The high target of 8% economic growth set by President Prabowo's administration is not impossible to achieve, according to Minister of Investment and Downstreaming and Head of the Investment Coordinating Board (BKPM) Rosan Perkasa Roeslani. He is optimistic that the target can be achieved, through increased investment.

According to him, investment is an important factor after domestic consumption in driving national economic growth. Currently, domestic consumption contributes around 54% to economic growth, while investment is around 27%-28%.

The government also wants to increase the proportion of investment so that it contributes more to national economic growth, displacing household consumption. Based on calculations by the Ministry of National Development Planning/Bappenas, Indonesia needs a total investment of Rp13,032 trillion to achieve 8 percent economic growth.

In recent years, the government has begun to encourage the flow of funds from abroad through investment. However, it is also possible for domestic investment to be involved.

Various strategies were taken to boost investment. From providing incentives for tariffs and taxation, simplifying licensing, to creating special economic zones to accommodate the placement of capital into economic tools, to holding downstream mineral resource programs.

And in the end, the effort to boost investment showed significant results in the first year of President Prabowo Subianto's administration. Indonesia's investment realization for the January-September 2025 period reached Rp1,434.3 trillion, growing 13.7% compared to the same period the previous year, and equivalent to 75.3% of the annual target.

This achievement includes the absorption of 1,956,346 workers and is supported by downstream policies and equitable distribution of investment outside Java, with Singapore being the largest country of origin of Foreign Direct Investment (FDI).

However, Rosan admitted that it is not only numerical targets that are being pursued; the government also needs to encourage high-quality and sustainable investment. One of the government's main focuses is how to invest in downstreaming in the mineral sector. "That is the most important investment," he said while speaking at a forum titled 1 Year of Prabowo–Gibran: Optimism on 8% Economic Growth at the JS Luwansa Hotel & Convention Center, Jakarta, Thursday, October 16, 2025.

Towards Quality Investment

Realizing quality investment does take time, although it has now also begun to happen. This is shown by the investment achievements until September 2025, which are now greater outside Java, touching Rp741.8 trillion or 51.7 percent. The remaining 48.3 percent is in Java with the realization of IDR692.5 trillion.

Meanwhile, the contribution of PMA reached Rp644.6 trillion or 44.9 percent. This value is still inferior to domestic investment (PMDN) of IDR789.7 trillion or 55.1 percent of the total investment achievement. Singapore is still the country with the largest investment realization in Indonesia with an investment value of US$12.6 billion. Then there is Hong Kong which disbursed US$7.3 billion, China US$5.4 billion, Malaysia US$2.7 billion, and Japan worth US$2.3 billion.

Then the top five subsectors of investment realization until September 2025. The largest came from the basic metal industry, metal goods, non-machinery, and equipment worth IDR 196.4 trillion or 13.7 percent. Second, the transportation, warehouse, and telecommunications subsector worth IDR 163.3 trillion or 11.4 percent.

Then third, the mining subsector amounting to IDR158.1 trillion, aka 11 percent, and fourth, other services which absorbed IDR130 trillion or 9.1 percent. Fifth, the housing, industrial estate, office subsector worth IDR105.2 trillion, aka 7.3 percent.

Rosan Roeslani said the significant increase was shown by downstream investment, which increased by 5 percent from the previous level of 25-26 percent. "The level of contribution has increased, and this proves that the downstream policy implemented is working," Rosan said.

He mentioned that the largest contribution of turnover occurred in the mineral sector with a total investment of IDR 97.8 trillion. The nickel commodity is the most dominant in this aspect with an investment value of Rp42 trillion. Then followed by other commodities, such as copper, with an investment value of IDR 21.2 trillion.

He also outlined the plantation and forestry sector commodities that had an impact on investment realization in the third quarter of this year. The plantation sector, such as palm oil, provided a value of Rp 21 trillion, logs Rp 11.7 trillion, and rubber Rp 1.6 trillion. Rosan is optimistic that these realization achievements can create a multiplier effect and strengthen Indonesia's competitiveness in the global industry.

