfare of society," said Zinedine.

Minister of Energy and Mineral Resources (ESDM) Bahlil Lahadalia said that the government is committed to providing gas supply for domestic needs. This is reflected in 61% of natural gas production in the first semester of 2025, which amounted to 5,598 billion British thermal units (BBTU), being supplied for domestic needs.

"Utilize as much as possible domestic natural resources for domestic needs," Bahlil said at a press conference on the Ministry of Energy and Mineral Resources' first semester 2025 performance, Monday (11/8/2025).

Minister of Industry Agus Gumiwang Kartasasmita said that HGBT can spur industrial competitiveness. This is because this policy has proven to be able to reduce production costs and increase operational efficiency for industry players in industrial estates.

Moreover, he continued, based on the mandate of Law Number 3 of 2014 concerning Industry, that industries must be located in industrial estates. This will certainly bring benefits to industries operating in industrial estates due to the availability of integrated infrastructure, including in the supply of energy raw materials.

However, the Minister of Industry admitted that in the implementation of the HGBT policy for industry, there are still obstacles in the field. In fact, the implementation of this policy has been emphasized and strengthened in Presidential Regulation (Perpres) Number 121 of 2020 concerning Natural Gas Pricing.

"HGBT must be continued, but its implementation has not run optimally in all industrial areas," said Agus.