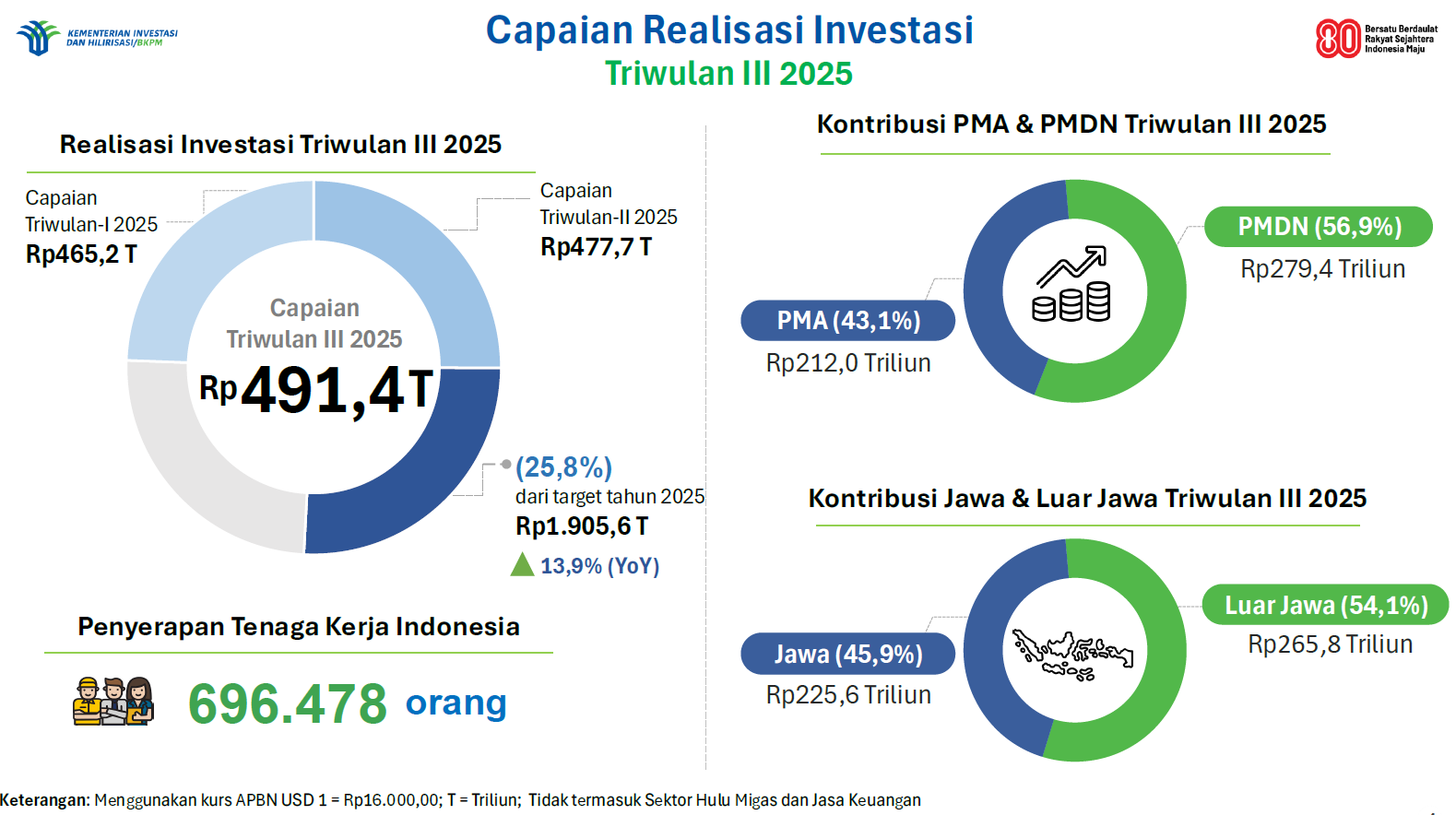

When compared by quarter, investment achievements in the third quarter of 2025 were higher than in the first and second quarters of 2025. The previous two quarters only recorded investment realization of IDR465.2 trillion and IDR477.7 trillion, respectively. Meanwhile, the achievements from January to September were recorded with a total of Rp1,434.3 trillion.

Rosan said the increase in investment realization in the third quarter was a form of the government's hard work in panning for turnover to create a positive impact on job creation. "And most importantly, how the incoming investment is sustainable and sustainable so that it has an impact," he said.

Investment in multinational companies

This high investment achievement is also thanks to the entry of many giant companies that invest in Indonesia in collaboration with Indonesian companies. One of them is a battery company from China, Contemporary Amperex Technology Co. Limited (CATL), which in partnership with PT Aneka Tambang (Antam) is finalizing a US$1.9 billion investment plan for the construction of an integrated nickel smelter in the Feni Haltim (FHT) industrial area, East Halmahera, North Maluku.

This high pressure acid leach (HPAL) and rotary kiln electric furnace (RKEF) technology project is an important part of the national electric vehicle battery ecosystem.

Antam's Director of Finance and Risk Management, Arianto S. Rudjito, said the company and the consortium of Ningbo Contemporary Brunp Lygend Co Ltd. (CBL) are finalizing the final investment decision (FID).

"Initial investment for the HPAL project will be made in late 2025 or early 2026. Construction is scheduled to be completed in 2028, followed by commissioning in the same year," he said in a public expose in mid-September.

The HPAL project is targeted to produce 55,000 tons of mixed hydroxide precipitate (MHP) per year with Antam's 30% stake. Meanwhile, the RKEF smelter with a capacity of 88,000 tons of nickel pig iron (NPI) per year is targeted to operate in 2027 with an investment of US$1.4 billion, in which Antam holds a 40% stake through PT Feni Haltim.

These two projects are part of the integrated investment of the CBL and Indonesia Battery Corporation (IBC) consortium with a total value of around US$6 billion. In the cooperation structure, Antam and CBL cooperate with PT Sumber Daya Arindo (SDA) on the upstream side, while IBC holds a minority stake in the raw material processing, battery cell assembly and recycling sectors.

On the other hand, the investment ecosystem is also getting stronger after the government established an investment company that manages SOE dividend funds, the Daya Anagata Nusantara Investment Management Agency (BPI Danantara) in February and allocated an initial investment fund of US$20 billion for 20 strategic projects.

Starting last October, BPI Danantara began pouring investment funds of US$10 billion or equivalent to Rp165.92 trillion. BP Danantara CIO Pandu Sjahrir said, of the total funds, 80% will be allocated for domestic investment and the rest for overseas investment.BPI Danantara has the mandate to manage state assets in a professional and transparent manner, while supporting Indonesia's economic transformation and strengthening its competitiveness.

Previously, Danantara has invested in a Hajj village project in Saudi Arabia, an upstream energy venture with Pertamina, and a waste power plant in Indonesia, with several more projects due to start operations by the end of this year. Danantara is also working to increase liquidity in the Jakarta stock market where average daily trading is around US$1 billion.

The figure is far behind India's US$10 billion to US$11 billion. "We need a very strong public market for the private market to come in because the public market is where you recycle that capital," Pandu said.In addition, Danantara also plans to focus on energy security, food security, renewable energy, financial services, healthcare, real estate and digital infrastructure in the next two years.

According to Pandu, Indonesia is one of the best places in the world for investors, with strong growth, low inflation and a young population. "One of the few places that offers not only high returns, but also high security," he said.

More optimistically, the manufacturing sector is one that is growing rapidly in terms of investment and production performance. Although it is only one product, processed nickel. "Nickel has 75 factories, 63 are already running, 12 are in process. Copper is only four. Bauxite is three. Tin is also three or four," said Meidy Katrin Lengkey, Indonesian Nickel Miners Association (APNI).

In total, 173 companies are registered in the Indonesian Standard Industrial Classification for Non-Iron Base Metal Manufacturing Industry (KBLI) 24202, Meidy said.

According to Dr. Meidy, nickel is indeed a prima donna in the processing industry in Indonesia overtaking other minerals. This is because the technology used to process nickel is cheaper than bauxite, tin, or copper. "The demand is also high," he said. In other words, nickel is like a neat toll road, while other minerals are still gravel roads that do not necessarily have lighting.

However, behind the development of smelters , especially nickel smelters , Meidy highlighted something more urgent related to regulatory inconsistencies. He gave an example of changes in the rules regarding the Work Plan and Budget (RKB). "It used to be three years, suddenly it became one year. We have been fighting for three years. Changes like this create a big polemic for entrepreneurs," he explained.

The next problem appeared more complicated. The government issued rules limiting new investment in nickel, something APNI actually supports. "It's enough for nickel," said Meidy, but the wording of the rule actually makes the industry nervous. "It was just released and it's ambiguous. Factories that are still being built could be threatened with not getting a license if they are still producing NPI, ferronickel, nickel matte, and MHP. So you have to build end products directly." He said.

According to him, the government should also do mitigation before deciding. "Look at balancing raw materials, market potential, global prices. Now prices are falling, while costs are rising," he said.

On the other hand, Meydi also reminded that not only nickel is the strength of Indonesia's mineral exports. "Our tin is number two in the world. Think about tin," she said.

He mentioned Indonesia's four main minerals, nickel, tin, copper, bauxite, but downstreaming has only really taken place in one commodity, nickel. According to him, if the government wants sustainable downstreaming, then investment should not stop at the intermediate stage. "Learning from nickel, don't just invite investment for intermediate. It must reach the end product. Until recycling. Until the market is in Indonesia. End-to-end," he said.

And to be able to make the management of domestic mineral resources consistent, Meidy suggests that policy makers be consistent. "We just ask to be consistent. Don't change the rules, that's all." According to him, rule changes should consider global conditions. "If the world market is down and entrepreneurs are burdened with additional costs, it's not fair. If entrepreneurs stop production, where will the economy come from?" he asked.

Great regional potential needs support

Foreign companies such as those from Europe also recognize the promising potential in Indonesia. Gerry Julian, Deputy Head of the Energy Working Group Eurocham Indonesia emphasized that his party is very interested in one province, Central Java, to be recommended to investors from the Blue Continent.

At the Central Java Investment Business Forum on Tuesday, November 4, 2025, Gerry Julian said that Central Java has enormous potential as an investment location. Eurocham itself is a joint venture of chambers of commerce associations from all European countries. The task of the institution is in the field of advocacy and promotion of investment in European countries in Indonesia.

In its conclusion, Eurocham considers Central Java, whose role as the largest electricity production center in Indonesia, makes it very potential to invest in the region in the new renewable energy sector.

Including from the food sector, to manufacturing. And of course from the energy side as we know now Central Java is the largest electricity production center in Indonesia, where many steam power plants are located in Central Java, and of course in the future the development of the time we see that there has been an energy transition in the world," he explained.

However, the huge potential in Central Java has not been followed by investments related to renewable energy. Therefore, this field is considered very potential and promising with all the potential offered by Central Java.

"Indonesia itself is still very small, related to renewable energy where the potential in Indonesia, especially in Central Java, is very large but there is still very little investment. We do see the very high potential of renewable energy in Central Java," he said.

Needs improvement to be perfect

INDEF senior researcher Tauhid Ahmad made a note regarding the improvement in Indonesia's investment. He reminded whether this improvement was also accompanied by an improvement in the quality of investment, or whether it was just a mere increase in numbers. "What should be noted is that foreign investment (PMA) has actually fallen relatively," said Tauhid.

According to him, the decline in foreign investment flows should be an alarm for the government. "Ideally, both should increase. If outside investors develop, it is a good signal for the economy. But now, even though investment has increased in total, FDI has decreased," he explained.

Tauhid also noted that Indonesia's overallcapital inflow is still negative. Many investors in the global financial sector have not shown full confidence to return. Despite improvements in the consumer confidence index and confidence in the government, the real sector is still not strong. "The credit rate only grew by 7%, even UMKM credit was only 2%-3%. This means that economic activity has not fully recovered," he explained.

one of the root causes of the decline in foreign investor interest is legal uncertainty

According to Tauhid, one of the root causes of the decline in foreign investor interest is legal uncertainty. He considers that investment regulations in Indonesia are still too complicated and often change. "Our legal consistency is still lacking. There are too many rules across sectors that overlap, and that adds to the cost of law for investors," he said.

The integrated licensing system or Online Single Submission (OSS) is also considered ineffective. Because there are many windows in it. Supposedly, said Tauhid, investors only need to submit documents, and the government takes care of cross-ministries. "In fact, there are still many permits that must be taken care of one by one. Especially for the mining, oil and gas sectors. Not to mention that there are land issues, often not clean and clear," he added.

Regarding the direction of fulfilling quality investment, Deputy for Investment Promotion of the Ministry of Investment and Downstream/Investment Coordinating Board Nurul Ichwan, explained that quality investment is not only those that bring large capital or high technology, but also have a real impact on society, especially in job creation and improving welfare around the project.

Therefore, the government encourages the concept of inclusive investment so that incoming investment can also have a broad impact. For example, every large company, both PMA and PMDN, that wants to get import duty exemption facilities for capital goods and raw materials, must collaborate with local UMKM .

They may not bring or create UMKM own UMKM. "All of this collaboration is transparent through the OSS system, so businesses in the regions can directly see and apply as partners," he said.

And for this provision to be effective, each investor is also required to report its investment activities periodically through the Investment Activity Report, every three months for ongoing projects and every six months for commercial projects.

In addition, there is a unit of the Deputy for Investment Implementation Control that works closely with the Deputy for Investment Climate Development to ensure that partnerships with UMKM are actually implemented in the field.

Nurul Ichwan also agreed that the majority of investment in Indonesia comes from developed countries such as Japan, Korea, and European countries with aging populations. As their workforce is declining, they rely on efficiency and technology to maintain productivity. "When investing in Indonesia, they still bring this technology-based approach," he said.

So it is natural that the proportion of labor per trillion investment appears to be declining. However, this does not mean that the government is neglecting its absorption. The government is still looking for sectors that can create more jobs, but it must also be realistic, it is impossible to force investors to abandon technology.

"So what we do is adjust Indonesian human resources to be ready to operate the technology, through training, vocational, and knowledge transfer programs," Nurul explained.

Mukhlison, Gema Dzikri, and Dian Amalia